Question

a. record Armstrong's acquisition of Richens Corporation common stock. b. show the computation of goodwill purchase at acquisition c. Richens Corporation paid dividends of $3

a. record Armstrong's acquisition of Richens Corporation common stock. b. show the computation of goodwill purchase at acquisition c. Richens Corporation paid dividends of $3 per share on August 15, year 1. Record the dividend received by Armstrong. d. Richens Corporation reported ner income of $900000 for year 1. Provide the journal entry to record RC's income on Armstrong's accounting record. e. provide any other adjusting entries related to Armstrong Company's investment in RC on Dec 31, year 1. f. On January 1, year 2, Armstrong Company sold 7000 share of their RC stock for $90 per share. Record sale.

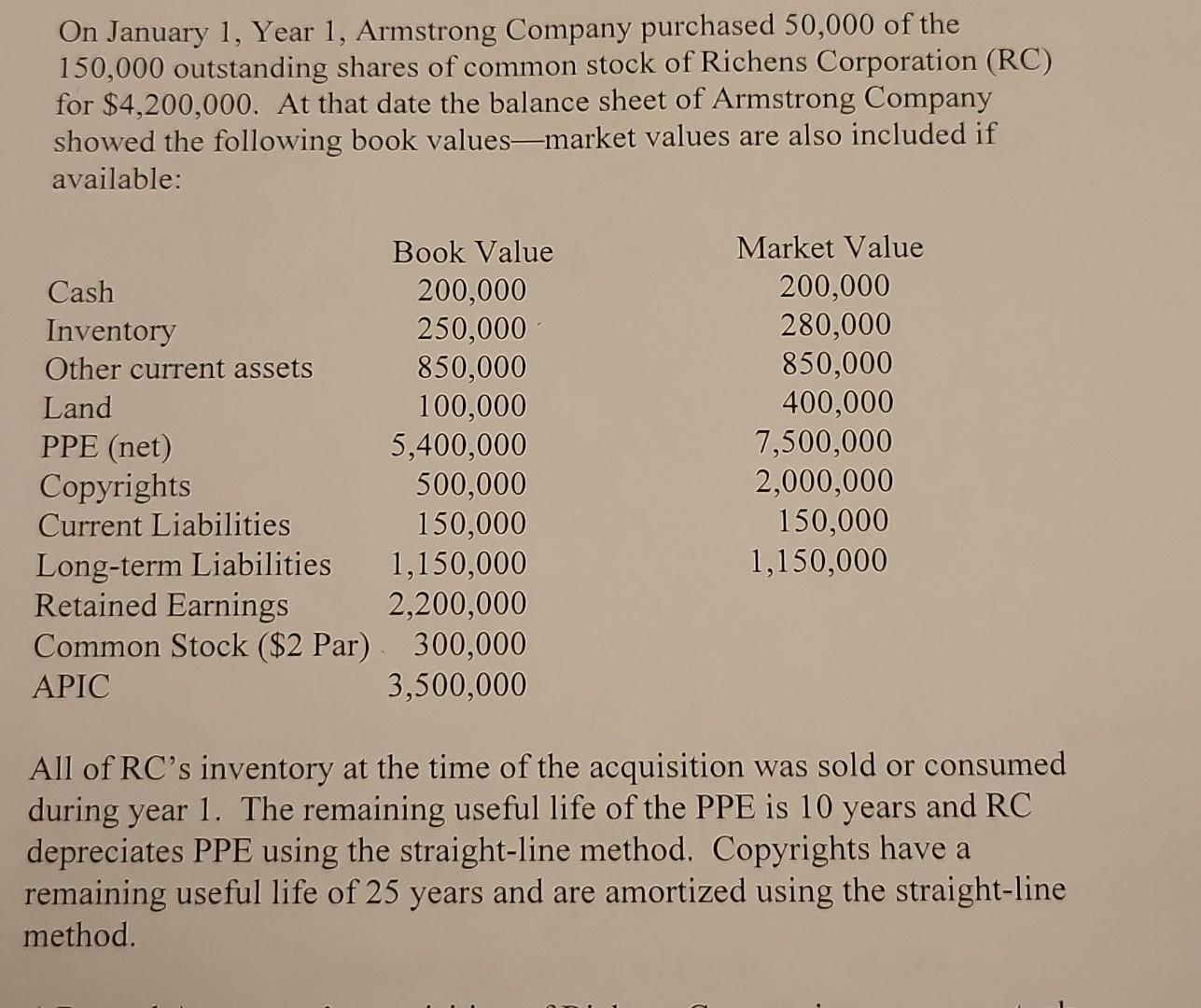

On January 1, Year 1, Armstrong Company purchased 50,000 of the 150,000 outstanding shares of common stock of Richens Corporation (RC) for $4,200,000. At that date the balance sheet of Armstrong Company showed the following book values - market values are also included if available: All of RC's inventory at the time of the acquisition was sold or consumed during year 1 . The remaining useful life of the PPE is 10 years and RC depreciates PPE using the straight-line method. Copyrights have a remaining useful life of 25 years and are amortized using the straight-line methodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started