Question

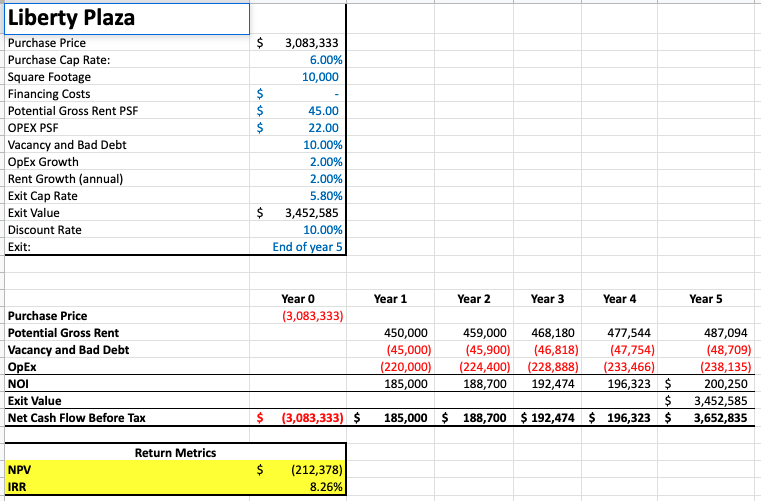

A property is listed for sale at a 6.0% cap rate. This model reflects your investment group's assumptions and discount rate for an unlevered purchase

A property is listed for sale at a 6.0% cap rate.

This model reflects your investment group's assumptions and discount rate for an unlevered purchase at the asking rate.

Which of the following are true?

(Select all that apply)

1. If the purchase price is reduced by the amount indicated by the negative NPV, the investment would achieve the 10% return required in your discount rate.

2. The negative NPV value means this is likely a good investment at the asking price.

3. The maximum purchase price without leverage is $2,870,955.

4. The maximum purchase price without leverage is $3,295,756

5. The positive IRR suggests this is likely a good investment at the asking price.

$ 3,083,333 6.00% 10,000 Liberty Plaza Purchase Price Purchase Cap Rate: Square Footage Financing Costs Potential Gross Rent PSF OPEX PSF Vacancy and Bad Debt OpEx Growth Rent Growth (annual) Exit Cap Rate Exit Value Discount Rate Exit: $ $ $ i 45.00 22.00 10.00% 2.00% 2.00% 5.80% 3,452,585 10.00% End of year 5 $ Year 1 Year 2 Year 3 Year 4 Year 5 Year o (3,083,333) Purchase Price Potential Gross Rent Vacancy and Bad Debt Opex NOI Exit Value Net Cash Flow Before Tax 450,000 459,000 468,180 477,544 (45,000) (45,900) (46,818) (47,754) (220,000) (224,400) (228,888) (233,466) 185,000 188,700 192,474 196,323 $ $ 185,000 $ 188,700 $ 192,474 $ 196,323 $ 487,094 (48,709) (238,135) 200,250 3,452,585 3,652,835 $ (3,083,333) $ Return Metrics $ NPV IRR (212,378) 8.26%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started