Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A property was purchased for $4,500,000.00 and earns a rental income of $50,000.00 per month. Mr. Johnson, the owner, has to pay annual property

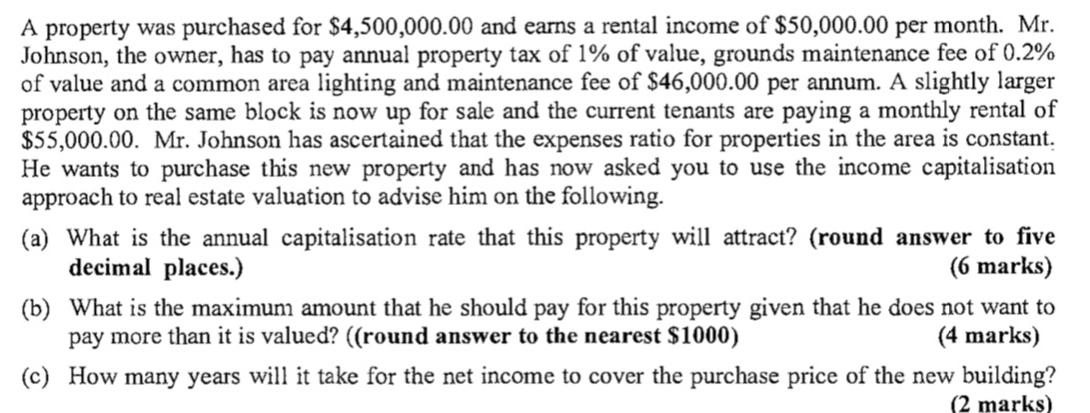

A property was purchased for $4,500,000.00 and earns a rental income of $50,000.00 per month. Mr. Johnson, the owner, has to pay annual property tax of 1% of value, grounds maintenance fee of 0.2% of value and a common area lighting and maintenance fee of $46,000.00 per annum. A slightly larger property on the same block is now up for sale and the current tenants are paying a monthly rental of $55,000.00. Mr. Johnson has ascertained that the expenses ratio for properties in the area is constant. He wants to purchase this new property and has now asked you to use the income capitalisation approach to real estate valuation to advise him on the following. (a) What is the annual capitalisation rate that this property will attract? (round answer to five decimal places.) (6 marks) (b) What is the maximum amount that he should pay for this property given that he does not want to pay more than it is valued? ((round answer to the nearest $1000) (4 marks) (c) How many years will it take for the net income to cover the purchase price of the new building? (2 marks)

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started