Answered step by step

Verified Expert Solution

Question

1 Approved Answer

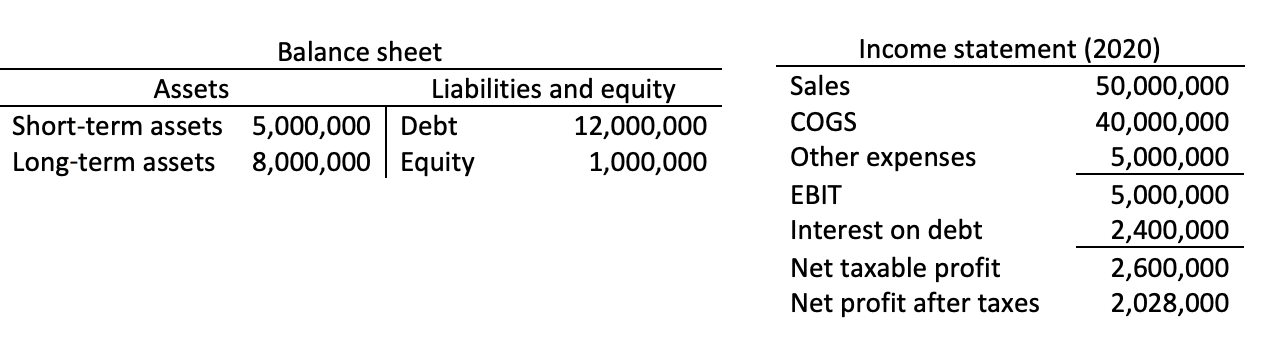

A publiclyheld corporation hasrecently reported the following financialstatements as of 31/12/2020. The company has outstanding 1 million shares of common stock, currently traded at a

A publiclyheld corporation hasrecently reported the following financialstatements as of 31/12/2020.

The company has outstanding 1 million shares of common stock, currently traded at a price of 9/share in Borsa stanbul.

a. If the riskfree rate of interest (current yield on shortterm Tbills) is 19%, the stock market is expected to return 23% next year and the companys estimated (CAPM) beta is 1.2, what is the required rate of return on its equity?

b. Calculate the companys weighted average cost of capital.

Balance sheet Assets Liabilities and equity Short-term assets 5,000,000 Debt 12,000,000 Long-term assets 8,000,000 Equity 1,000,000 Income statement (2020) Sales 50,000,000 COGS 40,000,000 Other expenses 5,000,000 EBIT 5,000,000 Interest on debt 2,400,000 Net taxable profit 2,600,000 Net profit after taxes 2,028,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started