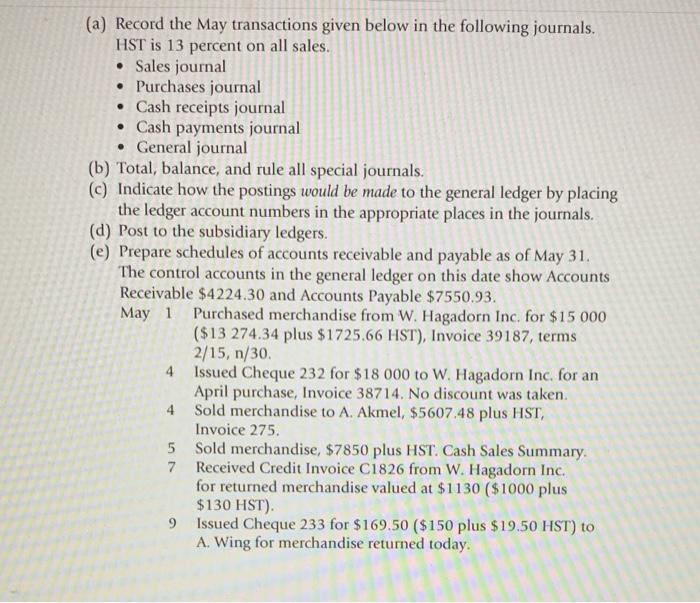

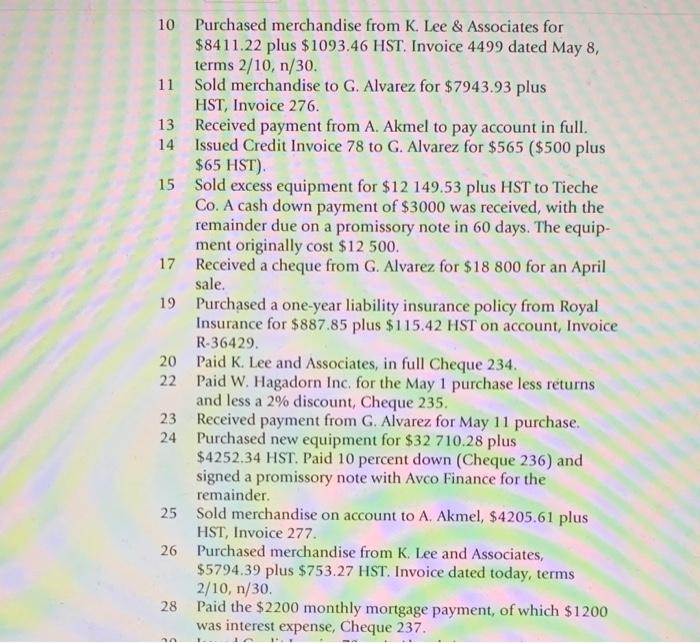

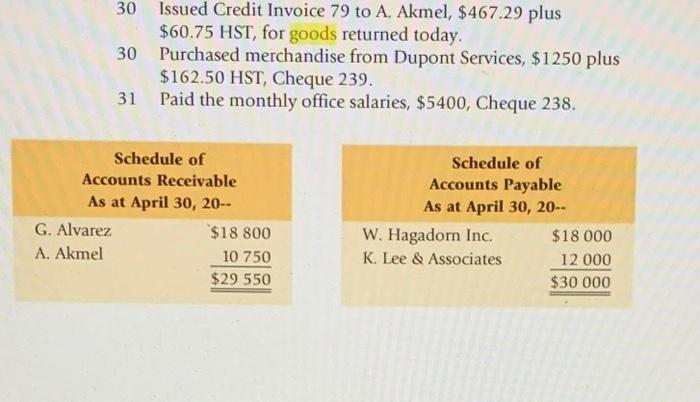

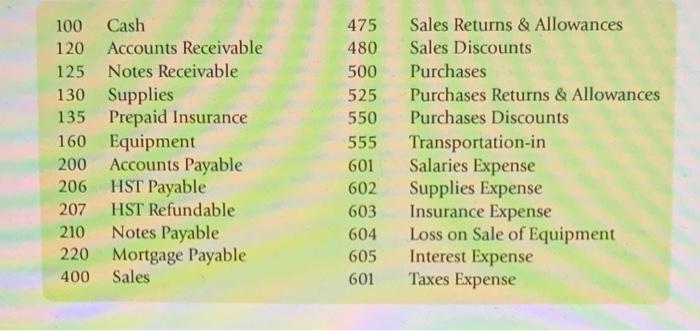

(a) Record the May transactions given below in the following journals. HST is 13 percent on all sales. Sales journal Purchases journal Cash receipts journal Cash payments journal General journal (b) Total, balance, and rule all special journals. (c) Indicate how the postings would be made to the general ledger by placing the ledger account numbers in the appropriate places in the journals. (d) Post to the subsidiary ledgers. (e) Prepare schedules of accounts receivable and payable as of May 31. The control accounts in the general ledger on this date show Accounts Receivable $4224.30 and Accounts Payable $7550.93. May 1 Purchased merchandise from W. Hagadorn Inc. for $15 000 ($13 274.34 plus $1725.66 HST), Invoice 39187, terms 2/15, n/30 4 Issued Cheque 232 for $18 000 to W. Hagadorn Inc. for an April purchase, Invoice 38714. No discount was taken 4 Sold merchandise to A. Akmel, $5607.48 plus HST, Invoice 275 5 Sold merchandise, $7850 plus HST. Cash Sales Summary 7 Received Credit Invoice C1826 from W. Hagadorn Inc. for returned merchandise valued at $1130 ($1000 plus $130 HST) Issued Cheque 233 for $169.50 ($150 plus $19.50 HST) to A. Wing for merchandise returned today. 9 10 Purchased merchandise from K. Lee & Associates for $8411.22 plus $1093.46 HST. Invoice 4499 dated May 8, terms 2/10, n/30. 11 Sold merchandise to G. Alvarez for $7943.93 plus HST, Invoice 276. 13 Received payment from A. Akmel to pay account in full. 14 Issued Credit Invoice 78 to G. Alvarez for $565 ($500 plus $65 HST). 15 Sold excess equipment for $12 149.53 plus HST to Tieche Co. A cash down payment of $3000 was received, with the remainder due on a promissory note in 60 days. The equip- ment originally cost $12 500. 17 Received a cheque from G. Alvarez for $18 800 for an April sale. 19 Purchased a one-year liability insurance policy from Royal Insurance for $887.85 plus $115.42 HST on account, Invoice R-36429. 20 Paid K. Lee and Associates, in full Cheque 234. Paid W. Hagadorn Inc. for the May 1 purchase less returns and less a 2% discount, Cheque 235. Received payment from G. Alvarez for May 11 purchase. 24 Purchased new equipment for $32 710.28 plus $4252,34 HST. Paid 10 percent down (Cheque 236) and signed a promissory note with Avco Finance for the remainder. 