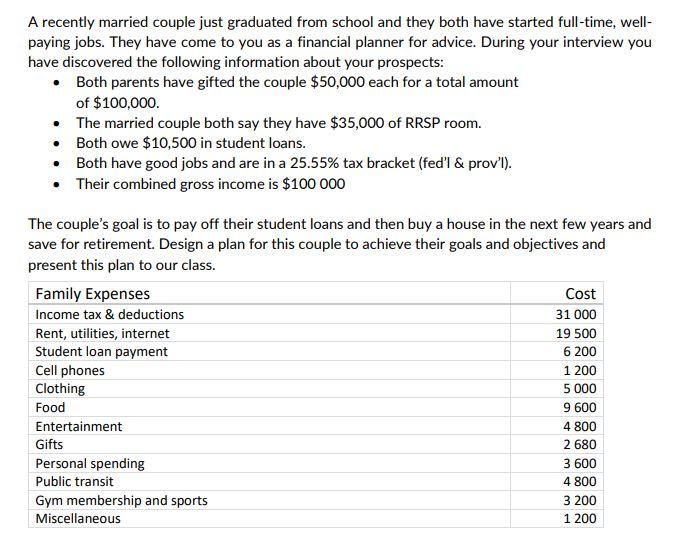

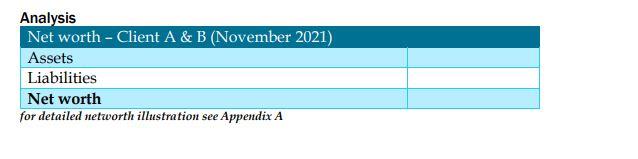

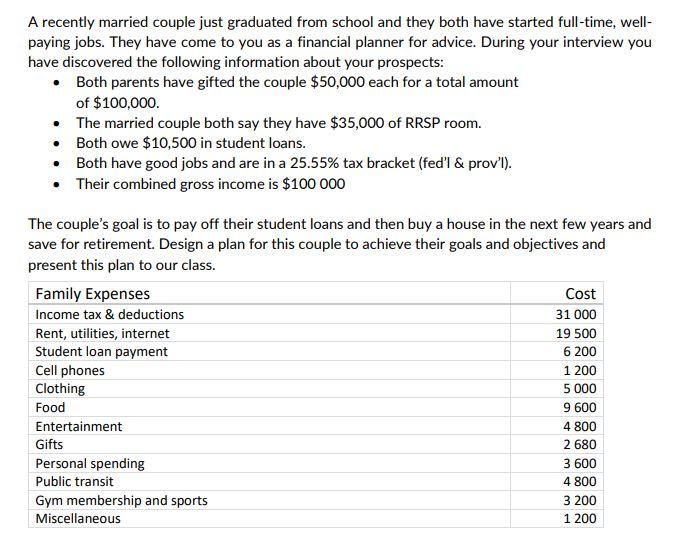

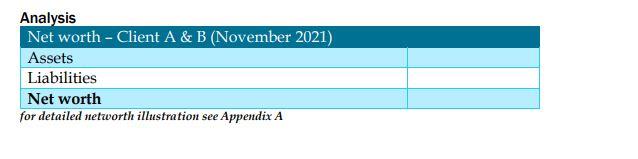

A recently married couple just graduated from school and they both have started full-time, wellpaying jobs. They have come to you as a financial planner for advice. During your interview you have discovered the following information about your prospects: - Both parents have gifted the couple $50,000 each for a total amount of $100,000. - The married couple both say they have $35,000 of RRSP room. - Both owe $10,500 in student loans. - Both have good jobs and are in a 25.55% tax bracket (fed'l \& prov'l). - Their combined gross income is $100000 The couple's goal is to pay off their student loans and then buy a house in the next few years and save for retirement. Design a plan for this couple to achieve their goals and objectives and present this plan to our class. Analysis \begin{tabular}{|l|l|} \hline Net worth - Client A \& B (November 2021) \\ \hline Assets \\ \hline Liabilities \\ \hline Net worth & \\ \hline \end{tabular} for detailed networth illustration see Appendix A A recently married couple just graduated from school and they both have started full-time, wellpaying jobs. They have come to you as a financial planner for advice. During your interview you have discovered the following information about your prospects: - Both parents have gifted the couple $50,000 each for a total amount of $100,000. - The married couple both say they have $35,000 of RRSP room. - Both owe $10,500 in student loans. - Both have good jobs and are in a 25.55% tax bracket (fed'l \& prov'l). - Their combined gross income is $100000 The couple's goal is to pay off their student loans and then buy a house in the next few years and save for retirement. Design a plan for this couple to achieve their goals and objectives and present this plan to our class. Analysis \begin{tabular}{|l|l|} \hline Net worth - Client A \& B (November 2021) \\ \hline Assets \\ \hline Liabilities \\ \hline Net worth & \\ \hline \end{tabular} for detailed networth illustration see Appendix A