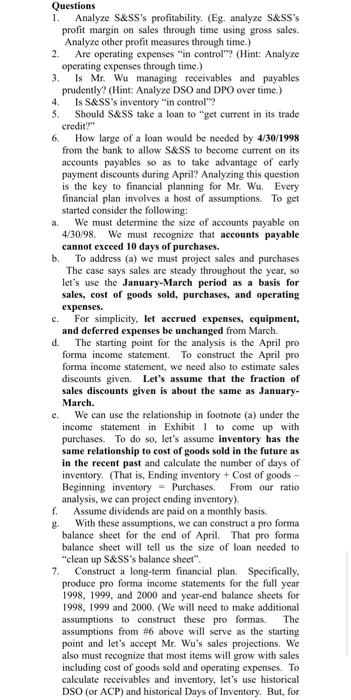

a. Questions 1. Analyze S&SS's profitability. (Eg, analyze S&SS's profit margin on sales through time using gross sales. Analyze other profit measures through time.) 2. Are operating expenses "in controll? (Hint: Analyze operating expenses through time.) 3. Is Mr. Wu managing receivables and payables prudently? (Hint: Analyze DSO and DPO over time.) 4. Is S&SS's inventory "in control"? 5. Should S&SS take a loan to "get current in its trade credit? 6. How large of a loan would be needed by 4/30/1998 from the bank to allow S&SS to become current on its accounts payables so as to take advantage of early payment discounts during April? Analyzing this question is the key to financial planning for Mr. Wu. Every financial plan involves a host of assumptions. To get started consider the following: We must determine the size of accounts payable on 4/30/98 We must recognize that accounts payable cannot exceed 10 days of purchases. b. To address (a) we must project sales and purchases The case says sales are steady throughout the year, so let's use the January-March period as a basis for sales, cost of goods sold, purchases, and operating expenses. c For simplicity, let accrued expenses, equipment, and deferred expenses be unchanged from March d. The starting point for the analysis is the April pro forma income statement. To construct the April pro forma income statement, we need also to estimate sales discounts given. Let's assume that the fraction of sales discounts given is about the same as January March. e. We can use the relationship in footnote (a) under the income statement in Exhibit to come up with purchases. To do so, let's assume inventory has the same relationship to cost of goods sold in the future as in the recent past and calculate the number of days of inventory. (That is, Ending inventory + Cost of goods Beginning inventory - Purchases, From our ratio analysis, we can project ending inventory). f. Assume dividends are paid on a monthly basis. With these assumptions, we can construct a pro forma balance sheet for the end of April. That pro forma balance sheet will tell us the size of loan needed to "clean up S&SS's balance sheet". 7. Construct a long-term financial plan. Specifically, produce pro forma income statements for the full year 1998, 1999, and 2000 and year-end balance sheets for 1998, 1999 and 2000. (We will need to make additional assumptions to construct these pro formas. The assumptions from #6 above will serve as the starting point and let's accept Mr. Wu's sales projections. We also must recognize that most items will grow with sales including cost of goods sold and operating expenses. To calculate receivables and inventory, let's use historical DSO (or ACP) and historical Days of Inventory. But, for a. Questions 1. Analyze S&SS's profitability. (Eg, analyze S&SS's profit margin on sales through time using gross sales. Analyze other profit measures through time.) 2. Are operating expenses "in controll? (Hint: Analyze operating expenses through time.) 3. Is Mr. Wu managing receivables and payables prudently? (Hint: Analyze DSO and DPO over time.) 4. Is S&SS's inventory "in control"? 5. Should S&SS take a loan to "get current in its trade credit? 6. How large of a loan would be needed by 4/30/1998 from the bank to allow S&SS to become current on its accounts payables so as to take advantage of early payment discounts during April? Analyzing this question is the key to financial planning for Mr. Wu. Every financial plan involves a host of assumptions. To get started consider the following: We must determine the size of accounts payable on 4/30/98 We must recognize that accounts payable cannot exceed 10 days of purchases. b. To address (a) we must project sales and purchases The case says sales are steady throughout the year, so let's use the January-March period as a basis for sales, cost of goods sold, purchases, and operating expenses. c For simplicity, let accrued expenses, equipment, and deferred expenses be unchanged from March d. The starting point for the analysis is the April pro forma income statement. To construct the April pro forma income statement, we need also to estimate sales discounts given. Let's assume that the fraction of sales discounts given is about the same as January March. e. We can use the relationship in footnote (a) under the income statement in Exhibit to come up with purchases. To do so, let's assume inventory has the same relationship to cost of goods sold in the future as in the recent past and calculate the number of days of inventory. (That is, Ending inventory + Cost of goods Beginning inventory - Purchases, From our ratio analysis, we can project ending inventory). f. Assume dividends are paid on a monthly basis. With these assumptions, we can construct a pro forma balance sheet for the end of April. That pro forma balance sheet will tell us the size of loan needed to "clean up S&SS's balance sheet". 7. Construct a long-term financial plan. Specifically, produce pro forma income statements for the full year 1998, 1999, and 2000 and year-end balance sheets for 1998, 1999 and 2000. (We will need to make additional assumptions to construct these pro formas. The assumptions from #6 above will serve as the starting point and let's accept Mr. Wu's sales projections. We also must recognize that most items will grow with sales including cost of goods sold and operating expenses. To calculate receivables and inventory, let's use historical DSO (or ACP) and historical Days of Inventory. But, for