Answered step by step

Verified Expert Solution

Question

1 Approved Answer

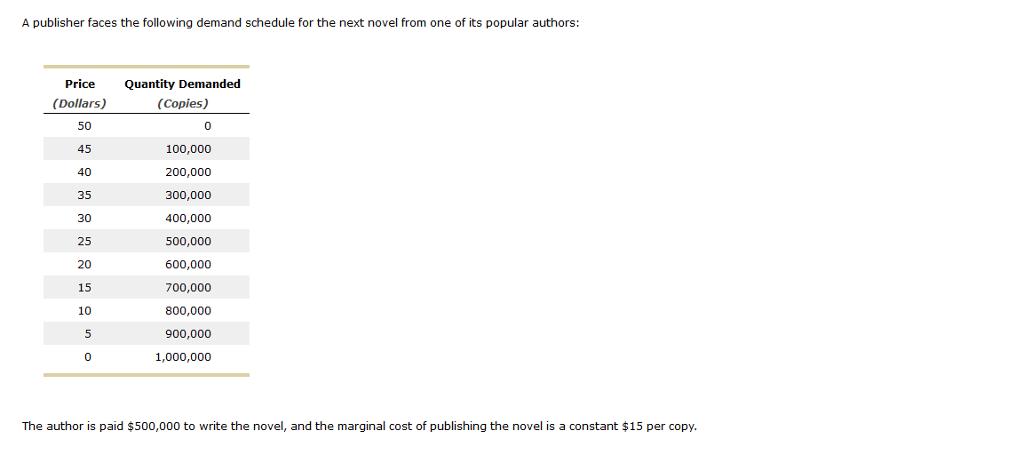

A publisher faces the following demand schedule for the next novel from one of its popular authors: Price (Dollars) 50 45 40 35 30

A publisher faces the following demand schedule for the next novel from one of its popular authors: Price (Dollars) 50 45 40 35 30 25 20 15 10 5 0 Quantity Demanded (Copies) 0 100,000 200,000 300,000 400,000 500,000 600,000 700,000 800,000 900,000 1,000,000 The author is paid $500,000 to write the novel, and the marginal cost of publishing the novel is a constant $15 per copy. The author is paid $500,000 to write the novel, and the marginal cost of publishing the novel is a constant $15 per copy. Complete the second, fourth, and fifth columns of the following table by computing total revenue, total cost, and profit at each quantity. Quantity Total Revenue (Copies) (Dollars) Marginal Revenue (Dollars) 0 100,000 200,000 300,000 400,000 500,000 600,000 700,000 800,000 900,000 1,000,000 M^^^^^ 300,000 copies at a price of $35 Total Cost (Dollars) Which of the following quantity-price combinations would a profit-maximizing publisher choose? (Note: If the publisher is indifferent between more than one choice, select all of the indifferent combinations.) Check all that apply. 400,000 copies at a price of $30 500,000 copies at a price of $25 600,000 copies at a price of $20 Profit (Dollars) Complete the third column of the previous table by computing marginal revenue. (Hint: Recall that MR = 40.) True or False: At each quantity, marginal revenue is less than the price. O True O False Use the black points (plus symbol) to graph the marginal revenue from the 100,000th, 200,000th, 300,000th, 400,000th, 500,000th, and 600,000th copy of the novel. Remember to plot from left to right and to plot between integers. For example, if the marginal revenue of increasing production from 100,000 copies to 200,000 copies is 10, then you would plot a point at (150, 10). Next use the orange line (square symbol) to graph the marginal-cost curve faced by the publisher. Finally, use the blue points (circle symbol) to graph demand at the following quantities (in thousands): 0, 100, 200, 300, 400, 500, 600, 700, 800, 900, and 1,000. Price 50 45 40 35 30 25 20 15 10 5 0 -5 0 100 200 300 400 500 600 700 800 900 1000 Quantity (Thousands of copies) Marginal Revenue O Marginal Cost Demand Deadweight Loss ? The marginal-revenue and marginal-cost curves intersect at a quantity of copies. On the previous graph, use the black triangle (plus symbols) to shade the area representing deadweight loss. If the author were paid $400,000 instead of $500,000 to write the book, the publisher would the novel. the price it charges for a copy of Suppose the publisher was not profit-maximizing but was concerned with maximizing economic efficiency, and the author of a novel is paid $500,000 to write the book. In this case, the publisher would charge $ for a copy of the novel and earn a profit of $ experiences a loss, be sure to enter a negative number for profit.) (Note: If the publisher

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started