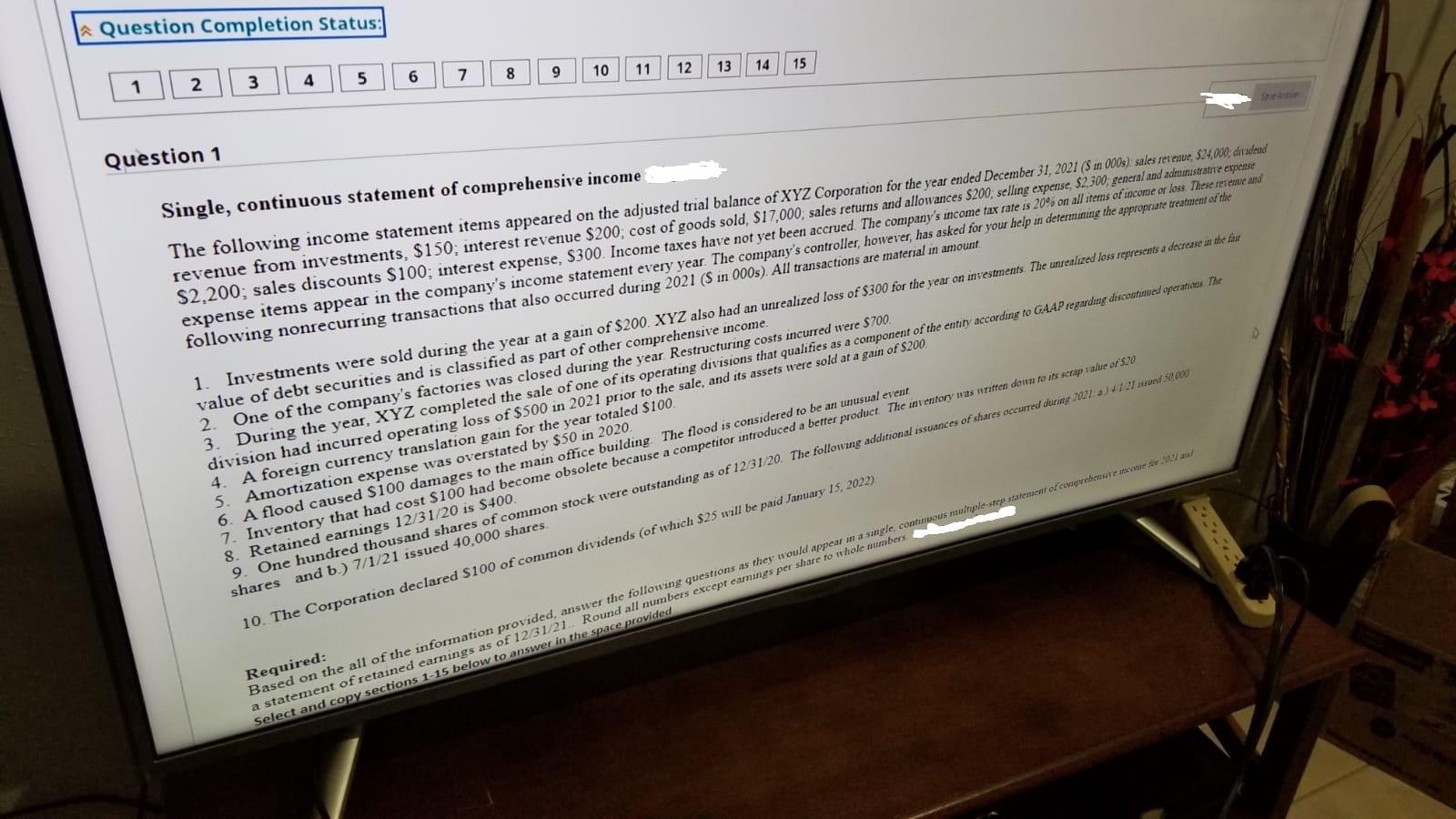

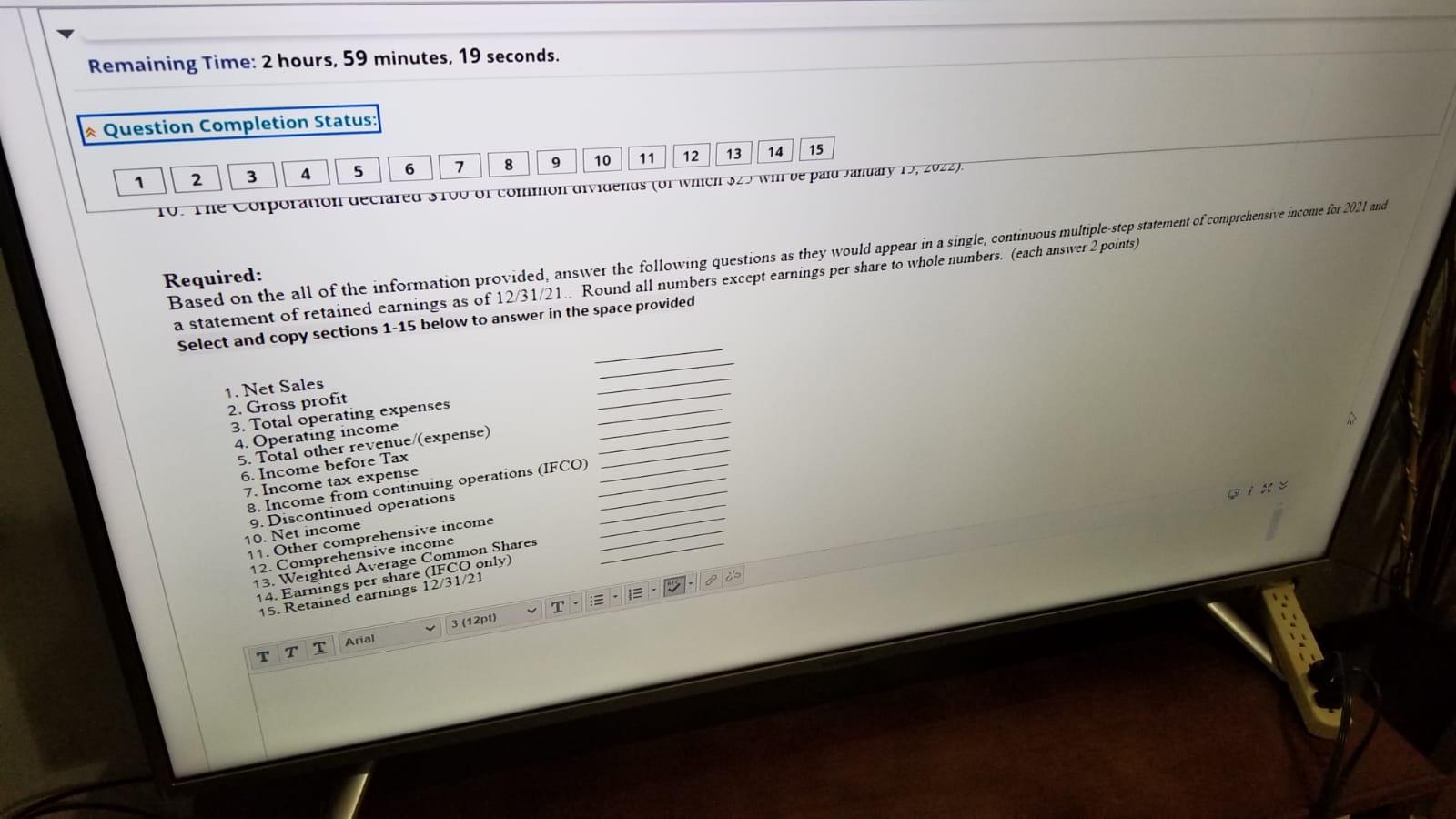

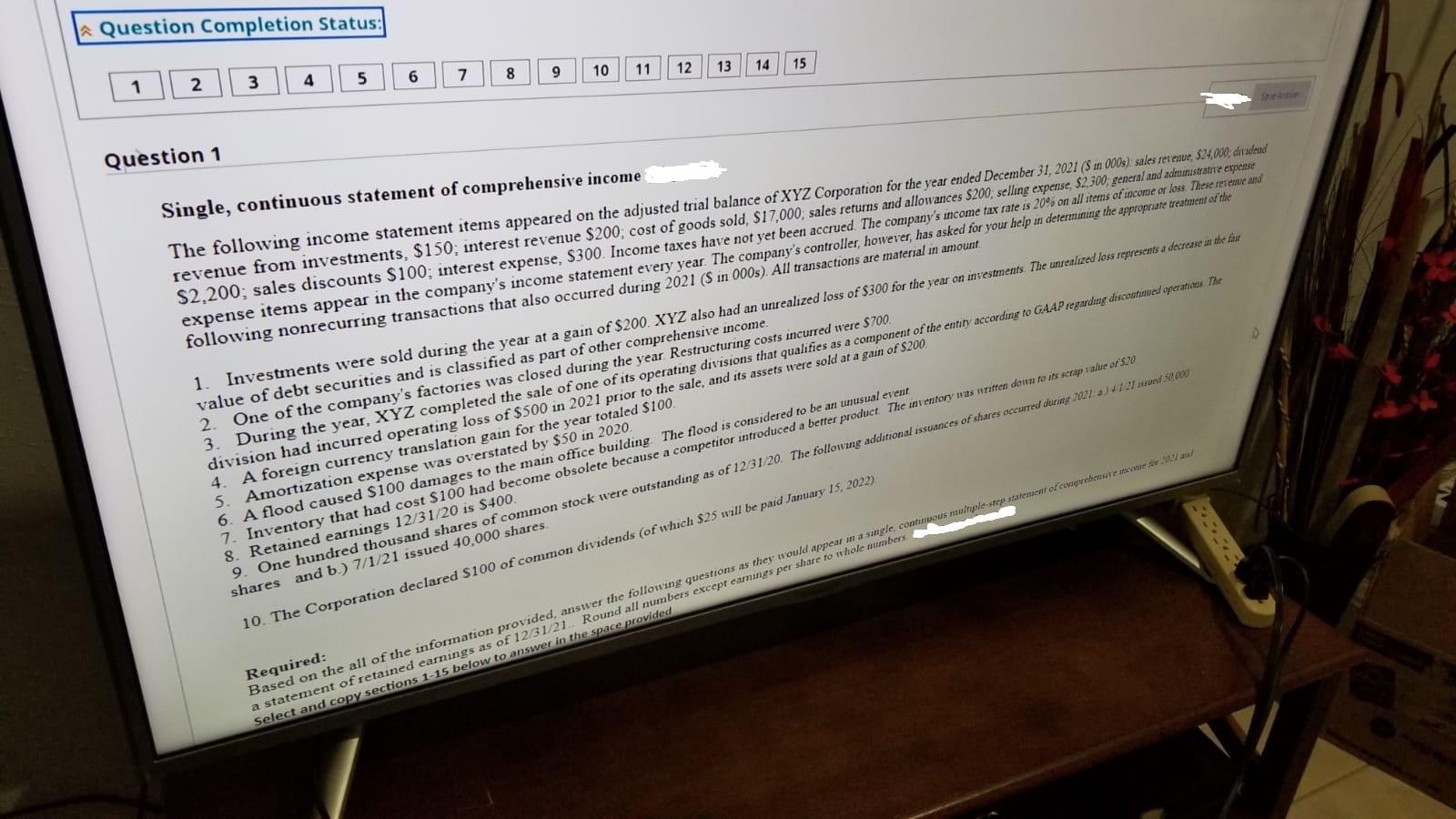

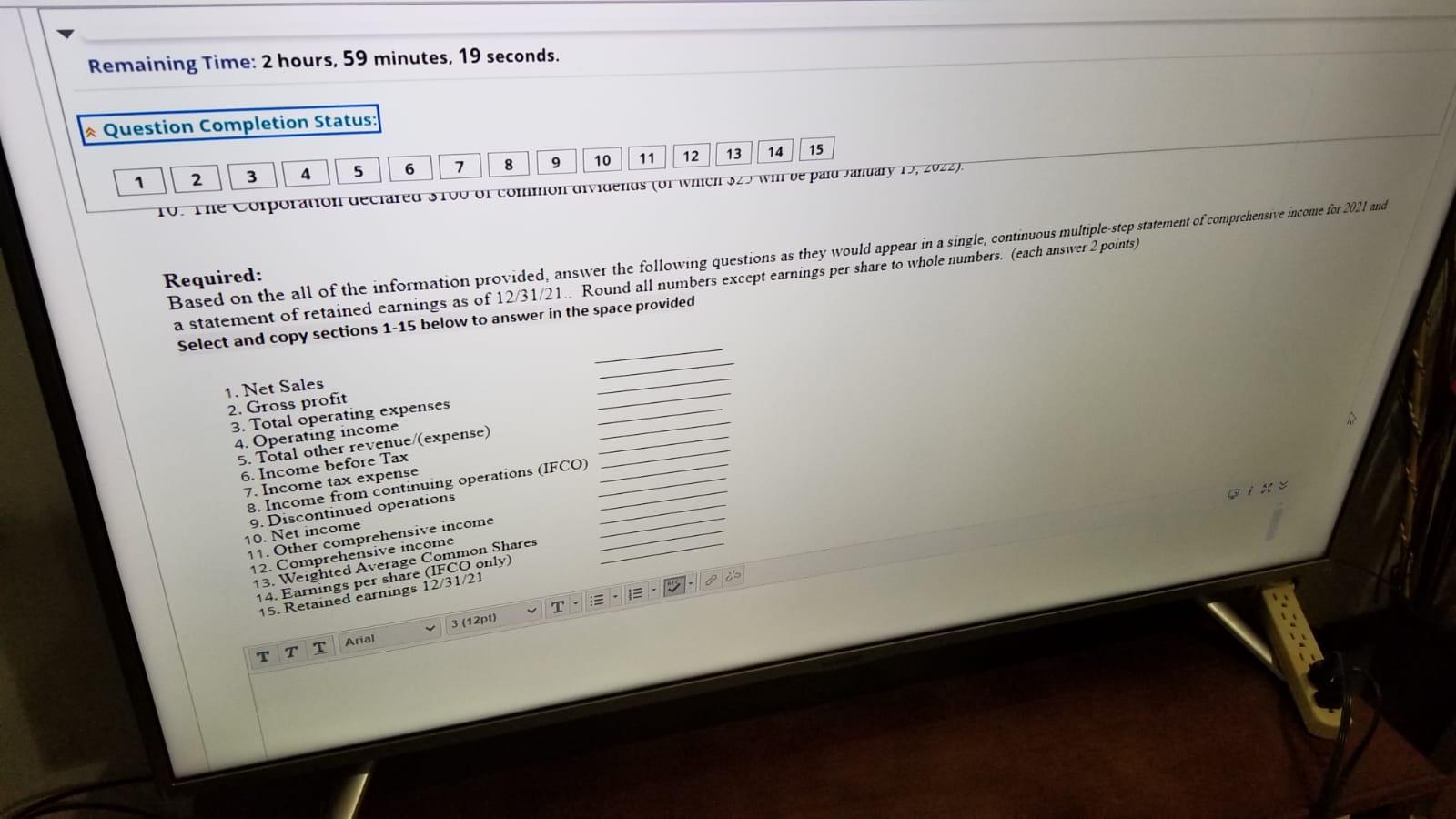

a Question Completion Status: 10 11 12 13 14 15 8 9 7 6 5 1 2 3 4 Question 1 Single, continuous statement of comprehensive income The following income statement items appeared on the adjusted trial balance of XYZ Corporation for the year ended December 31, 2021 (S in 0006): sales revenue, $24,000, dividend revenue from investments, $150, interest revenue $200; cost of goods sold, $17,000: sales returns and allowances S200, selling expense, $2,300, general and administrative expense $2,200, sales discounts $100, interest expense, $300. Income taxes have not yet been accrued. The company's income tax rate is 20% on all items of income or loss. These revenue and expense items appear in the company's income statement every year. The company's controller, however, has asked for your help in determining