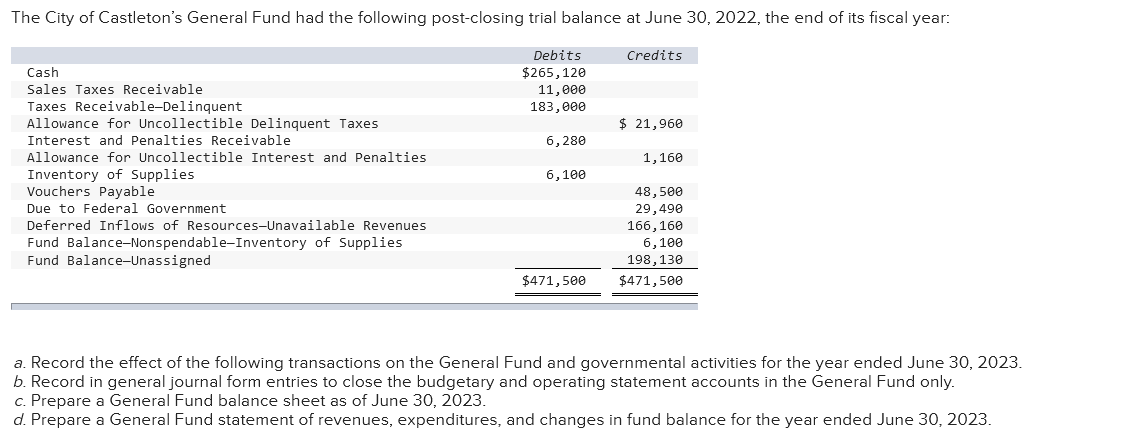

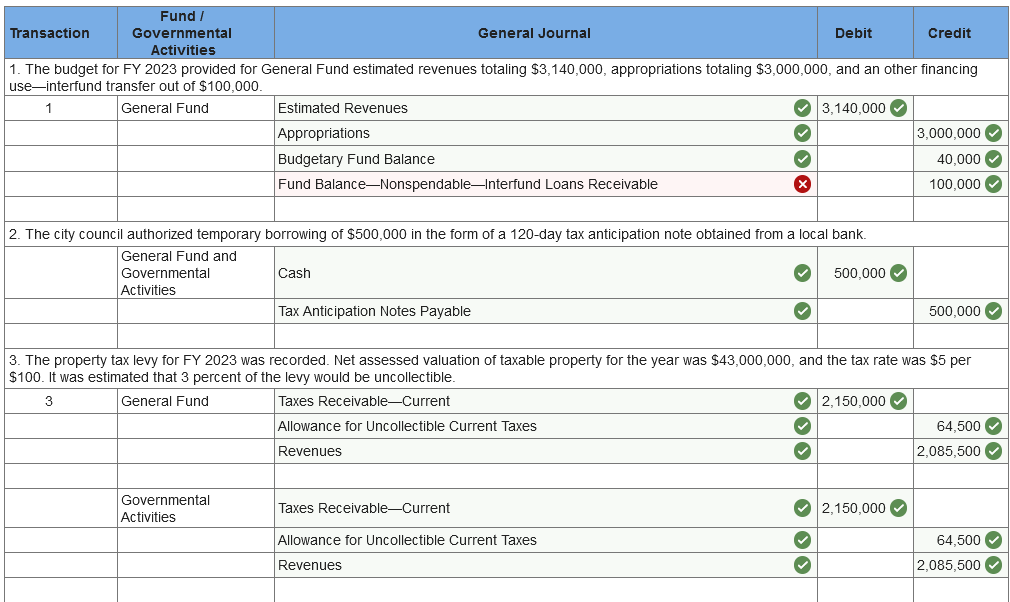

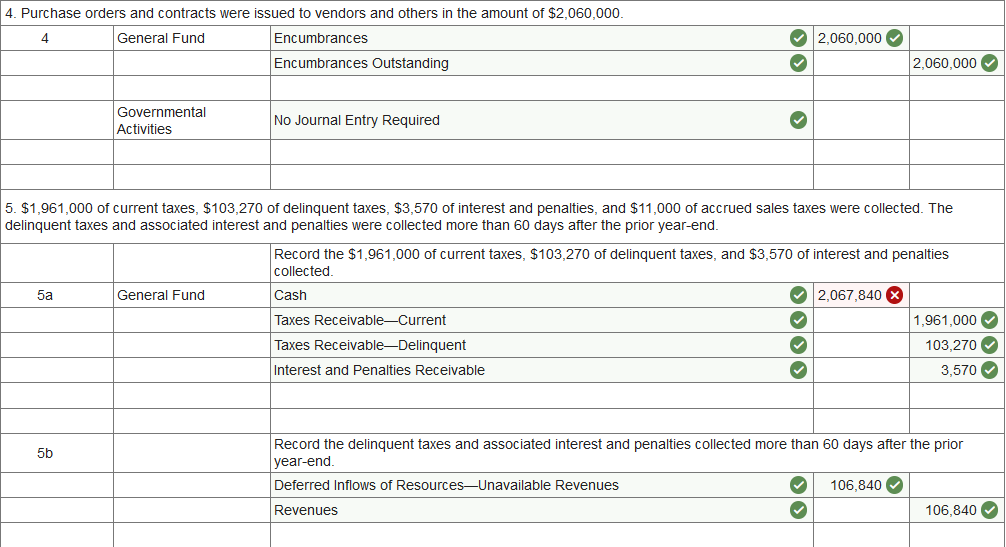

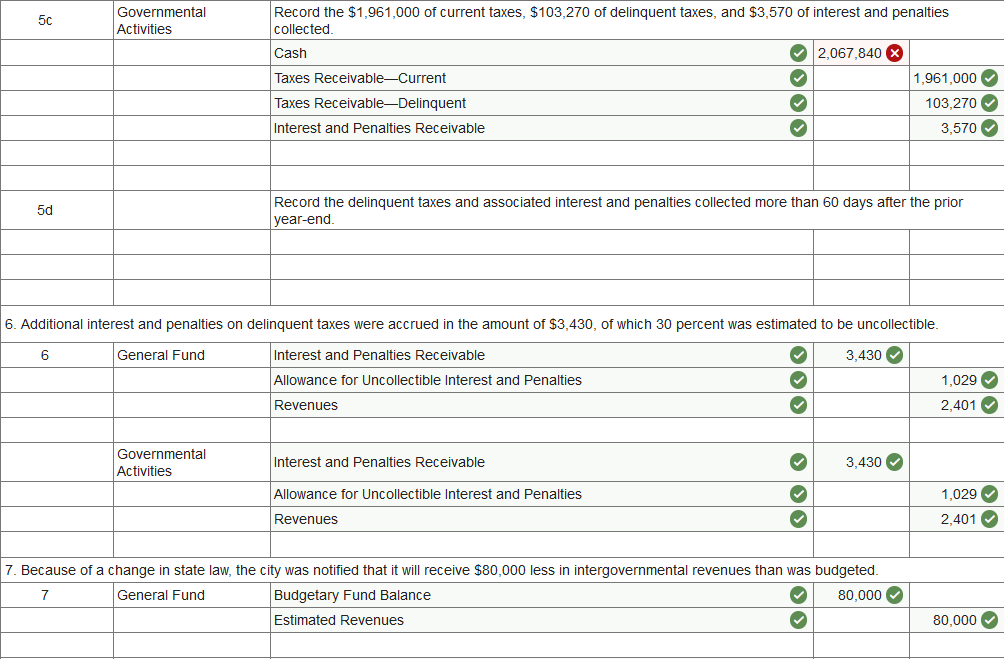

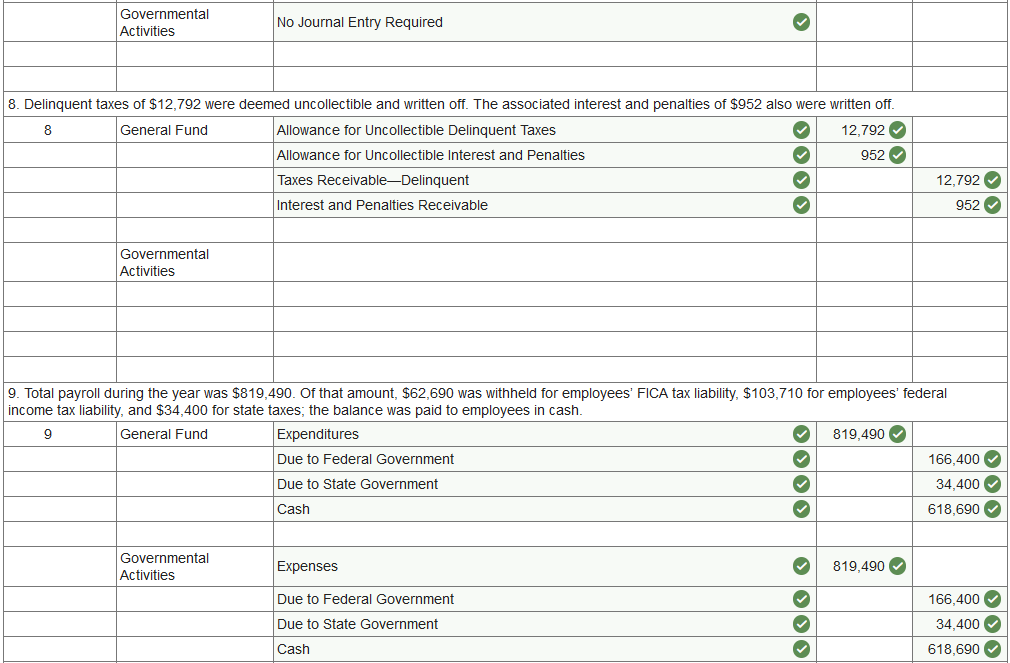

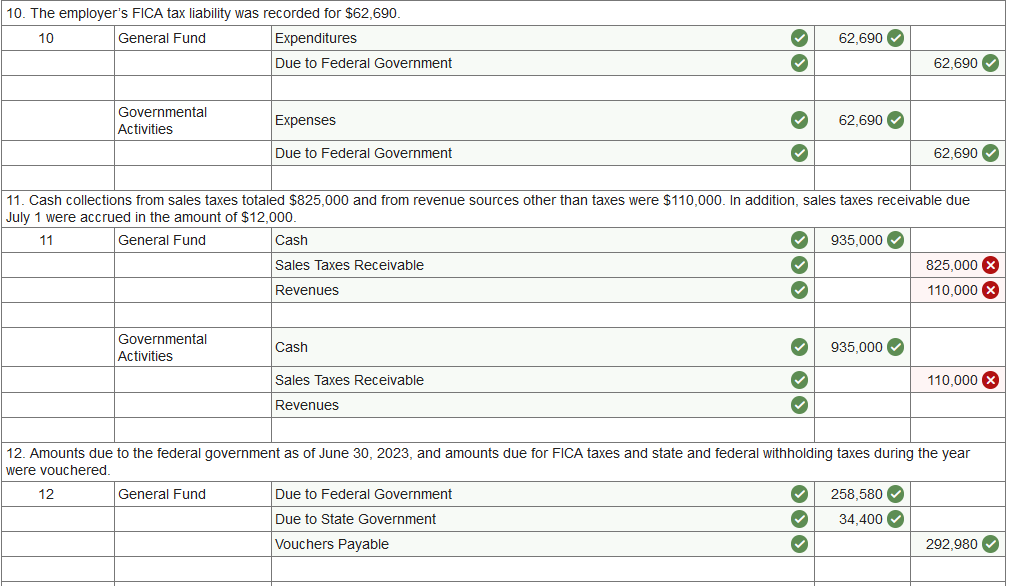

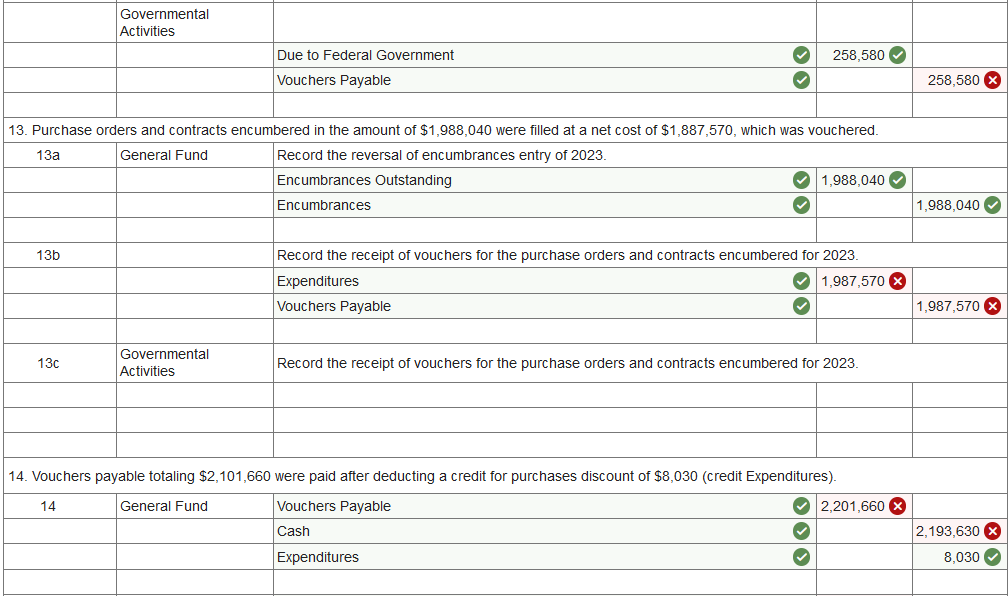

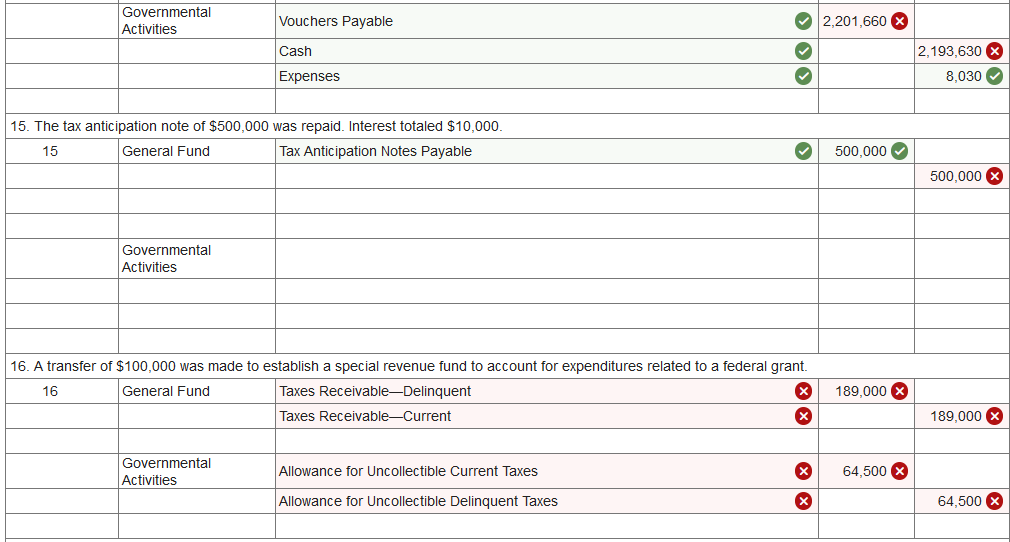

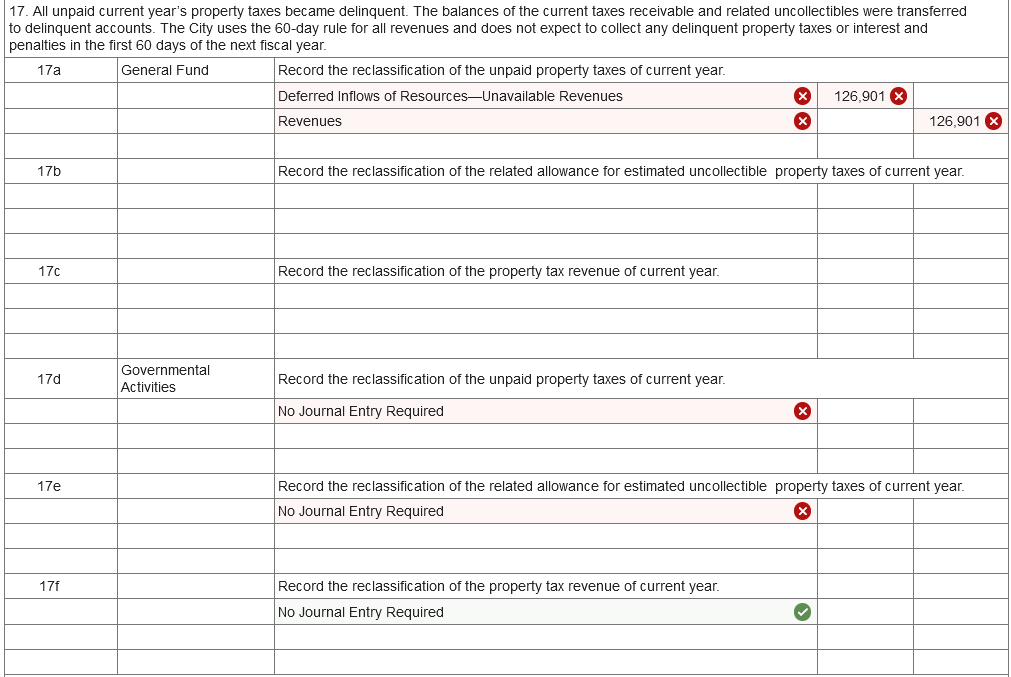

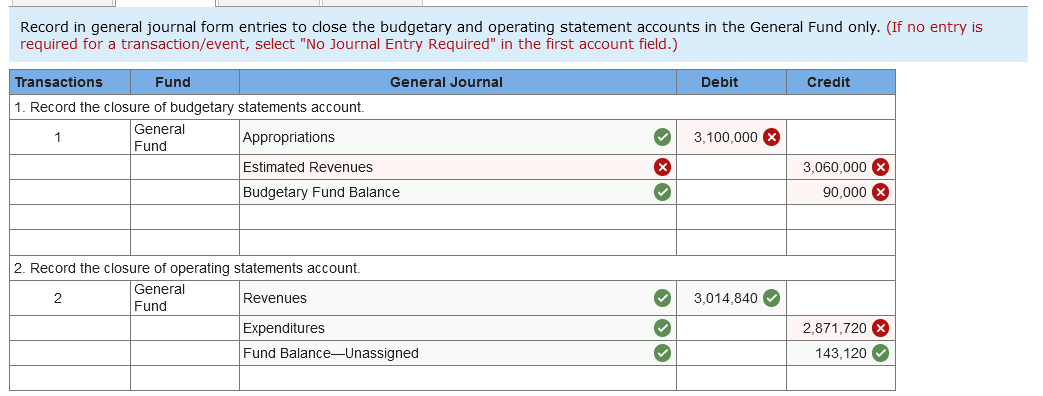

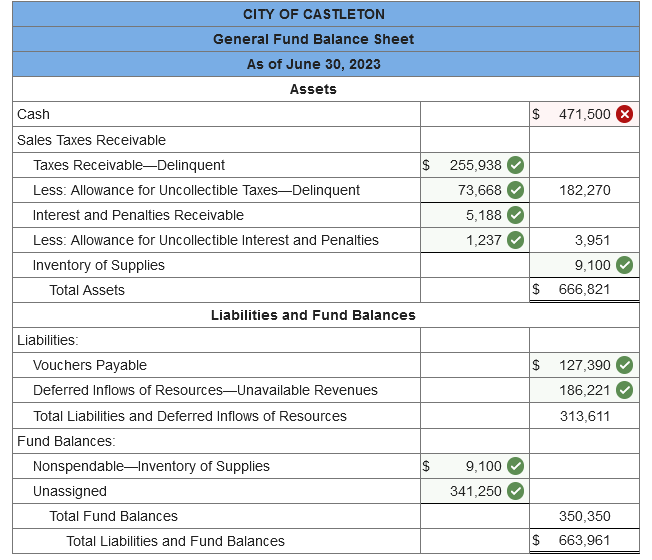

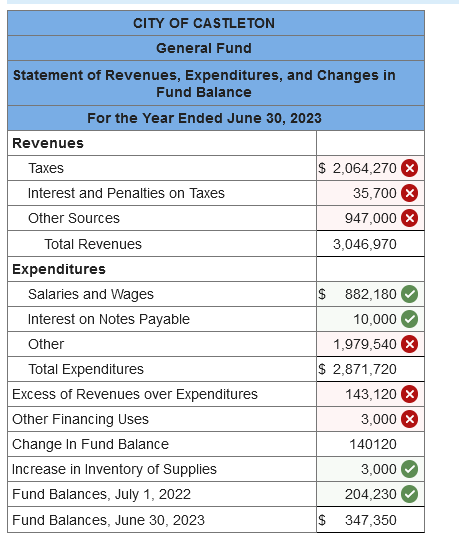

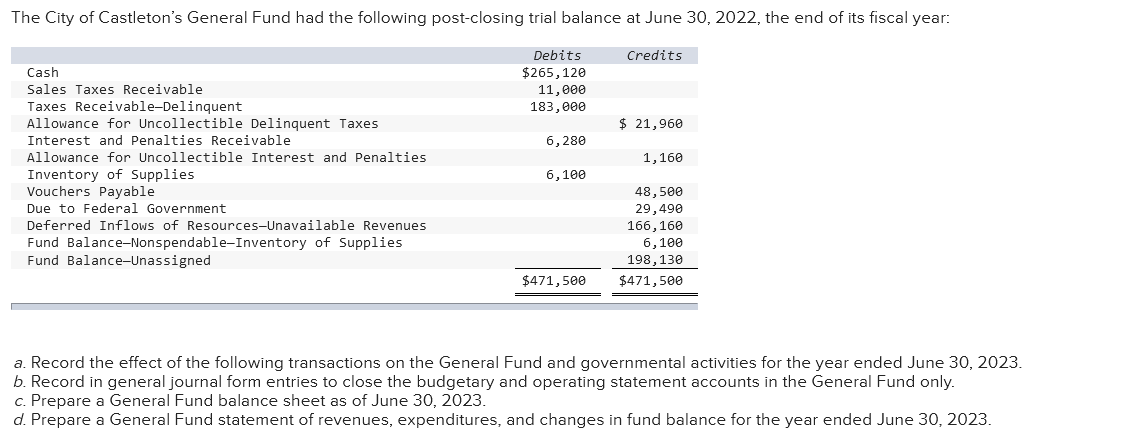

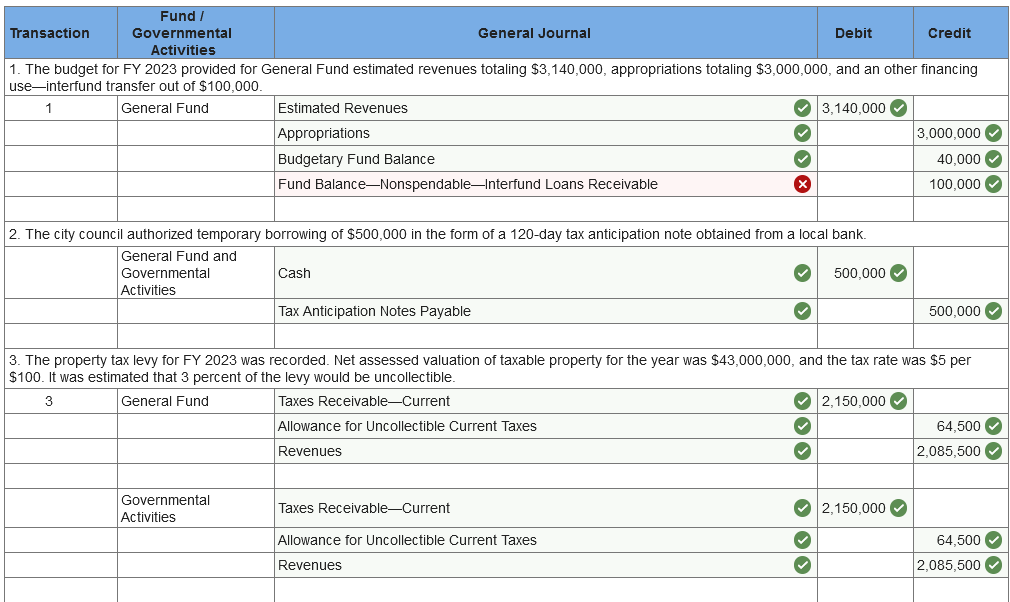

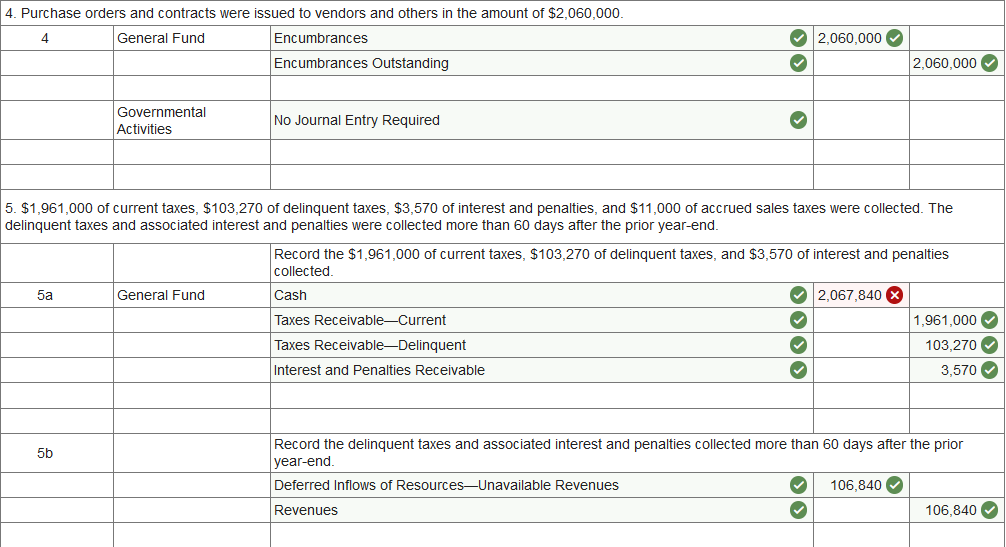

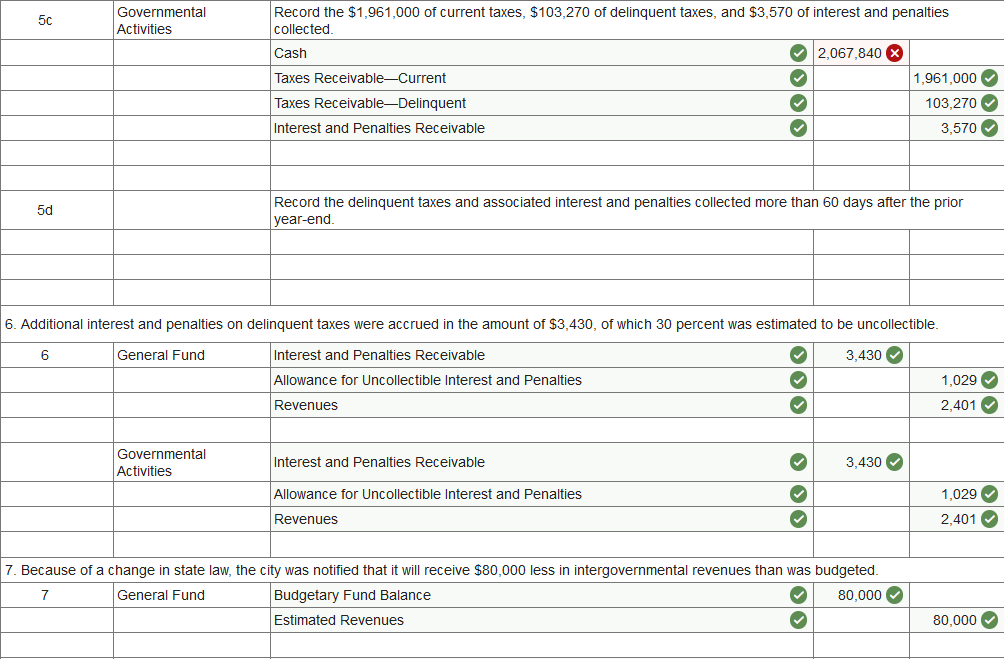

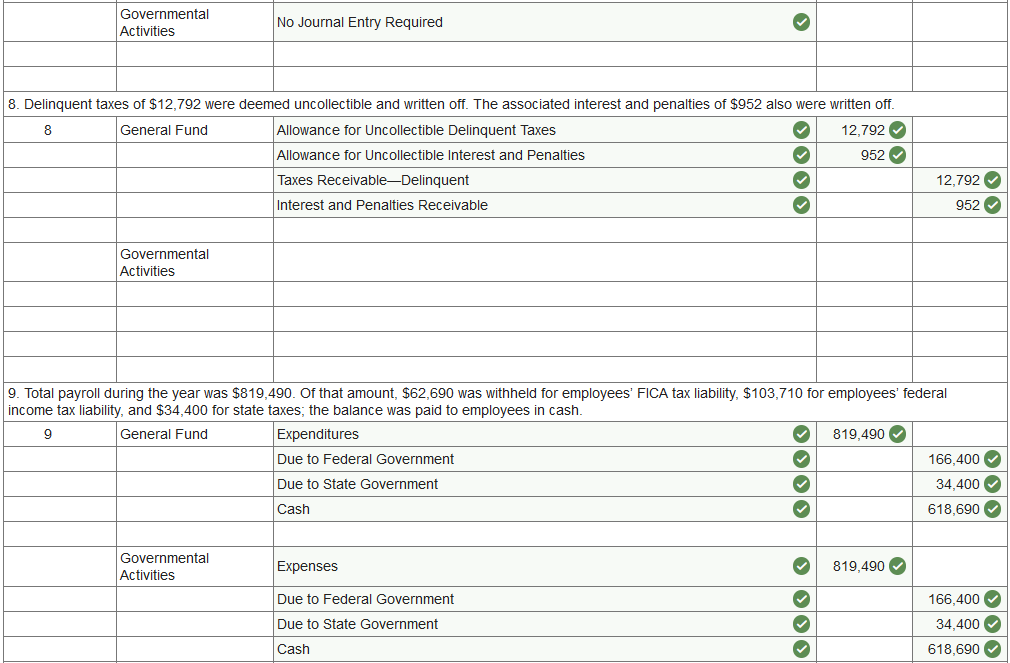

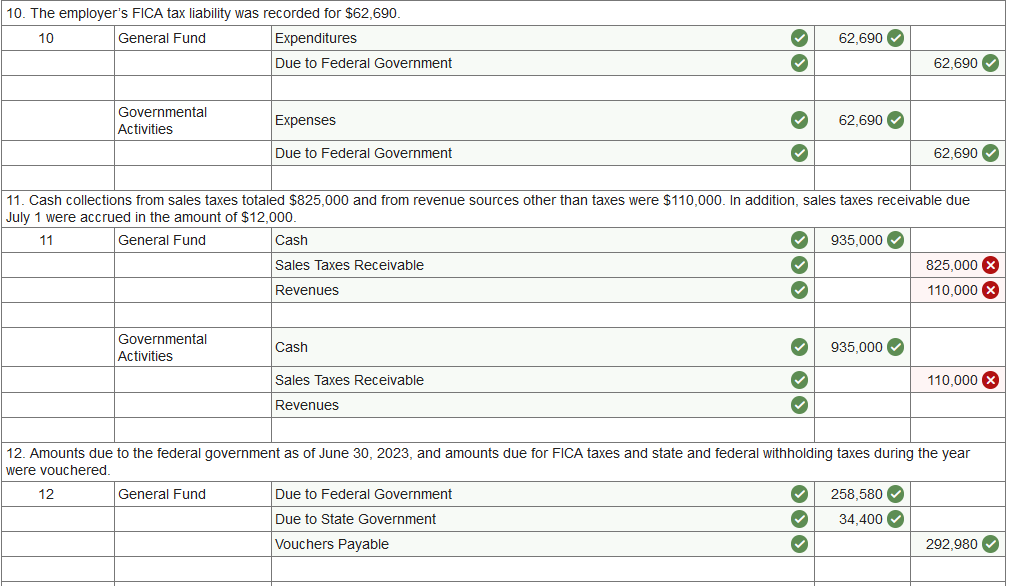

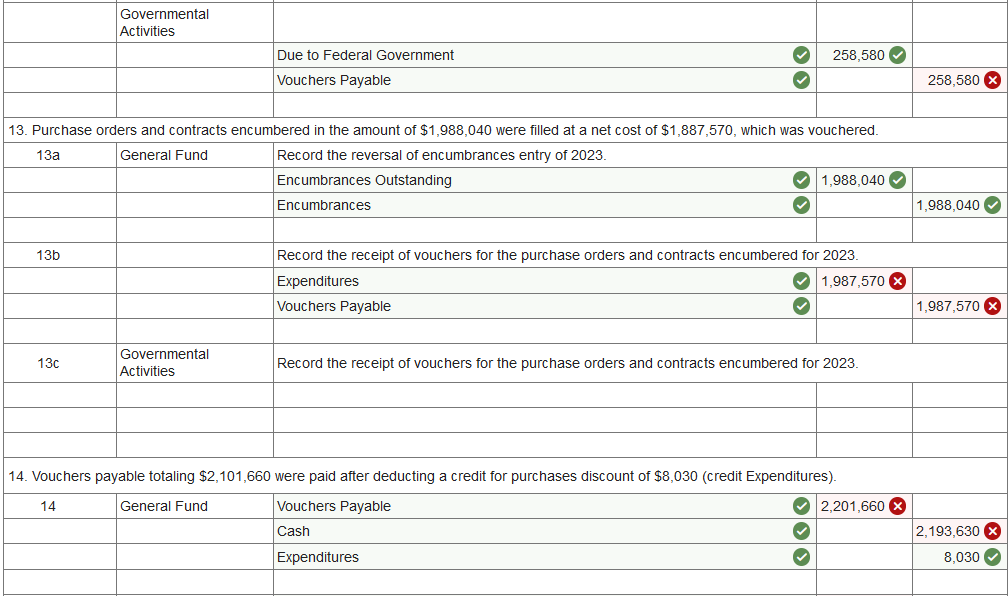

