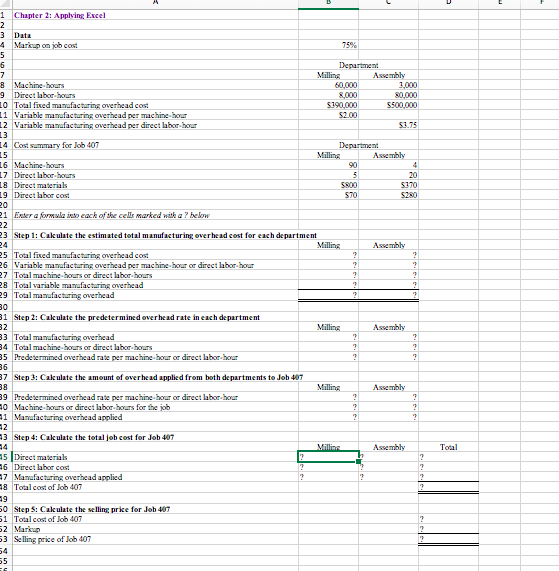

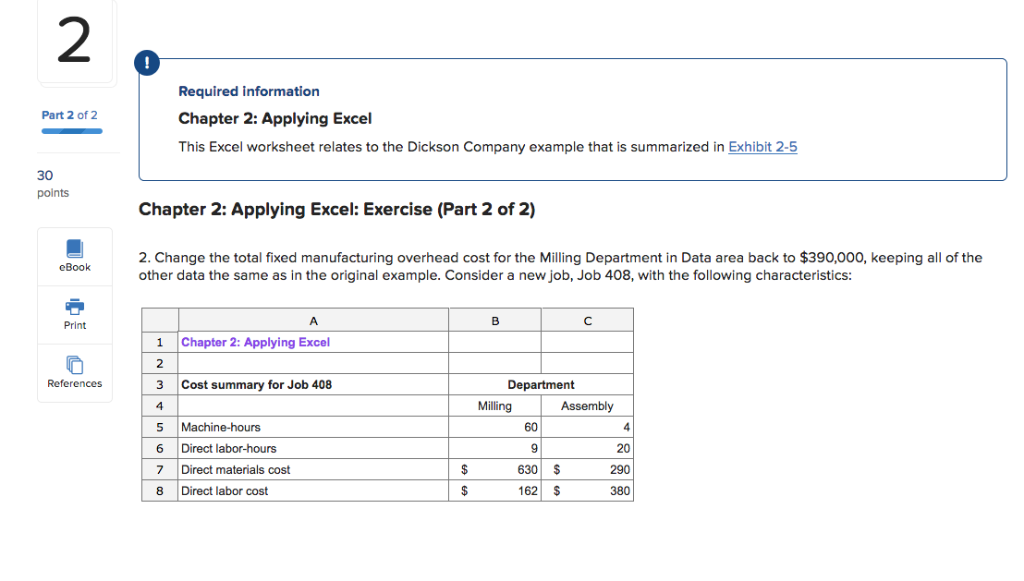

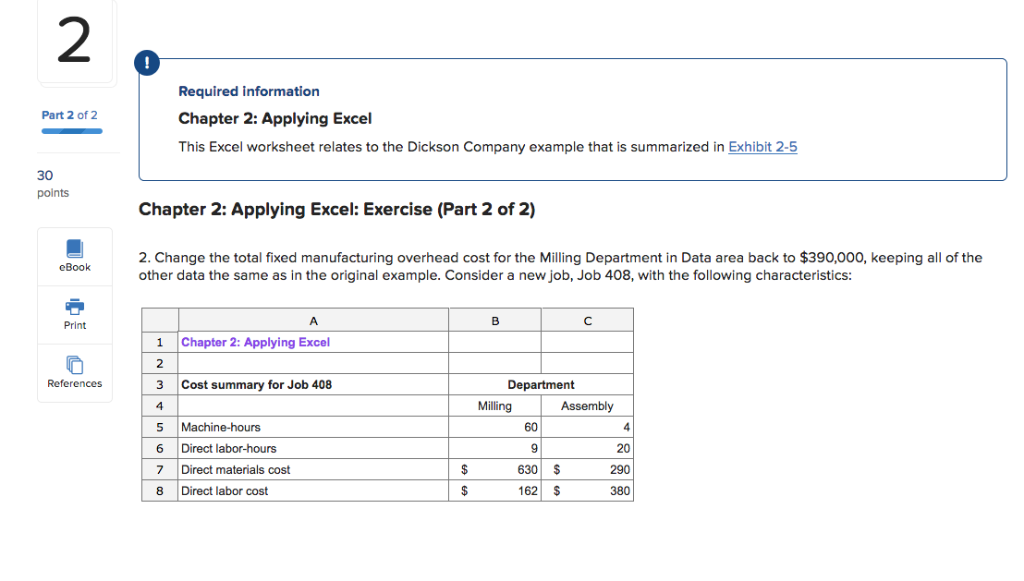

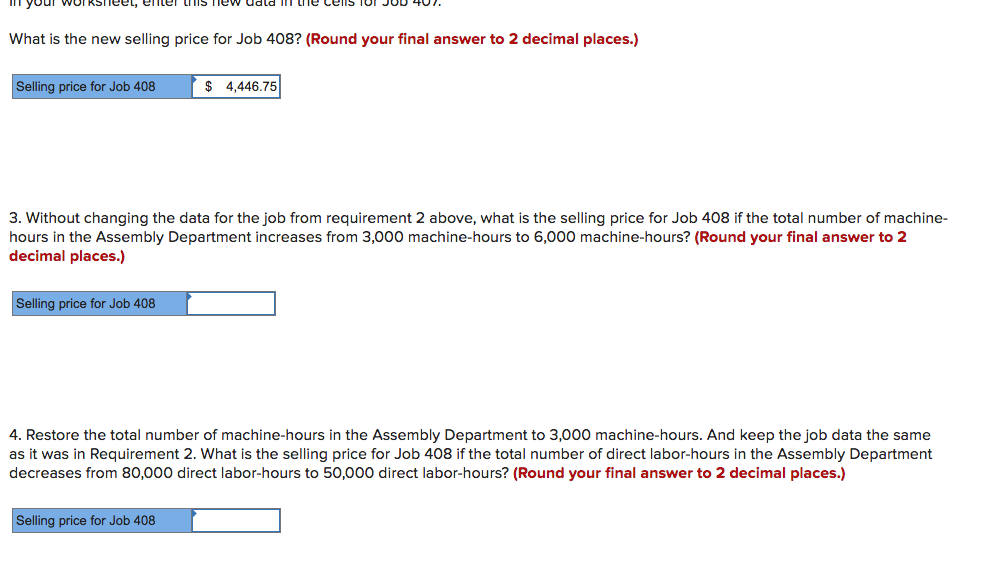

1 Chapter 2: Applying Excel 2 Data 4 Markup on iob cost 75% 5 6 Department 7 Milling Assembly 8 Machine-hours 9 Direct labor-hours 0 Total fived manfacturing overbcad cost 60,000 3,000 8,000 80,000 S390,000 5500.000 11 Variable mamufacturing overhead per machine-hour Variable manufacturing overhead per direct labor-hour S2.00 12 S3.75 14 Cost summary for Job 407 Department 15 16 Machine-hours 17 Direct labor-hours 18 Direct materials 19 Direct labor cost Milling Assembly 90 20 S800 S370 S70 $280 20 21 Enter a formula into each of the cells marked with a? below 22 3 Step 1: Cakulate the estimated total manufacturing overhead cost for each department 24 Milling Assembly 25 Total fixed mamufacturing overhead cost 26 Variable manufacturing overhead per machine-hour or direct labor-hour 27 Total machine-hours or direct labor-hours 28 Total variable manufacturing overhead 29 Total manafacturing overhead 30 1 Step 2: Cakulate the predetermined overhead rate in each department 82 Milling Assembly 3 Total manufacturing overhead 4 Total machine-hours or direct abor-hours 5 Predetermined overhead rate per machine-hour or direct labor-hour 86 87 Step 3: Cak ulate the amount of overhead applied from both departments to Job 407 38 Milling Assembly 9 Predetermined overhead rate per machine-hour or direct labor-hour Machine-hours or direct labor-hovurs for the job Manufacturing overhead applied 0 11 42 43 Step 4 job cost for Job 407 culate the 14 Milling Assembly Total 5 Direct materiak 6 Direct labor cost 