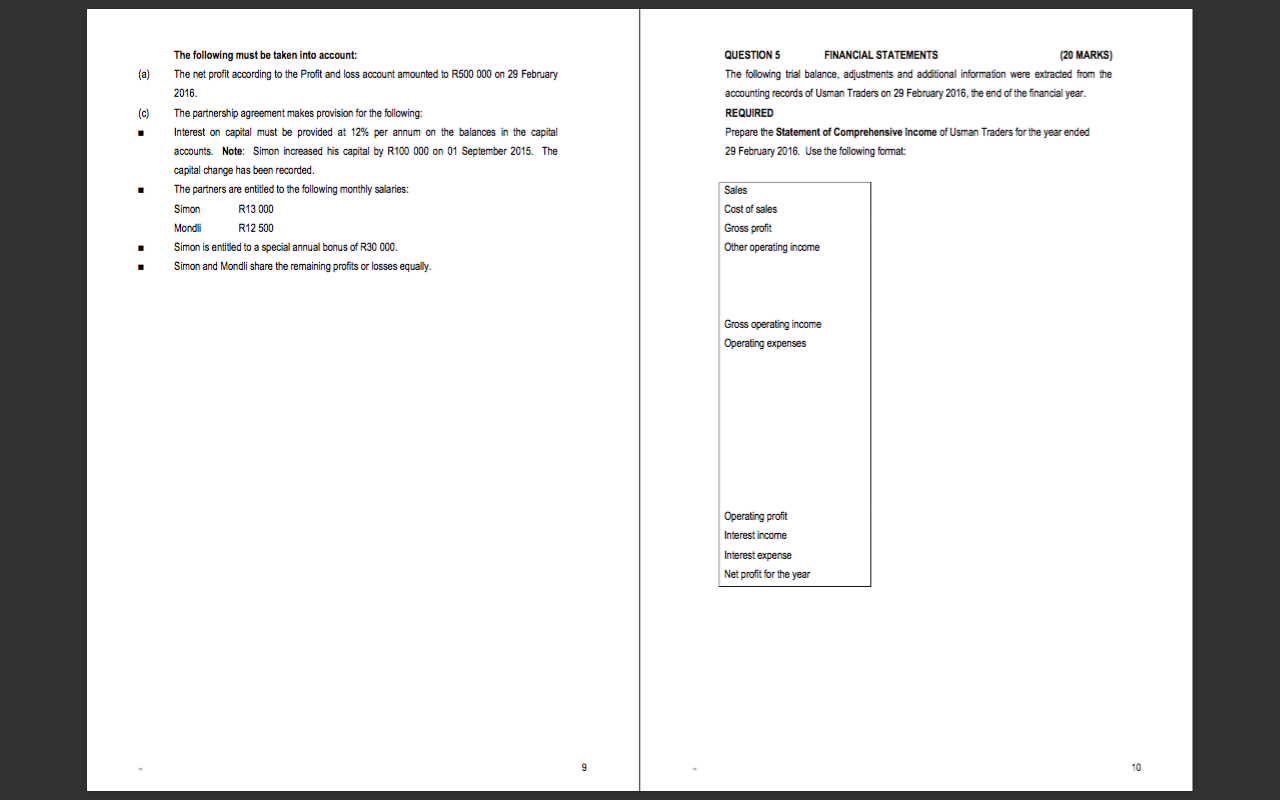

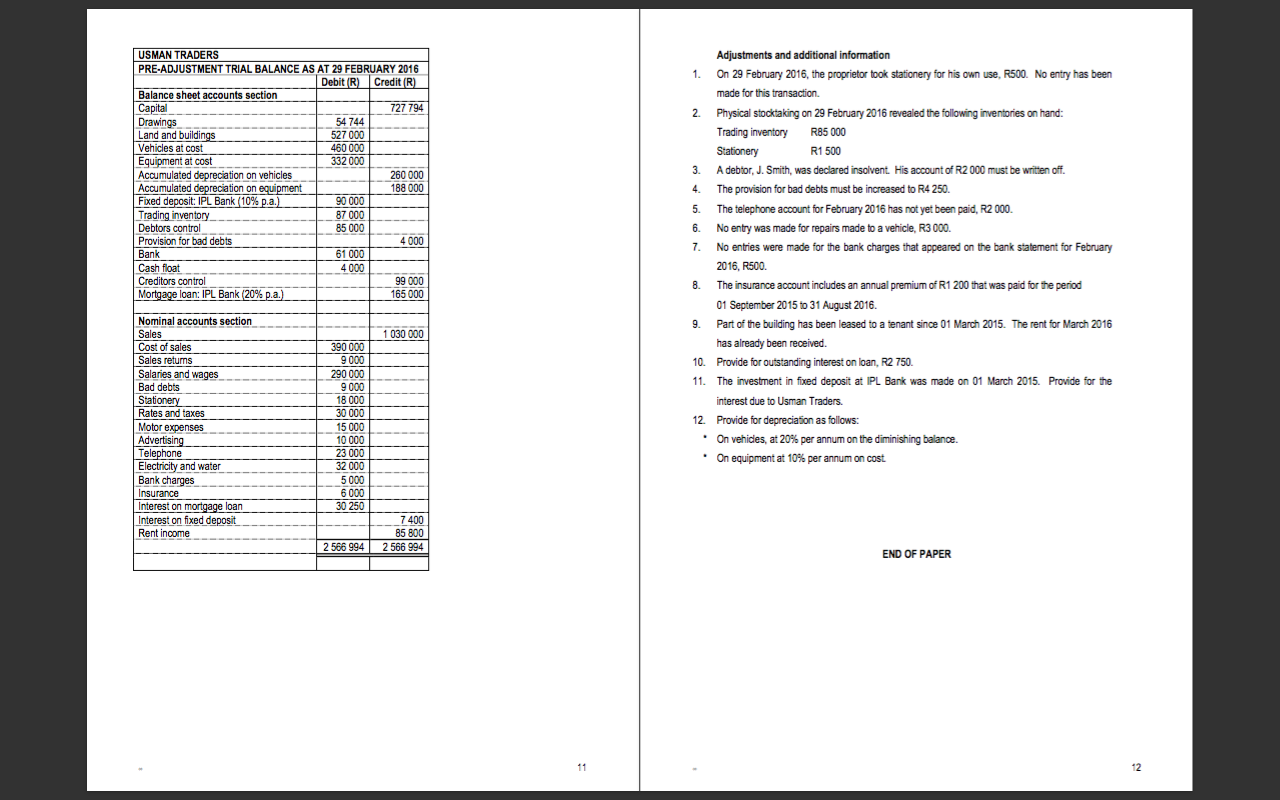

(a) QUESTION 5 FINANCIAL STATEMENTS (20 MARKS) The following trial balance, adjustments and additional information were extracted from the accounting records of Usman Traders on 29 February 2016, the end of the financial year. REQUIRED Prepare the Statement of Comprehensive Income of Usman Traders for the year ended 29 February 2016. Use the following format: The following must be taken into account: The net profit according to the Profit and loss account amounted to R500 000 on 29 February 2016. The partnership agreement makes provision for the following: Interest on capital must be provided at 12% per annum on the balances in the capital accounts. Note: Simon increased his capital by R100 000 on 01 September 2015. The capital change has been recorded. The partners are entitled to the following monthly salaries: Simon R13 000 Mondli R12 500 Simon is entitled to a special annual bonus of R30 000 Simon and Mondi share the remaining profits or losses equally. Sales Cost of sales Gross profit Other operating income Gross operating income Operating expenses Operating profit Interest income Interest expense Net profit for the year USMAN TRADERS PRE-ADJUSTMENT TRIAL BALANCE AS AT 29 FEBRUARY 2016 Debit Credit (R) Balance sheet accounts section Capital 727 794 Drawings 54 744 Land and buildings 527 000 Vehicles at cost 460 000 Equipment at cost 332 000 Accumulated depreciation on vehicles 260 000 Accumulated depreciation on equipment 188 000 Fixed deposit IPL Bank (10% p.a.) 90 000 Trading inventory 87 000 Debtors control 85 000 Provision for bad debts Bank 61 000 Cash float 4000 Creditors control 