the appropriate treatment of the following nonrecurring transactions that also occurred during 2021 (S in 000s). All transactions are material in amount 1. Investments were sold during the year at a gain of $200 XYZ also had an unrealized loss of $300 for the year on investments. The unrealized loss represents a decrease in the fair value of debt securities and is classified as part of other comprehensive income. 2. One of the company's factories was closed during the year. Restructuring costs incurred were $700. 3. During the year, XYZ completed the sale of one of its operating divisions that qualities as a component of the entity according to GAAP regarding discontinued operaties. The division had incurred operating loss of $500 in 2021 prior to the sale, and its assets were sold at a gain of $200. 4. A foreign currency translation gain for the ye totaled $100 5. Amortization expense was overstated by $50 in 2020 6. A flood caused $100 damages to the main office building. The flood is considered to be an unusual event 7. Inventory that had cost $100 had become obsolete because a competitor introduced a better product. The mnventory was written down to its serap value of 5.20 8. Retained earnings 12/31/20 is $400. 9. One hundred thousand shares of common stock were outstanding as of 12/31/20. The following additional issuances of shares occurred during 2021: a) 27 i 20.000 shares and b.) 7/1/21 issued 40,000 shares 10. The Corporation declared $100 of common dividends (of which $25 will be paid January 15, 2022) Required: Based on the all of the information provided, answer the following questions as they would appear in a single continuous multiple stepstatement of competere come for 102 a statement of retained earnings as of 12/31/21. Round all numbers except earnings per share to whole numbers Select and copy sections 1-15 below to answer in the space provided Remaining Time: 2 hours, 59 minutes, 19 seconds. la Question Completion Status: 13 15 11 14 12 9 10 8 6 7 4 5 1 2 3 TV. The Corporation tecrareu STVU OT COMMON UIVIJETUS TOT WHICH ZJ Wir ve paru January 1, 2022). Required: Based on the all of the information provided, answer the following questions as they would appear in a single, continuous multiple-step statement of comprehensive income for 2021 and a statement of retained earnings as of 12/31/21. Round all numbers except earnings per share to whole numbers. (each answer 2 points) Select and copy sections 1-15 below to answer in the space provided 1. Net Sales 2. Gross profit 3. Total operating expenses 4. Operating income 5. Total other revenue (expense) 6. Income before Tax 7. Income tax expense 8. Income from continuing operations (IFCO) 9. Discontinued operations 10. Net income 11. Other comprehensive income 12. Comprehensive income 13. Weighted Average Common Shares per share (IFCO only) S-a's 14. Earning earnings 12/31/21 15. T- 3 (12pt) Arial