Answered step by step

Verified Expert Solution

Question

1 Approved Answer

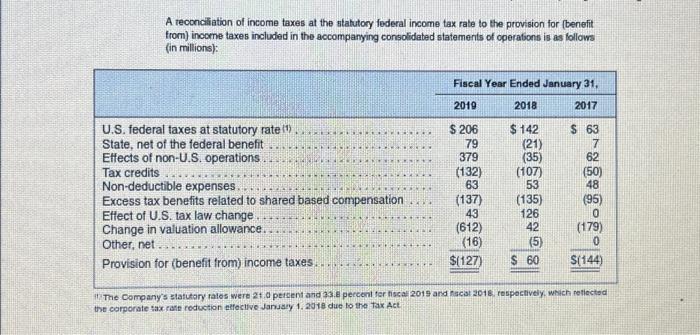

A reconciliation of income taxes at the statutory federal income tax rate to the provision for (benefit from) income taxes included in the accompanying consolidated

A reconciliation of income taxes at the statutory federal income tax rate to the provision for (benefit from) income taxes included in the accompanying consolidated statements of operations is as follows (in millions): U.S. federal taxes at statutory rate (1) State, net of the federal benefit Effects of non-U.S. operations Tax credits Non-deductible expenses LEGO CITES Xxx CILI CASARES 2 FREE DO S Excess tax benefits related to shared based compensation Effect of U.S. tax law change Change in valuation allowance Other, net Provision for (benefit from) income taxes Fiscal Year Ended January 31, 2019 2018 2017 $ 206 379 (132) (137) (612) (16) $(127) $ 142 (21) (35) (107) 53 (135) 126 42 (5) $ 60 %>%8*8 $ 63 62 (50) 48 (95) (179) S(144) "The Company's statutory rates were 21.0 percent and 33.8 percent for fiscal 2015 and fiscal 2018, respectively, which reflected the corporate tax rate reduction effective January 1, 2018 due to the Tax Act

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started