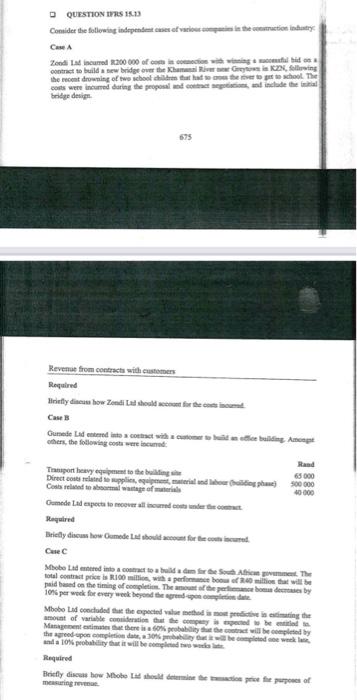

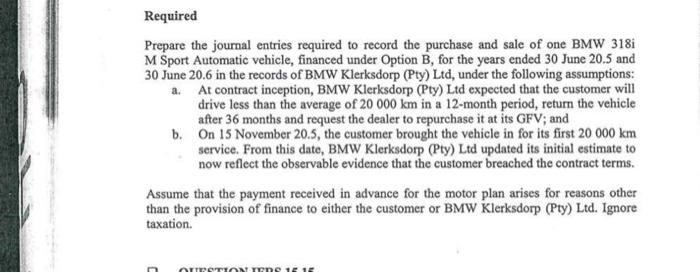

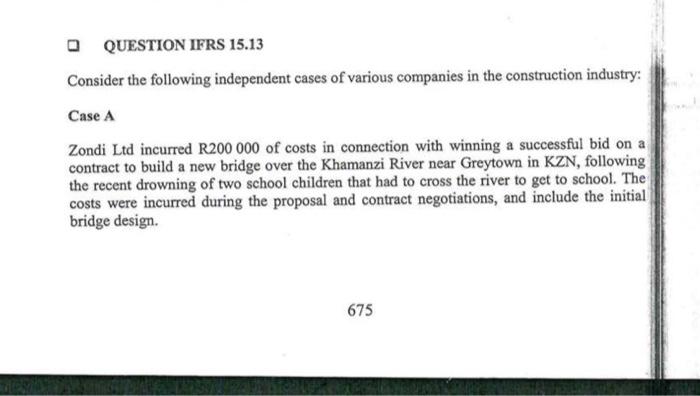

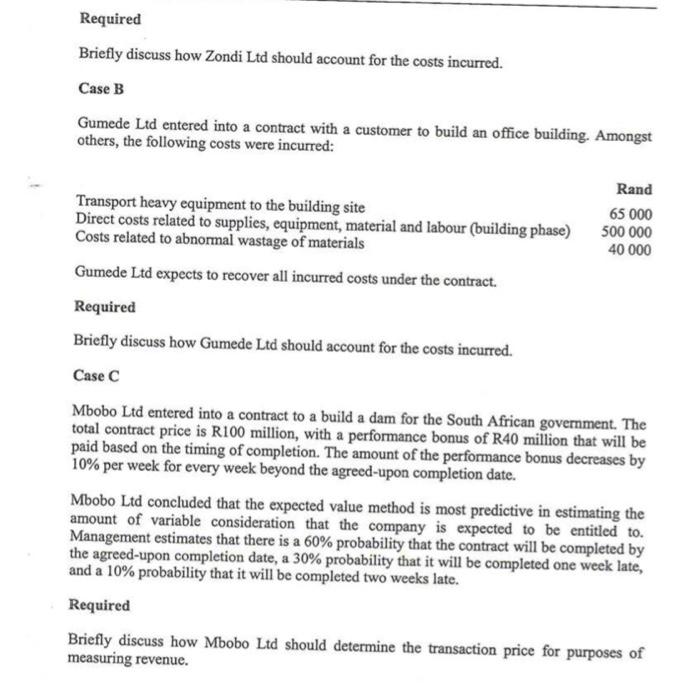

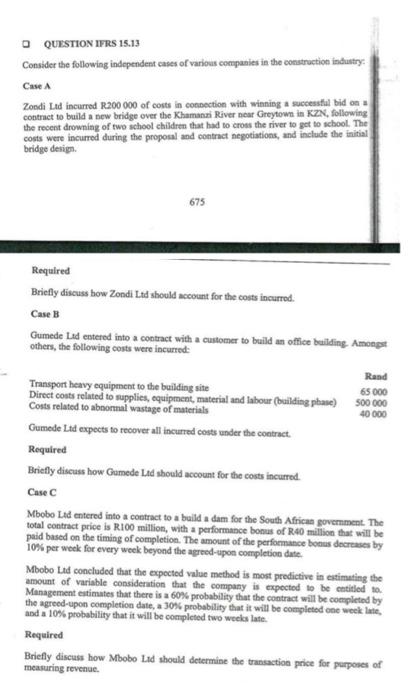

a Questionmes is. Cane A bnder desipn Revenue from coestact with customers Required Hrinfly dineus how Zendi La should wenum ifr es coss inoven. Case B whers, the following costa rere incumet: Gemede tad eqpeta to noover all bound ond inder the cuenut. Mequired Brielly divous bow Cumede Lu bovid movent fir te eosh incuret. Caie C Reguired measuring revmoue. Required Prepare the journal entries required to record the purchase and sale of one BMW 318i M Sport Automatic vehicle, financed under Option B, for the years ended 30 June 20.5 and 30 June 20.6 in the records of BMW Klerksdorp (Pty) Ltd, under the following assumptions: a. At contract inception, BMW Klerksdorp (Pty) Ltd expected that the customer will drive less than the average of 20000km in a 12 -month period, return the vehicle after 36 months and request the dealer to repurchase it at its GFV; and b. On 15 November 20.5 , the customer brought the vehicle in for its first 20000km service. From this date, BMW Klerksdorp (Pty) Ltd updated its initial estimate to now reflect the observable evidence that the customer breached the contract terms. Assume that the payment received in advance for the motor plan arises for reasons other than the provision of finance to either the customer or BMW Klerksdorp (Pty) Ltd. Ignore taxation. Consider the following independent cases of various companies in the construction industry: Case A Zondi Ltd incurred R200 000 of costs in connection with winning a successful bid on a contract to build a new bridge over the Khamanzi River near Greytown in KZN, following the recent drowning of two school children that had to cross the river to get to school. The costs were incurred during the proposal and contract negotiations, and include the initial bridge design. Required Briefly discuss how Zondi Ltd should account for the costs incurred. Case B Gumede Ltd entered into a contract with a customer to build an office building. Amongst others, the following costs were incurred: TransportheavyequipmenttothebuildingsiteDirectcostsrelatedtosupplies,equipment,materialandlabour(buildingphase)CostsrelatedtoabnormalwastageofmaterialsRand6500050000040000 Gumede Ltd expects to recover all incurred costs under the contract. Required Briefly discuss how Gumede Ltd should account for the costs incurred. Case C Mbobo Ltd entered into a contract to a build a dam for the South African government. The total contract price is R 100 million, with a performance bonus of R40 million that will be paid based on the timing of completion. The amount of the performance bonus decreases by 10% per week for every week beyond the agreed-upon completion date. Mbobo Ltd concluded that the expected value method is most predictive in estimating the amount of variable consideration that the company is expected to be entitled to. Management estimates that there is a 60% probability that the contract will be completed by the agreed-upon completion date, a 30% probability that it will be completed one week late, and a 10% probability that it will be completed two weeks late. Required Briefly discuss how Mbobo Ltd should