Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A realistic budget is the most important financial tool in achieving your dreams and understanding your financial health. Your budget is both a plan and

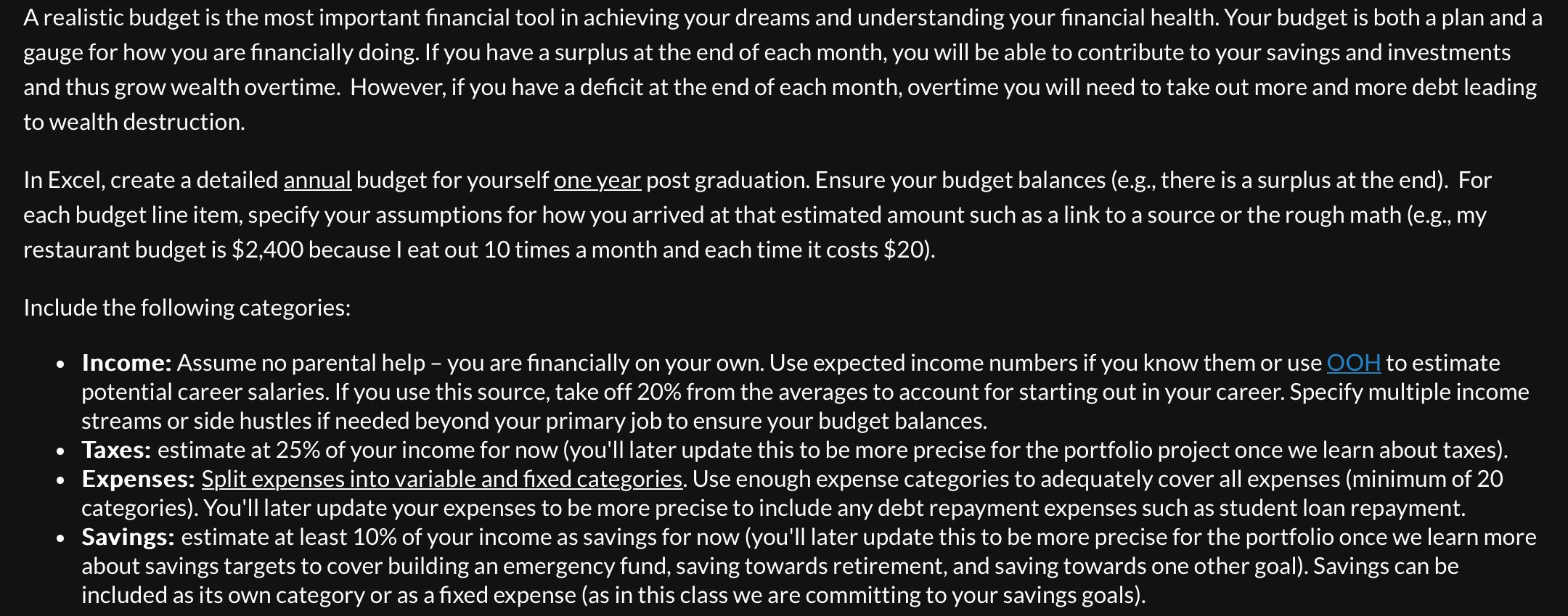

A realistic budget is the most important financial tool in achieving your dreams and understanding your financial health. Your budget is both a plan and a gauge for how you are financially doing. If you have a surplus at the end of each month, you will be able to contribute to your savings and investments and thus grow wealth overtime. However, if you have a deficit at the end of each month, overtime you will need to take out more and more debt leading to wealth destruction.

In Excel, create a detailed annual budget for yourself one year post graduation. Ensure your budget balances eg there is a surplus at the end For each budget line item, specify your assumptions for how you arrived at that estimated amount such as a link to a source or the rough math eg my restaurant budget is $ because I eat out times a month and each time it costs $

Include the following categories:

Income: Assume no parental help you are financially on your own. Use expected income numbers if you know them or use potential career salaries. If you use this source, take off from the averages to account for starting out in your career. Specify multiple income streams or side hustles if needed beyond your primary job to ensure your budget balances.

Taxes: estimate at of your income for now youll later update this to be more precise for the portfolio project once we learn about taxes

Expenses: Split expenses into variable and fixed categories. Use enough expense categories to adequately cover all expenses minimum of categories You'll later update your expenses to be more precise to include any debt repayment expenses such as student loan repayment.

Savings: estimate at least of your income as savings for now youll later update this to be more precise for the portfolio once we learn more about savings targets to cover building an emergency fund, saving towards retirement, and saving towards one other goal Savings can be included as its own category or as a fixed expense as in this class we are committing to your savings goals

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started