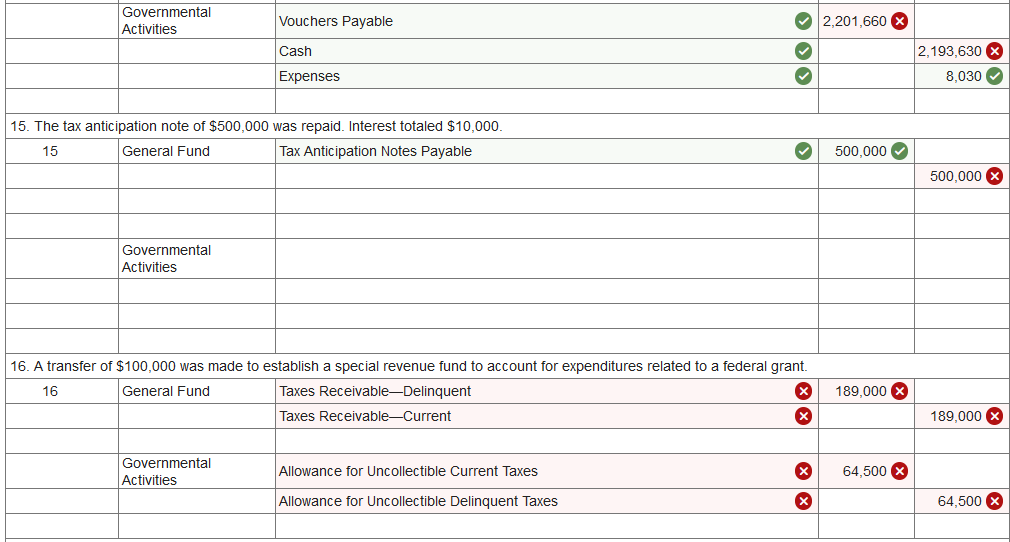

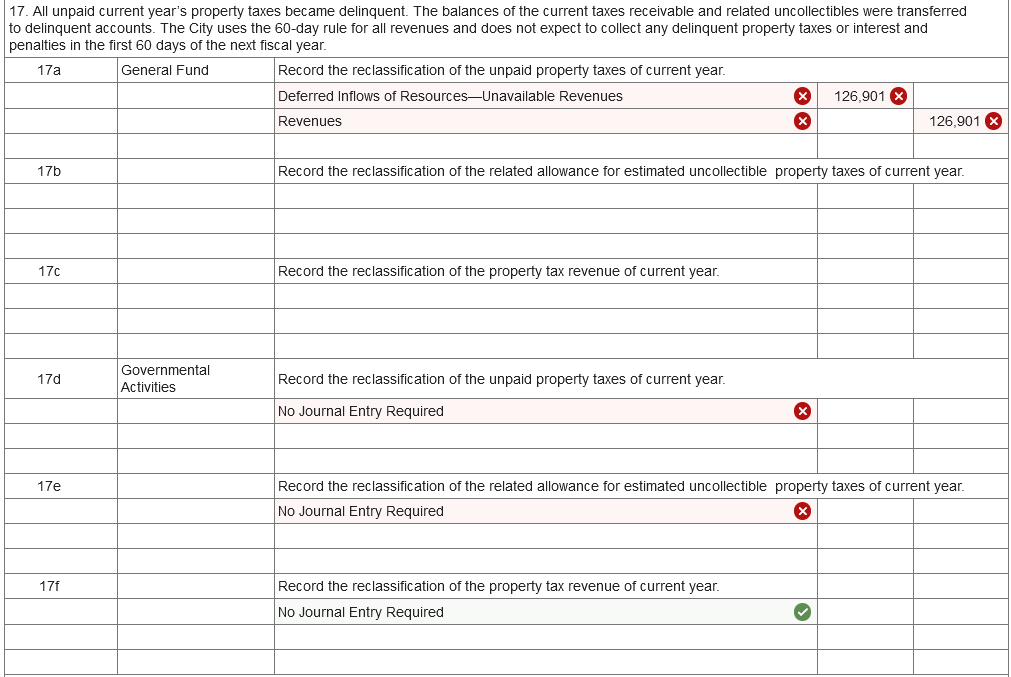

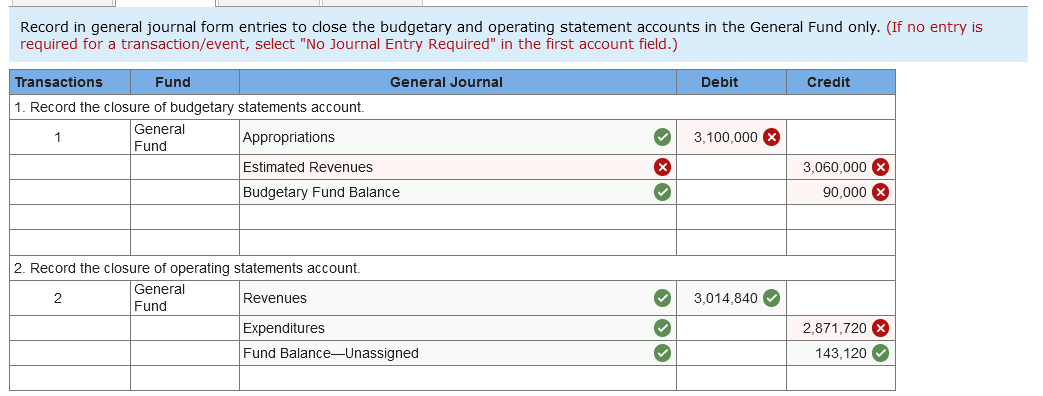

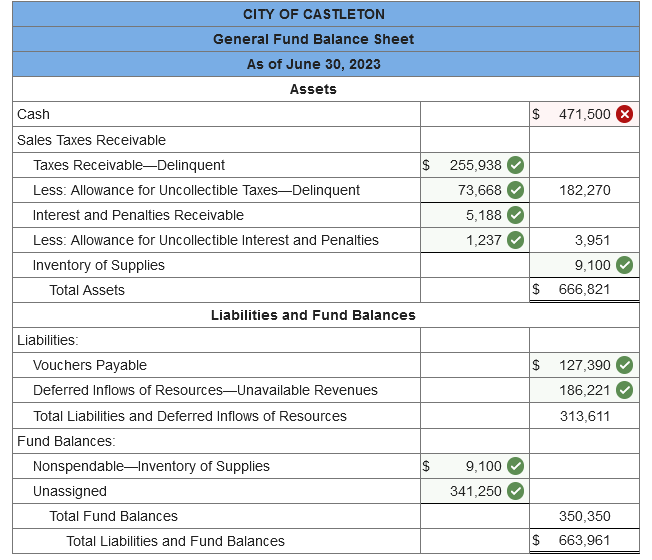

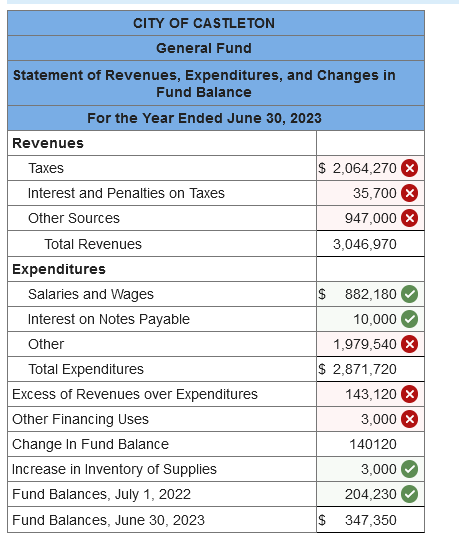

a. Record the effect of the following transactions on the General Fund and governmental activities for the year ended June 30,2023. b. Record in general journal form entries to close the budgetary and operating statement accounts in the General Fund only. c. Prepare a General Fund balance sheet as of June 30, 2023. d. Prepare a General Fund statement of revenues, expenditures, and changes in fund balance for the year ended June 30,2023. 2. The city council authorized temporary borrowing of $500,000 in the form of a 120-day tax anticipation note obtained from