determine the transaction price for purposes of measuring revenue. QUESTION IFRS 15.13 Consider the following independent cases of various companies in the construction industry: Case A Zondi Lad incurrod R200 000 of conts in conoction with winnisg a successtal bid on a cobtract to build a new bridge over the Khamanni River near Greytown in KZN, following the resent drowning of two school children that had to cross the river to get to school. The costs were incurred during the proposal and contract negotiations, and include the fritial bridge design. Required Briefly discuss how Zondi Ltd should account for the costs incurrod. Case Hs Gumede Lud enterod into a contract with a customer to build an offlice building. Amongt others, the following costs were incurred: Gumede Ltd expects to reoover all incurred costs under the coatract. Required Briefly discuss how Gumede Lid should account for the costs incurred. Case C Mbobo Lad entered into a contract to a build a dam for the South African govemment. The total contract price is R100 million, with a performance bonus of R40 million that will be paid based on the timing of completion. The amount of the performance boaus docreases by 10 per week for every week beyond the agreed-upon completion date. Mbobo Lad concluded that the expected value method is most predictive in eatimating the amount of variable considenation that the company is expectod to be entitled to. Management eitimates that there is a 60% probability that the contract will be compieted by. the agreed-upon completion date, a 30% probability that it will be completed ene week late, and a 10% probability that it will be completed two weeks late. Required Briefly discuss how Mbobo Lid should determine the trancaction price for perposes of a Questionmes is. Cane A bnder desipn Revenue from coestact with customers Required Hrinfly dineus how Zendi La should wenum ifr es coss inoven. Case B whers, the following costa rere incumet: Gemede tad eqpeta to noover all bound ond inder the cuenut. Mequired Brielly divous bow Cumede Lu bovid movent fir te eosh incuret. Caie C Reguired measuring revmoue. Required Prepare the journal entries required to record the purchase and sale of one BMW 318i M Sport Automatic vehicle, financed under Option B, for the years ended 30 June 20.5 and 30 June 20.6 in the records of BMW Klerksdorp (Pty) Ltd, under the following assumptions: a. At contract inception, BMW Klerksdorp (Pty) Ltd expected that the customer will drive less than the average of 20000km in a 12 -month period, return the vehicle after 36 months and request the dealer to repurchase it at its GFV; and b. On 15 November 20.5 , the customer brought the vehicle in for its first 20000km service. From this date, BMW Klerksdorp (Pty) Ltd updated its initial estimate to now reflect the observable evidence that the customer breached the contract terms. Assume that the payment received in advance for the motor plan arises for reasons other than the provision of finance to either the customer or BMW Klerksdorp (Pty) Ltd. Ignore taxation. Consider the following independent cases of various companies in the construction industry: Case A Zondi Ltd incurred R200 000 of costs in connection with winning a successful bid on a contract to build a new bridge over the Khamanzi River near Greytown in