Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A Project to consider Blue Mesa Inc. (BMI) is considering a 4-year project. The firm has already spent $24M on research and development efforts.[1] To

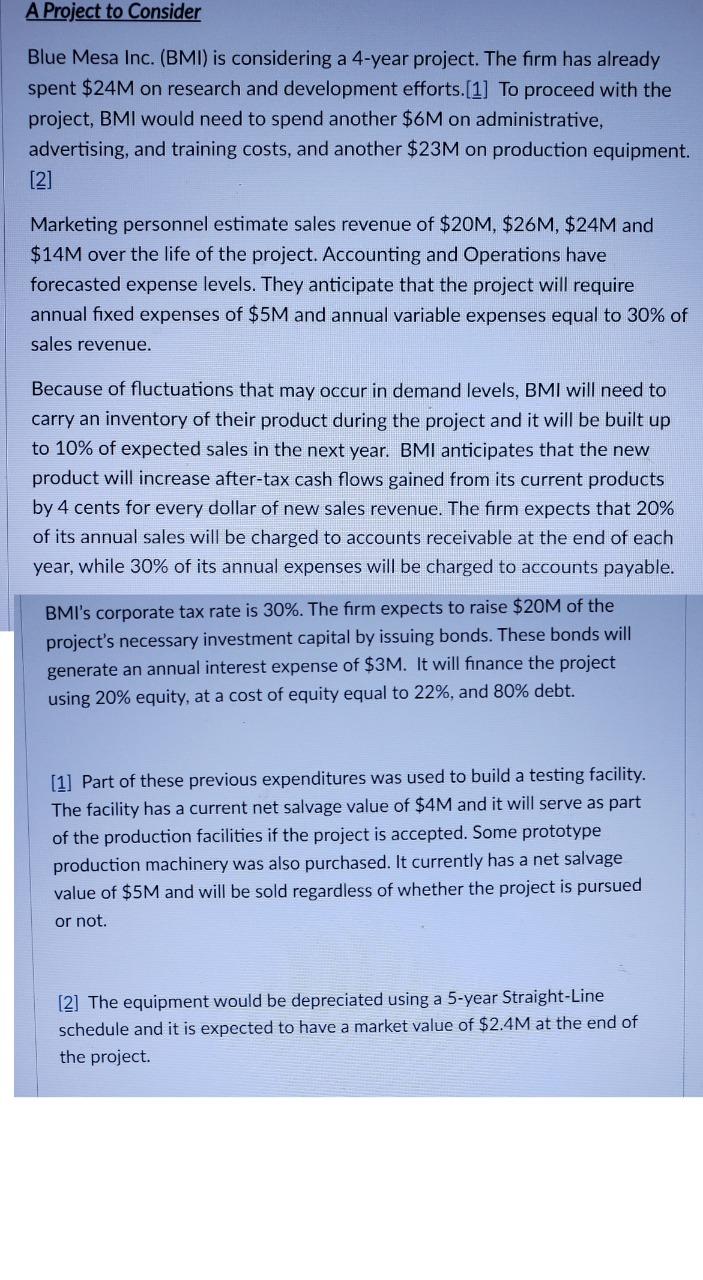

A Project to consider Blue Mesa Inc. (BMI) is considering a 4-year project. The firm has already spent $24M on research and development efforts.[1] To proceed with the project, BMI would need to spend another $6M on administrative, advertising, and training costs, and another $23M on production equipment. [2] Marketing personnel estimate sales revenue of $20M, $26M, $24M and $14M over the life of the project. Accounting and Operations have forecasted expense levels. They anticipate that the project will require annual fixed expenses of $5M and annual variable expenses equal to 30% of sales revenue. Because of fluctuations that may occur in demand levels, BMI will need to carry an inventory of their product during the project and it will be built up to 10% of expected sales in the next year. BMI anticipates that the new product will increase after-tax cash flows gained from its current products by 4 cents for every dollar of new sales revenue. The firm expects that 20% of its annual sales will be charged to accounts receivable at the end of each year, while 30% of its annual expenses will be charged to accounts payable. BMI's corporate tax rate is 30%. The firm expects to raise $20M of the project's necessary investment capital by issuing bonds. These bonds will generate an annual interest expense of $3M. It will finance the project using 20% equity, at a cost of equity equal to 22%, and 80% debt. [1] Part of these previous expenditures was used to build a testing facility. The facility has a current net salvage value of $4M and it will serve as part of the production facilities if the project is accepted. Some prototype production machinery was also purchased. It currently has a net salvage value of $5M and will be sold regardless of whether the project is pursued or not. [2] The equipment would be depreciated using a 5-year Straight-Line schedule and it is expected to have a market value of $2.4M at the end of the project. Question 16 4 pts What is the free cash flow for the firm in 2012? 0 1,391 million 1,471 million 3,341 million 3,421 million > Question 14 3 pts Using the effective tax rate of 31.5%, what is NOPAT in 2012 for the firm? 2,517 million 2,406 million 2,394 million 2,158 million A Project to consider Blue Mesa Inc. (BMI) is considering a 4-year project. The firm has already spent $24M on research and development efforts.[1] To proceed with the project, BMI would need to spend another $6M on administrative, advertising, and training costs, and another $23M on production equipment. [2] Marketing personnel estimate sales revenue of $20M, $26M, $24M and $14M over the life of the project. Accounting and Operations have forecasted expense levels. They anticipate that the project will require annual fixed expenses of $5M and annual variable expenses equal to 30% of sales revenue. Because of fluctuations that may occur in demand levels, BMI will need to carry an inventory of their product during the project and it will be built up to 10% of expected sales in the next year. BMI anticipates that the new product will increase after-tax cash flows gained from its current products by 4 cents for every dollar of new sales revenue. The firm expects that 20% of its annual sales will be charged to accounts receivable at the end of each year, while 30% of its annual expenses will be charged to accounts payable. BMI's corporate tax rate is 30%. The firm expects to raise $20M of the project's necessary investment capital by issuing bonds. These bonds will generate an annual interest expense of $3M. It will finance the project using 20% equity, at a cost of equity equal to 22%, and 80% debt. [1] Part of these previous expenditures was used to build a testing facility. The facility has a current net salvage value of $4M and it will serve as part of the production facilities if the project is accepted. Some prototype production machinery was also purchased. It currently has a net salvage value of $5M and will be sold regardless of whether the project is pursued or not. [2] The equipment would be depreciated using a 5-year Straight-Line schedule and it is expected to have a market value of $2.4M at the end of the project. Question 16 4 pts What is the free cash flow for the firm in 2012? 0 1,391 million 1,471 million 3,341 million 3,421 million > Question 14 3 pts Using the effective tax rate of 31.5%, what is NOPAT in 2012 for the firm? 2,517 million 2,406 million 2,394 million 2,158 million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started