a local bank. \begin{tabular}{|l|l|l|c|c|} \hline & General Fund and Governmental Activities & Cash & 500,000 & \\ \hline & & Tax Anticipation Notes Payable & \\ \hline & & & 500,000( \\ \hline \end{tabular} 3. The property tax levy for FY 2023 was recorded. Net assessed valuation of taxable property for the year was $43,000,000, and the tax rate was $5 per $100. It was estimated that 3 percent of the levy would be uncollectible. 4. Purchase orders and contracts were issued to vendors and others in the amount of $2,060,000. \begin{tabular}{|l|l|l|l|} \hline 4 & General Fund & Encumbrances \\ \hline & & Encumbrances Outstanding \\ \hline & & \\ \hline & Governmental Activities & No Journal Entry Required \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} 5. $1,961,000 of current taxes, $103,270 of delinquent taxes, $3,570 of interest and penalties, and $11,000 of accrued sales taxes were collected. The delinquent taxes and associated interest and penalties were collected more than 60 days after the prior year-end. \begin{tabular}{|c|l|l|l|} \hline & & \multicolumn{2}{|l|}{ Record the $1,961,000 of current taxes, $103,270 of delinquent taxes, and $3,570 of interest and penalties collected. } \\ \hline 5a & General Fund & Cash \\ \hline & & Taxes Receivable-Current \\ \hline & & Taxes Receivable-Delinquent \\ \hline & & Interest and Penalties Receivable \\ \hline & & 1,961,000 \\ \hline 5b & & \begin{tabular}{l} 2,067,840 \\ \hline \end{tabular} & Record the delinquent taxes and associated interest and penalties collected more than 60 days after