KZN, following the recent drowning of two school children that had to cross the river to get to school. The costs were incurred during the proposal and contract negotiations, and include the initial bridge design. Required Briefly discuss how Zondi Ltd should account for the costs incurred. Case B Gumede Ltd entered into a contract with a customer to build an office building. Amongst others, the following costs were incurred: TransportheavyequipmenttothebuildingsiteDirectcostsrelatedtosupplies,equipment,materialandlabour(buildingphase)CostsrelatedtoabnormalwastageofmaterialsRand6500050000040000 Gumede Ltd expects to recover all incurred costs under the contract. Required Briefly discuss how Gumede Ltd should account for the costs incurred. Case C Mbobo Ltd entered into a contract to a build a dam for the South African government. The total contract price is R 100 million, with a performance bonus of R40 million that will be paid based on the timing of completion. The amount of the performance bonus decreases by 10% per week for every week beyond the agreed-upon completion date. Mbobo Ltd concluded that the expected value method is most predictive in estimating the amount of variable consideration that the company is expected to be entitled to. Management estimates that there is a 60% probability that the contract will be completed by the agreed-upon completion date, a 30% probability that it will be completed one week late, and a 10% probability that it will be completed two weeks late. Required Briefly discuss how Mbobo Ltd should determine the transaction price for purposes of measuring revenue. QUESTION IFRS 15.13 Consider the following independent cases of various companies in the construction industry: Case A Zondi Lad incurrod R200 000 of conts in conoction with winnisg a successtal bid on a cobtract to build a new bridge over the Khamanni River near Greytown in KZN, following the resent drowning of two school children that had to cross the river to get to school. The costs were incurred during the proposal and contract negotiations, and include the fritial bridge design. Required Briefly discuss how Zondi Ltd should account for the costs incurrod. Case Hs Gumede Lud enterod into a contract with a customer to build an offlice building. Amongt others, the following costs were incurred: Gumede Ltd expects to reoover all incurred costs under the coatract. Required Briefly discuss how Gumede Lid should account for the costs incurred. Case C Mbobo Lad entered into a contract to a build a dam for the South African govemment. The total contract price is R100 million, with a performance bonus of R40 million that will be paid based on the timing of completion. The amount of the performance boaus docreases by 10 per week for every week beyond the agreed-upon completion date. Mbobo Lad concluded that the expected value method is most predictive in eatimating the amount of variable considenation that the company is expectod to be entitled to. Management eitimates that there is a 60% probability that the contract will be compieted by. the agreed-upon completion date, a 30% probability that it will be completed ene week late, and a 10% probability that it will be completed two weeks late. Required Briefly discuss how Mbobo Lid should determine the trancaction price for perposes of