Answered step by step

Verified Expert Solution

Question

1 Approved Answer

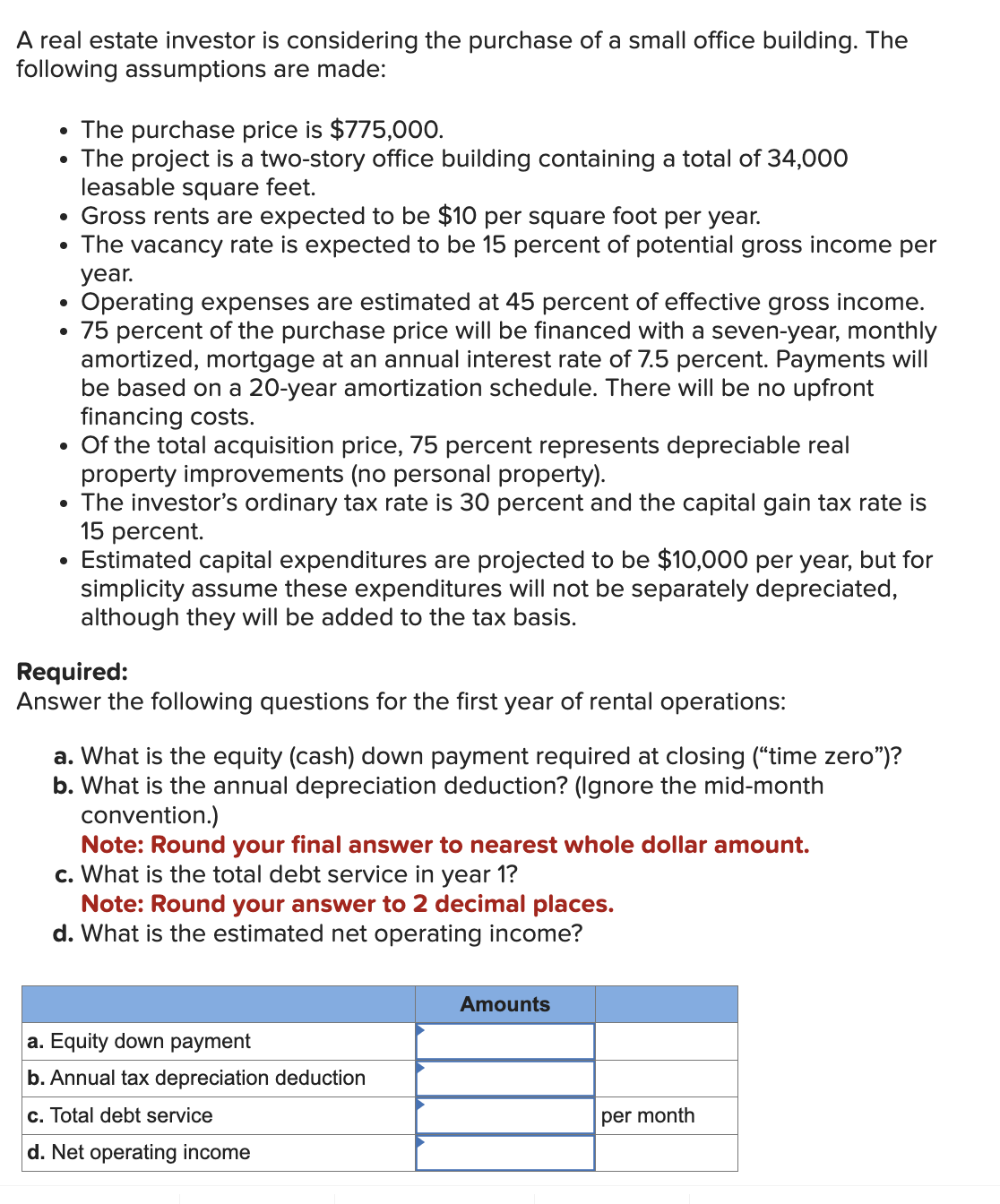

A real estate investor is considering the purchase of a small office building. The following assumptions are made: The purchase price is $ 7 7

A real estate investor is considering the purchase of a small office building. The

following assumptions are made:

The purchase price is $

The project is a twostory office building containing a total of

leasable square feet.

Gross rents are expected to be $ per square foot per year.

The vacancy rate is expected to be percent of potential gross income per

year.

Operating expenses are estimated at percent of effective gross income.

percent of the purchase price will be financed with a sevenyear, monthly

amortized, mortgage at an annual interest rate of percent. Payments will

be based on a year amortization schedule. There will be no upfront

financing costs.

Of the total acquisition price, percent represents depreciable real

property improvements no personal property

The investor's ordinary tax rate is percent and the capital gain tax rate is

percent.

Estimated capital expenditures are projected to be $ per year, but for

simplicity assume these expenditures will not be separately depreciated,

although they will be added to the tax basis.

Required:

Answer the following questions for the first year of rental operations:

a What is the equity cash down payment required at closing time zero"

b What is the annual depreciation deduction? Ignore the midmonth

convention.

Note: Round your final answer to nearest whole dollar amount.

c What is the total debt service in year

Note: Round your answer to decimal places.

d What is the estimated net operating income?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started