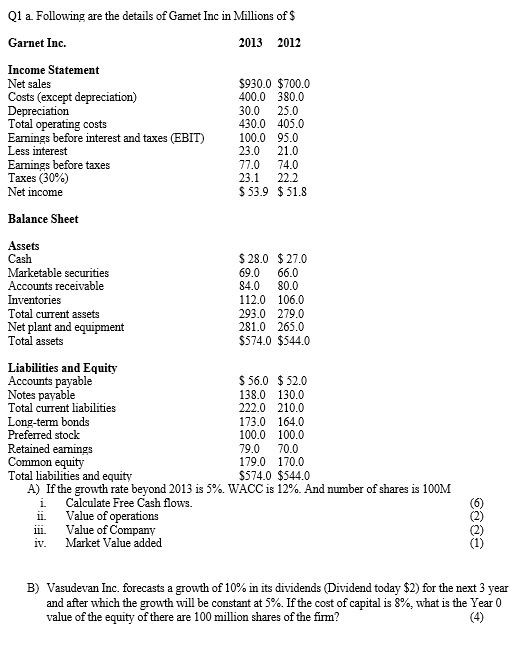

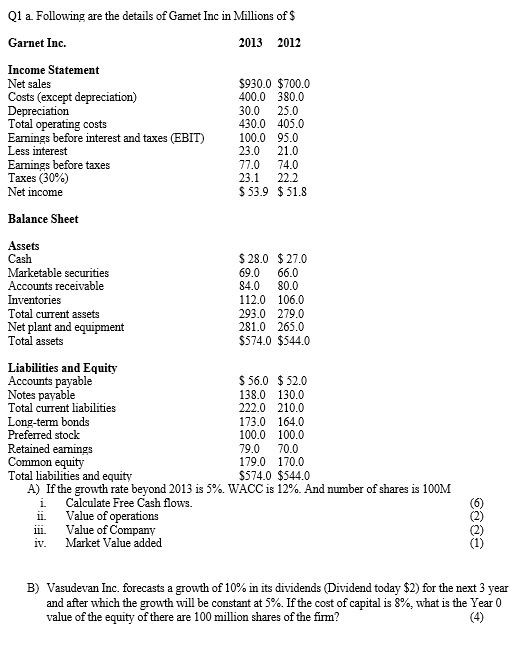

a Q1 a Following are the details of Gamet Inc in Millions of $ Garnet Inc. 2013 2012 Income Statement Net sales $930.0 $700.0 Costs (except depreciation) 400.0 380.0 Depreciation 30.0 25.0 Total operating costs 430.0 405.0 Earnings before interest and taxes (EBIT) 100.0 95.0 Less interest 23.0 21.0 Earnings before taxes 77.0 74.0 Taxes (30%) 23.1 22.2 Net income $ 53.9 $ 51.8 Balance Sheet Assets Cash $ 28.0 $ 27.0 Marketable securities 69.0 66.0 Accounts receivable 84.0 80.0 Inventories 112.0 106.0 Total current assets 293.0 279.0 Net plant and equipment 281.0 265.0 Total assets $574.0 $544.0 Liabilities and Equity Accounts payable $ 56.0 $ 52.0 Notes payable 138.0 130.0 Total current liabilities 222.0 210.0 Long-term bonds 173.0 164.0 Preferred stock 100.0 100.0 Retained earnings 79.0 70.0 Common equity 179.0 170.0 Total liabilities and equity $574.0 $544.0 A) If the growth rate beyond 2013 is 5%. WACC is 12%. And number of shares is 100M i. Calculate Free Cash flows. 11. Value of operations ili. Value of Company iv. Market Value added caas B) Vasudevan Inc. forecasts a growth of 10% in its dividends (Dividend today $2) for the next 3 year and after which the growth will be constant at 5%. If the cost of capital is 8%, what is the Year 0 value of the equity of there are 100 million shares of the firm? (4) a Q1 a Following are the details of Gamet Inc in Millions of $ Garnet Inc. 2013 2012 Income Statement Net sales $930.0 $700.0 Costs (except depreciation) 400.0 380.0 Depreciation 30.0 25.0 Total operating costs 430.0 405.0 Earnings before interest and taxes (EBIT) 100.0 95.0 Less interest 23.0 21.0 Earnings before taxes 77.0 74.0 Taxes (30%) 23.1 22.2 Net income $ 53.9 $ 51.8 Balance Sheet Assets Cash $ 28.0 $ 27.0 Marketable securities 69.0 66.0 Accounts receivable 84.0 80.0 Inventories 112.0 106.0 Total current assets 293.0 279.0 Net plant and equipment 281.0 265.0 Total assets $574.0 $544.0 Liabilities and Equity Accounts payable $ 56.0 $ 52.0 Notes payable 138.0 130.0 Total current liabilities 222.0 210.0 Long-term bonds 173.0 164.0 Preferred stock 100.0 100.0 Retained earnings 79.0 70.0 Common equity 179.0 170.0 Total liabilities and equity $574.0 $544.0 A) If the growth rate beyond 2013 is 5%. WACC is 12%. And number of shares is 100M i. Calculate Free Cash flows. 11. Value of operations ili. Value of Company iv. Market Value added caas B) Vasudevan Inc. forecasts a growth of 10% in its dividends (Dividend today $2) for the next 3 year and after which the growth will be constant at 5%. If the cost of capital is 8%, what is the Year 0 value of the equity of there are 100 million shares of the firm? (4)