Answered step by step

Verified Expert Solution

Question

1 Approved Answer

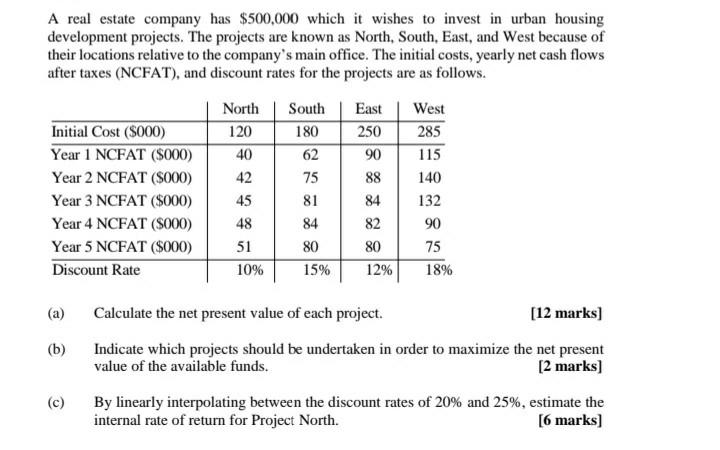

A real estate company has $500,000 which it wishes to invest in urban housing development projects. The projects are known as North, South, East, and

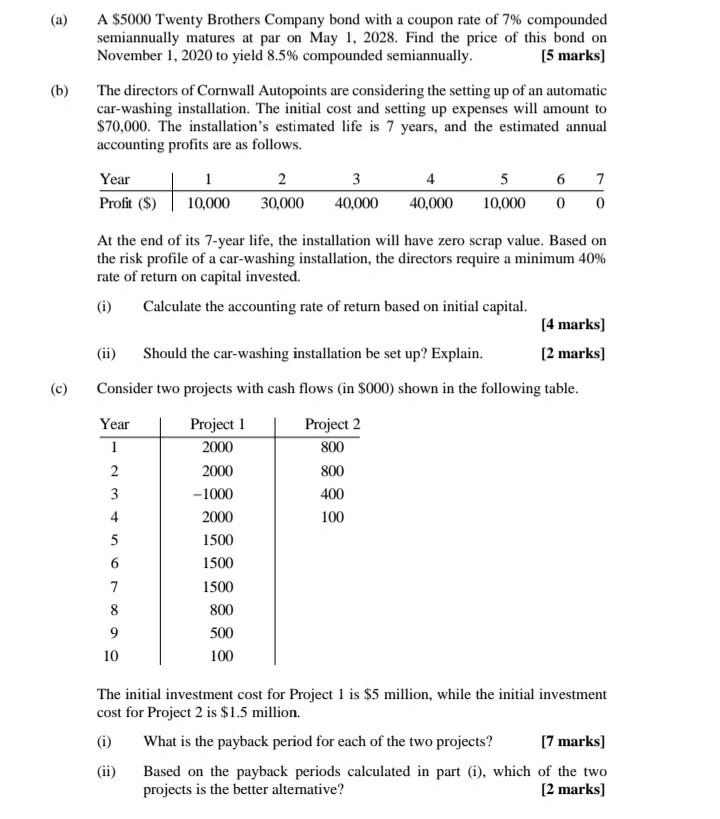

A real estate company has $500,000 which it wishes to invest in urban housing development projects. The projects are known as North, South, East, and West because of their locations relative to the company's main office. The initial costs, yearly net cash flows after taxes (NCFAT), and discount rates for the projects are as follows. East West 250 285 Initial Cost (5000) Year 1 NCFAT (5000) Year 2 NCFAT ($000) Year 3 NCFAT ($000) Year 4 NCFAT (5000) Year 5 NCFAT ($000) Discount Rate North 120 40 42 45 48 51 10% South 180 62 75 81 84 80 15% 115 140 132 90 88 84 82 80 12% 90 75 18% (a) (b) Calculate the net present value of each project. [12 marks] Indicate which projects should be undertaken in order to maximize the net present value of the available funds. [2 marks] By linearly interpolating between the discount rates of 20% and 25%, estimate the internal rate of return for Project North. [6 marks) (c) (a) (b) A $5000 Twenty Brothers Company bond with a coupon rate of 7% compounded semiannually matures at par on May 1, 2028. Find the price of this bond on November 1, 2020 to yield 8.5% compounded semiannually. [5 marks) The directors of Cornwall Autopoints are considering the setting up of an automatic car-washing installation. The initial cost and setting up expenses will amount to $70,000. The installation's estimated life is 7 years, and the estimated annual accounting profits are as follows. Year Profit ($) 1 10,000 2 30,000 3 40,000 4 40,000 5 10,000 6 7 0 0 (c) At the end of its 7-year life, the installation will have zero scrap value. Based on the risk profile of a car-washing installation, the directors require a minimum 40% rate of return on capital invested. (i) Calculate the accounting rate of return based on initial capital. [4 marks) Should the car-washing installation be set up? Explain. [2 marks] Consider two projects with cash flows (in $000) shown in the following table. Year Project 1 Project 2 1 2000 800 2 2000 800 3 -1000 400 4 2000 100 5 1500 6 1500 7 1500 8 800 9 500 10 100 au The initial investment cost for Project 1 is $5 million, while the initial investment cost for Project 2 is $1.5 million. (i) What is the payback period for each of the two projects? [7 marks) (ii) Based on the payback periods calculated in part (1), which of the two projects is the better alternative? [2 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started