Question

a. Provide two examples of actions you have taken (or will take in the future) to build good credit, and link each example to one

a. Provide two examples of actions you have taken (or will take in the future) to build good credit, and link each example to one of the steps to building good credit provided in the text. --> (If you paid your bills on time, carried only a reasonable amount of debt, didnt max out your credit cards, had a history of borrowing, hadnt applied for a bunch of new loans, and borrowed from a mix of lenders, youd be in good shape. Your FICO score would be high and lenders would like you. Because of your high credit score, theyd give you the loans you asked for at reasonable interest rates.)

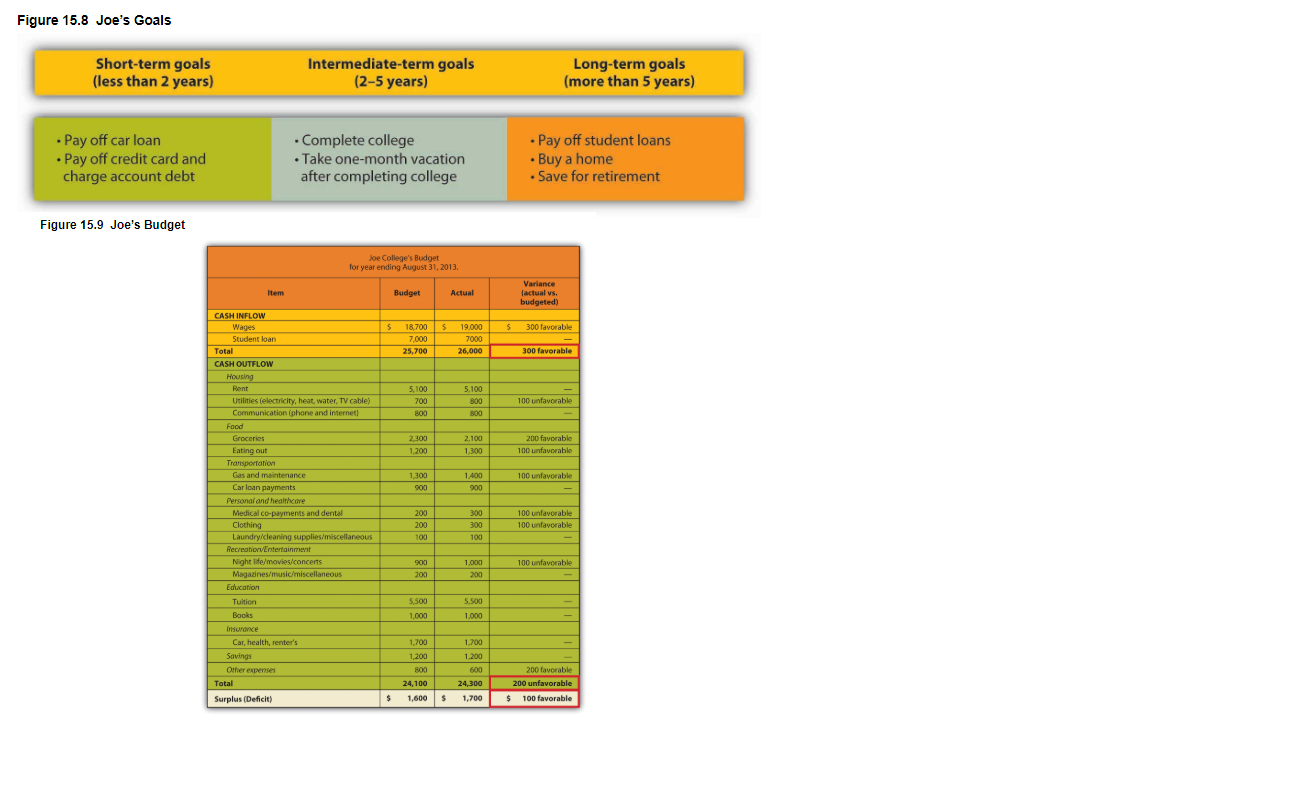

b. Describe two of your own financial goals and how you expect to achieve them. See Figure 15.8 for examples. Your answers can go beyond the examples shown in Figure 15.8.

c. Review Figure 15.9. Why is it important to create a personal budget, and perhaps even more important to compare actual results to your budget?

d. What is meant by the phrase pay yourself first? (As a side note, the dollar amount saved on a monthly basis is not as important as getting in the habit of saving. The dollar amount can be increased over time. If you dont currently have a savings plan, start with a small amount, even if its just $5 per month.)

Figure 15.8 Joe's Goals Short-term goals (less than 2 years) Intermediate-term goals (2-5 years) Long-term goals (more than 5 years) Pay off car loan Pay off credit card and charge account debt . Complete college Take one-month vacation after completing college - Pay off student loans Buy a home Save for retirement Figure 15.9 Joe's Budget Joe College's Budget for year ending August 31, 2013. Budget Actual 19,000 S 300 favorable CASH INFLOW Waces Student loan Total CASH OUTFLOW Housing 18.700S 7 000 25,700 7000 26,000 Rent 5.100 700 5.100 800 800 100 unfavorable 800 2,300 2.100 1,300 200 favorable 100 unfavorable 1.200 100 unfavorable 1300 900 1400 900 Utilities electricity, heat, water, TV cable) Communkation phone and internet Food Groceries Eating out Transportation Gas and maintenance Car loan payments Persondi and health care Medical co-payments and dental Clothing Laundry/cleaning supplies/miscellaneous Recreationtertainment Nightlife/movies/concerts Magazines/music/miscellaneous Education 200 300 300 100 1 1 00 unfavorable 00 unfavorable 100 100 unfavorable 1.000 200 2 00 5.500 Tuition Books 5.500 1.000 1.000 Car, health, renter's Savings Other expenses 1,700 1.200 800 1.200 600 24,300 1,700 200 favorable 200 unfavorable Total 24.100 Surplus (Deficit) $ 1,600 $ $ 100 favorable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started