25 Sold merchandise on account to A. Akmel, $4205.61 plus HST, Invoice 277 26 Purchased merchandise from K. Lee and Associates, $5794.39 plus $753.27 HST. Invoice dated today, terms 2/10, n/30 Paid the $2200 monthly mortgage payment, of which $1200 was interest expense, Cheque 237. 22 23 28 A 30 Issued Credit Invoice 79 to A. Akmel, $467.29 plus $60.75 HST, for goods returned today. 30 Purchased merchandise from Dupont Services, $1250 plus $162.50 HST, Cheque 239. Paid the monthly office salaries, $5400, Cheque 238. Schedule of Accounts Receivable As at April 30, 20-- G. Alvarez $18 800 A. Akmel 10 750 $29 550 Schedule of Accounts Payable As at April 30, 20-- W. Hagadorn Inc. $18 000 K. Lee & Associates 12 000 $30 000 475 480 500 525 550 100 Cash 120 Accounts Receivable 125 Notes Receivable 130 Supplies 135 Prepaid Insurance 160 Equipment 200 Accounts Payable 206 HST Payable 207 HST Refundable 210 Notes Payable 220 Mortgage Payable 400 Sales 555 Sales Returns & Allowances Sales Discounts Purchases Purchases Returns & Allowances Purchases Discounts Transportation-in Salaries Expense Supplies Expense Insurance Expense Loss on Sale of Equipment Interest Expense Taxes Expense 601 602 603 604 605 601 (a) Record the May transactions given below in the following journals. HST is 13 percent on all sales. Sales journal Purchases journal Cash receipts journal Cash payments journal General journal (b) Total, balance, and rule all special journals. (c) Indicate how the postings would be made to the general ledger by placing the ledger account numbers in the appropriate places in the journals. (d) Post to the subsidiary ledgers. (e) Prepare schedules of accounts receivable and payable as of May 31. The control accounts in the general ledger on this date show Accounts Receivable $4224.30 and Accounts Payable $7550.93. May 1 Purchased merchandise from W. Hagadorn Inc. for $15 000 ($13 274.34 plus $1725.66 HST), Invoice 39187, terms 2/15, n/30 4 Issued Cheque 232 for $18 000 to W. Hagadorn Inc. for an April purchase, Invoice 38714. No discount was taken 4 Sold merchandise to A. Akmel, $5607.48 plus HST, Invoice 275 5 Sold merchandise, $7850 plus HST. Cash Sales Summary 7 Received Credit Invoice C1826 from W. Hagadorn Inc. for returned merchandise valued at $1130 ($1000 plus $130 HST) Issued Cheque 233 for $169.50 ($150 plus $19.50 HST) to A. Wing for merchandise returned today. 