99 000 Mortgage loan: IPL Bank (20% p.a.) 165 000 2000 Adjustments and additional information 1. On 29 February 2016, the proprietor took stationery for his own use, R500. No entry has been made for this transaction Physical stooktaking on 29 February 2016 revealed the following inventories on hand: Trading inventory R85 000 Stationery R1 500 3. A debtor, J. Smith, was declared insolvent. His account of R2 000 must be written off. 4. The provision for bad debts must be increased to R4250 The telephone account for February 2016 has not yet been paid, R2 000 6. No entry was made for repairs made to a vehicle, R3 000 7. No entries were made for the bank charges that appeared on the bank statement for February 2016, R500 8. The insurance account includes an annual premium of R1 200 that was paid for the period 01 September 2015 to 31 August 2016. 9. Part of the building has been leased to a tenant since 01 March 2015. The rent for March 2016 has already been received. 10. Provide for outstanding interest on loan, R2 750. 11. The investment in fixed deposit at IPL Bank was made on 01 March 2015. Provide for the interest due to Usman Traders. 12. Provide for depreciation as follows: . On vehides, at 20% per annum on the diminishing balance. On equipment at 10% per annum on cost 1 030 000 Nominal accounts section | Sales Cost of sales Sales returns Salaries and wages Bad debts Stationery Rates and taxes Motor expenses Advertising Telephone Electricity and water Bank charges Insurance Interest on mortgage loan Interest on fixed deposit Rent income 390 000 9000 290 000 9000 18 000 30 000 15 000 10 000 23 000 32 000 5 000 6 000 30 250 7400 85 800 2 566 994 2 566 994 END OF PAPER