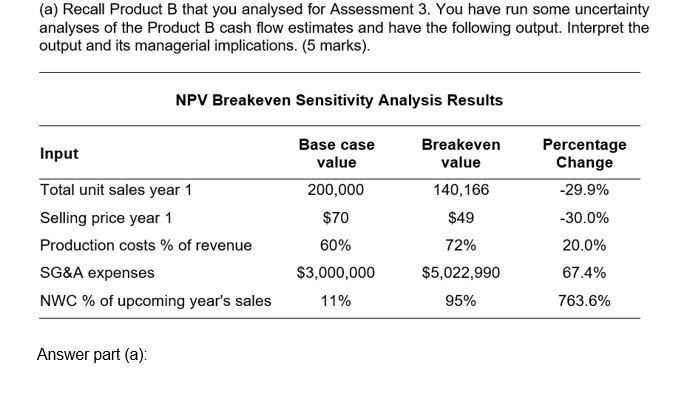

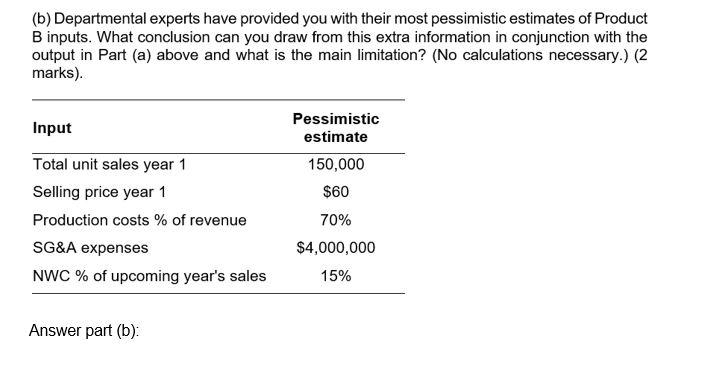

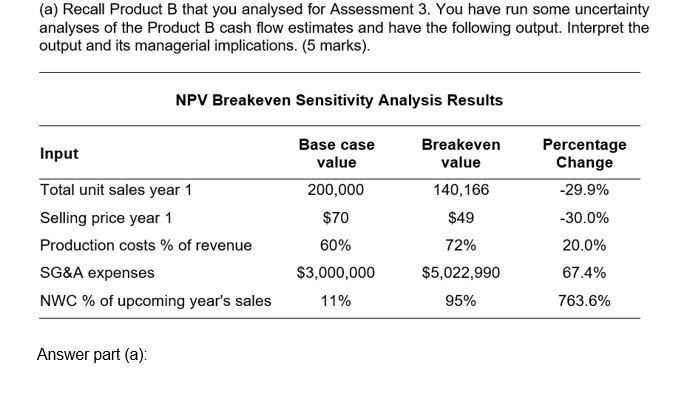

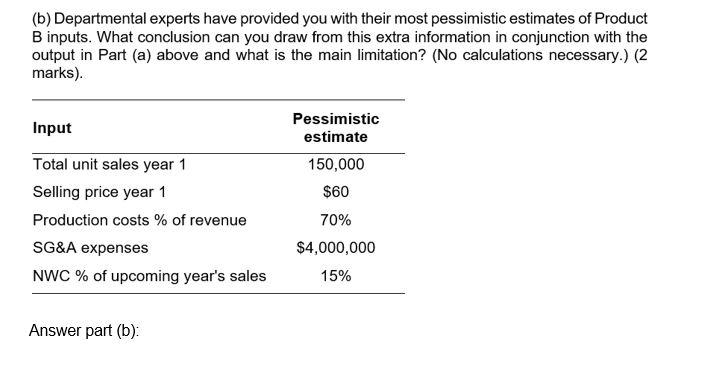

(a) Recall Product B that you analysed for Assessment 3. You have run some uncertainty analyses of the Product B cash flow estimates and have the following output. Interpret the output and its managerial implications. (5 marks). NPV Breakeven Sensitivity Analysis Results Input Breakeven value 140,166 Percentage Change -29.9% Base case value 200,000 $70 60% $3,000,000 11% $49 Total unit sales year 1 Selling price year 1 Production costs % of revenue SG&A expenses NWC % of upcoming year's sales -30.0% 20.0% 72% $5,022,990 95% 67.4% 763.6% Answer part (a) (b) Departmental experts have provided you with their most pessimistic estimates of Product B inputs. What conclusion can you draw from this extra information in conjunction with the output in Part (a) above and what is the main limitation? (No calculations necessary.) (2 marks). Input Total unit sales year 1 Selling price year 1 Production costs % of revenue SG&A expenses NWC % of upcoming year's sales Pessimistic estimate 150,000 $60 70% $4,000,000 15% Answer part (b) (c) Smith Ltd has a market value capital structure with 35% debt and 65% ordinary equity. Its debt has a current YTM of 7% and the required return on the company's equity is 15%. The company is subject to a 30% tax rate. Calculate the company's after-tax WACC. (3 marks). Answer part (c): (a) Recall Product B that you analysed for Assessment 3. You have run some uncertainty analyses of the Product B cash flow estimates and have the following output. Interpret the output and its managerial implications. (5 marks). NPV Breakeven Sensitivity Analysis Results Input Breakeven value 140,166 Percentage Change -29.9% Base case value 200,000 $70 60% $3,000,000 11% $49 Total unit sales year 1 Selling price year 1 Production costs % of revenue SG&A expenses NWC % of upcoming year's sales -30.0% 20.0% 72% $5,022,990 95% 67.4% 763.6% Answer part (a) (b) Departmental experts have provided you with their most pessimistic estimates of Product B inputs. What conclusion can you draw from this extra information in conjunction with the output in Part (a) above and what is the main limitation? (No calculations necessary.) (2 marks). Input Total unit sales year 1 Selling price year 1 Production costs % of revenue SG&A expenses NWC % of upcoming year's sales Pessimistic estimate 150,000 $60 70% $4,000,000 15% Answer part (b) (c) Smith Ltd has a market value capital structure with 35% debt and 65% ordinary equity. Its debt has a current YTM of 7% and the required return on the company's equity is 15%. The company is subject to a 30% tax rate. Calculate the company's after-tax WACC. (3 marks). Answer part (c)