Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. QUESTION 1 (20 MARKS) As a professional trader, you have been given responsibilities to get the profit from arbitraging activity. Your company trades 50,000

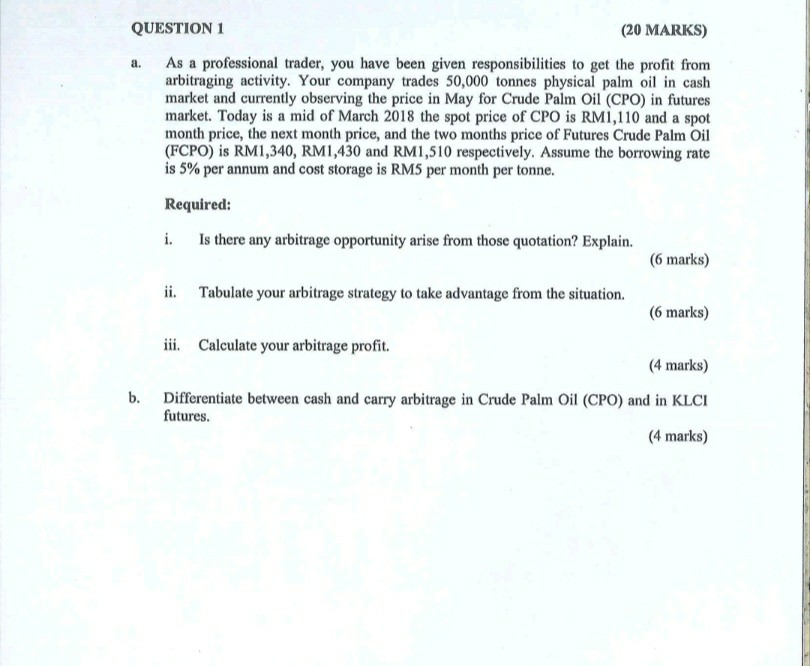

a. QUESTION 1 (20 MARKS) As a professional trader, you have been given responsibilities to get the profit from arbitraging activity. Your company trades 50,000 tonnes physical palm oil in cash market and currently observing the price in May for Crude Palm Oil (CPO) in futures market. Today is a mid of March 2018 the spot price of CPO is RM1,110 and a spot month price, the next month price, and the two months price of Futures Crude Palm Oil (FCPO) is RM1,340, RM1,430 and RM1,510 respectively. Assume the borrowing rate is 5% per annum and cost storage is RM5 per month per tonne. Required: i. Is there any arbitrage opportunity arise from those quotation? Explain. (6 marks) ii. Tabulate your arbitrage strategy to take advantage from the situation. (6 marks) iii. Calculate your arbitrage profit. (4 marks) b. Differentiate between cash and carry arbitrage in Crude Palm Oil (CPO) and in KLCI futures. (4 marks) a. QUESTION 1 (20 MARKS) As a professional trader, you have been given responsibilities to get the profit from arbitraging activity. Your company trades 50,000 tonnes physical palm oil in cash market and currently observing the price in May for Crude Palm Oil (CPO) in futures market. Today is a mid of March 2018 the spot price of CPO is RM1,110 and a spot month price, the next month price, and the two months price of Futures Crude Palm Oil (FCPO) is RM1,340, RM1,430 and RM1,510 respectively. Assume the borrowing rate is 5% per annum and cost storage is RM5 per month per tonne. Required: i. Is there any arbitrage opportunity arise from those quotation? Explain. (6 marks) ii. Tabulate your arbitrage strategy to take advantage from the situation. (6 marks) iii. Calculate your arbitrage profit. (4 marks) b. Differentiate between cash and carry arbitrage in Crude Palm Oil (CPO) and in KLCI futures. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started