Question

A prospective employee must choose between a $5,000 cash bonus, or 3,000 options to buy Telstar stock at $35.00 per share at her fifth anniversary

A prospective employee must choose between a $5,000 cash bonus, or 3,000 options to buy Telstar stock at $35.00 per share at her fifth anniversary with the firm. One option allows the employee to buy one share of Telstar.

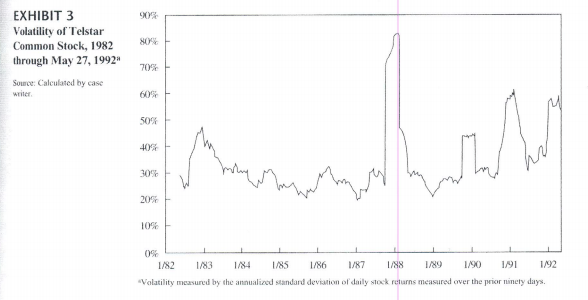

Find out the approximate historical average, lowest, and highest volatility from the Telstars volatility graph. If we ignore the tax considerations and assume that the employee will stay with Telstar for at least five years, what is the value of the 3,000 stock options at the average, lowest, and highest volatility based on the Black-Scholes option pricing model? The options expiration date will be five years if the employees tenure with Telstar is at least five years. Which compensation package, cash vs. stock options, is worth more? Which one would you recommend?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started