Question

a. Record the following adjusting entries on December 31. (If no entry is required for a particular transaction/event, select No Journal Entry Required in the

a. Record the following adjusting entries on December 31. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)

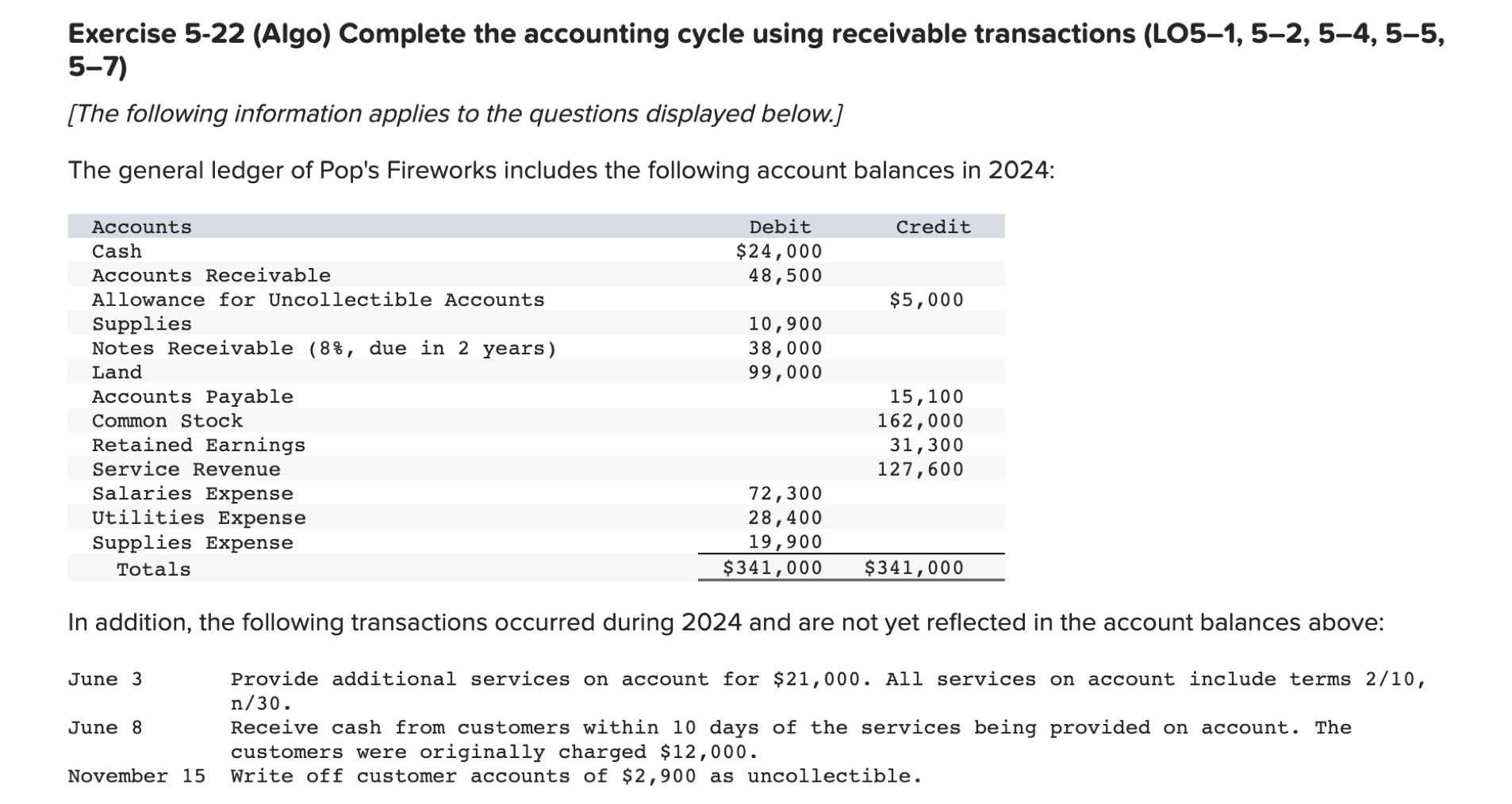

- Estimate that 10% of the balance of accounts receivable (after transactions in requirement 1) will not be collected. (Hint: Use the January 31 accounts receivable balance calculated in the general ledger to determine the total estimate of uncollectible accounts.)

- Accrue interest on the note receivable of $38,000, which was accepted on October 1, 2024. Interest is due each September 30.

b. Prepare an adjusted trial balance as of December 31, 2024, after updating account balances for transactions during the year (requirement 1) and adjusting entries at the end of the year (requirement 2).

c. Prepare an income statement for the period ended December 31, 2024. (Amounts to be deducted should be indicated with a minus sign.)

d. Prepare a classified balance sheet as of December 31, 2024. (Amounts to be deducted should be indicated with a minus sign.)

e. Record closing entries. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)

f. Analyze the following information:

- By how much does the year-end estimate of future uncollectible accounts reduce net income in 2024?

- What is the ending balance of Allowance for Uncollectible Accounts?

- What amount of cash is expected to be collected from accounts receivable?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started