9 10 Purchased merchandise from K. Lee & Associates for $8411.22 plus $1093.46 HST. Invoice 4499 dated May 8, terms 2/10, n/30. 11 Sold merchandise to G. Alvarez for $7943.93 plus HST, Invoice 276. 13 Received payment from A. Akmel to pay account in full. 14 Issued Credit Invoice 78 to G. Alvarez for $565 ($500 plus $65 HST). 15 Sold excess equipment for $12 149.53 plus HST to Tieche Co. A cash down payment of $3000 was received, with the remainder due on a promissory note in 60 days. The equip- ment originally cost $12 500. 17 Received a cheque from G. Alvarez for $18 800 for an April sale. 19 Purchased a one-year liability insurance policy from Royal Insurance for $887.85 plus $115.42 HST on account, Invoice R-36429. 20 Paid K. Lee and Associates, in full Cheque 234. Paid W. Hagadorn Inc. for the May 1 purchase less returns and less a 2% discount, Cheque 235. Received payment from G. Alvarez for May 11 purchase. 24 Purchased new equipment for $32 710.28 plus $4252,34 HST. Paid 10 percent down (Cheque 236) and signed a promissory note with Avco Finance for the remainder. 25 Sold merchandise on account to A. Akmel, $4205.61 plus HST, Invoice 277 26 Purchased merchandise from K. Lee and Associates, $5794.39 plus $753.27 HST. Invoice dated today, terms 2/10, n/30 Paid the $2200 monthly mortgage payment, of which $1200 was interest expense, Cheque 237. 22 23 28 A 30 Issued Credit Invoice 79 to A. Akmel, $467.29 plus $60.75 HST, for goods returned today. 30 Purchased merchandise from Dupont Services, $1250 plus $162.50 HST, Cheque 239. Paid the monthly office salaries, $5400, Cheque 238. Schedule of Accounts Receivable As at April 30, 20-- G. Alvarez $18 800 A. Akmel 10 750 $29 550 Schedule of Accounts Payable As at April 30, 20-- W. Hagadorn Inc. $18 000 K. Lee & Associates 12 000 $30 000 475 480 500 525 550 100 Cash 120 Accounts Receivable 125 Notes Receivable 130 Supplies 135 Prepaid Insurance 160 Equipment 200 Accounts Payable 206 HST Payable 207 HST Refundable 210 Notes Payable 220 Mortgage Payable 400 Sales 555 Sales Returns & Allowances Sales Discounts Purchases Purchases Returns & Allowances Purchases Discounts Transportation-in Salaries Expense Supplies Expense Insurance Expense Loss on Sale of Equipment Interest Expense Taxes Expense 601 602 603 604 605 601