the prior year-end. \\ \hline & & Deferred Inflows of Resources-Unavailable Revenues \\ \hline & & Revenues \\ \hline \end{tabular} 6. Additional interest and penalties on delinquent taxes were accrued in the amount of $3,430, of which 30 percent was estimated to be uncollectible. 7. Because of a change in state law, the city was notified that it will receive $80,000 less in intergovernmental revenues than was budgeted. 9. Total payroll during the year was $819,490. Of that amount, $62,690 was withheld for employees' FICA tax liability, $103,710 for employees' federal income tax liability, and $34,400 for state taxes; the balance was paid to employees in cash. 10 The emplover's FICA tax liabilitv was recorded for $62690 \begin{tabular}{|l|l|l|l|l|} \hline & Governmental Activities & & & \\ \hline & & Due to Federal Government & 258,580 & \\ \hline & & Vouchers Payable & 258,580 \\ \hline & & & & \\ \hline \end{tabular} 13. Purchase orders and contracts encumbered in the amount of $1,988,040 were filled at a net cost of $1,887,570, which was vouchered. 14. Vouchers payable totaling $2,101,660 were paid after deducting a credit for purchases discount of $8,030 (credit Expenditures). \begin{tabular}{|l|l|l|r|r|} \hline & Governmental Activities & Vouchers Payable & \multirow{2}{*}{2,201,660} & \\ \hline & & Cash & 2,193,630 \\ \hline & & Expenses & 8,030 \\ \hline & & & & \\ \hline \end{tabular} 15. The tax anticipation note of $500,000 was repaid. Interest totaled $10,000. 16. A transfer of $100,000 was made to establish a special revenue fund to account for expenditures related to a federal grant. 