7 Manfacturing overhead applied 48 Total cost of Job 407 19 0 Step 5: Cakulate the selling price for Job 407 1 Total cost of Job 407 52 Markup 53 Selling price of Job 407 4 5 2 Required information Part 2 of 2 Chapter 2: Applying Excel This Excel worksheet relates to the Dickson Company example that is summarized in Exhibit 2-5 30 points Chapter 2: Applying Excel: Exercise (Part 2 of 2) 2. Change the total fixed manufacturing overhead cost for the Milling Department in Data area back to $390,000, keeping all of the other data the same as in the original example. Consider eBook new job, Job 408, with the following characteristics: A B C Print Chapter 2: Applying Excel 1 2 References 3 Cost summary for Job 408 Department Milling Assembly 4 Machine-hours 60 4 5 Direct labor-hours 20 6 Direct materials cost 290 630 Direct labor cost 380 8 162 What is the new selling price for Job 408? (Round your final answer to 2 decimal places.) 4,446.75 Selling price for Job 408 3. Without changing the data for the job from requirement 2 above, what is the selling price for Job 408 if the total number of machine- hours in the Assembly Department increases from 3,000 machine-hours to 6,000 machine-hours? (Round your final answer to 2 decimal places.) Selling price for Job 408 4. Restore the total number of machine-hours in the Assembly Department to 3,000 machine-hours. And keep the job data the same as it was in Requirement 2. What is the selling price for Job 408 if the total number of direct labor-hours in the Assembly Department decreases from 80,000 direct labor-hours to 50,000 direct labor-hours? (Round your final answer to 2 decimal places.) Selling price for Job 408