Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A proposed power-saving equipment has a purchase price of $580,000. The equipment will be used in a four-year project but is classified as five-year

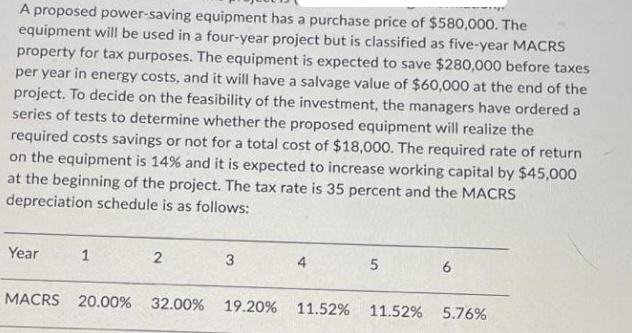

A proposed power-saving equipment has a purchase price of $580,000. The equipment will be used in a four-year project but is classified as five-year MACRS property for tax purposes. The equipment is expected to save $280,000 before taxes per year in energy costs, and it will have a salvage value of $60,000 at the end of the project. To decide on the feasibility of the investment, the managers have ordered a series of tests to determine whether the proposed equipment will realize the required costs savings or not for a total cost of $18,000. The required rate of return on the equipment is 14% and it is expected to increase working capital by $45,000 at the beginning of the project. The tax rate is 35 percent and the MACRS depreciation schedule is as follows: Year 1 2 3 5 6 MACRS 20.00% 32.00% 19.20 % 11.52% 11.52% 5.76% The terminal cash flow for this project is IR LIVETE

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the terminal cash flow for this project we need to consider the remaining value of the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started