17 All unnaid current vear's nronerty taxes herame delinculent The halances of the rurrent taxes receivahle and related uncollestihles were tranaferred Record in general journal form entries to close the budgetary and operating statement accounts in the General Fund only. (If no required for a transaction/event, select "No Journal Entry Required" in the first account field.) CITY OF CASTLETON General Fund Balance Sheet As of June 30,2023 Assets \begin{tabular}{|l|} \hline Cash \\ \hline Sales Taxes Receivable \\ \hline \end{tabular} \begin{tabular}{|l|r|c|} \hline Taxes Receivable-Delinquent & $255,938 & \\ \hline Less: Allowance for Uncollectible Taxes_Delinquent & 73,668 & 182,270 \\ \hline Interest and Penalties Receivable & 5,188 & \\ \hline Less: Allowance for Uncollectible Interest and Penalties & 1,237 & 3,951 \\ \hline Inventory of Supplies & & 9,100 \\ \hline Total Assets & & $666,821 \\ \hline \end{tabular} Liabilities and Fund Balances Liabilities: \begin{tabular}{|l|l|l|} \hline Vouchers Payable & & $127,390 \\ \hline Deferred Inflows of Resources_Unavailable Revenues & & 186,221 \\ \hline Total Liabilities and Deferred Inflows of Resources & & 313,611 \\ \hline Fund Balances: & & \\ \hline Nonspendable-Inventory of Supplies & $9,100 & \\ \hline Unassigned & 341,250 & \\ \hline Total Fund Balances & & 350,350 \\ \hline Total Liabilities and Fund Balances & $663,961 \\ \hline \end{tabular} CITY OF CASTLETON General Fund Statement of Revenues, Expenditures, and Changes in Fund Balance