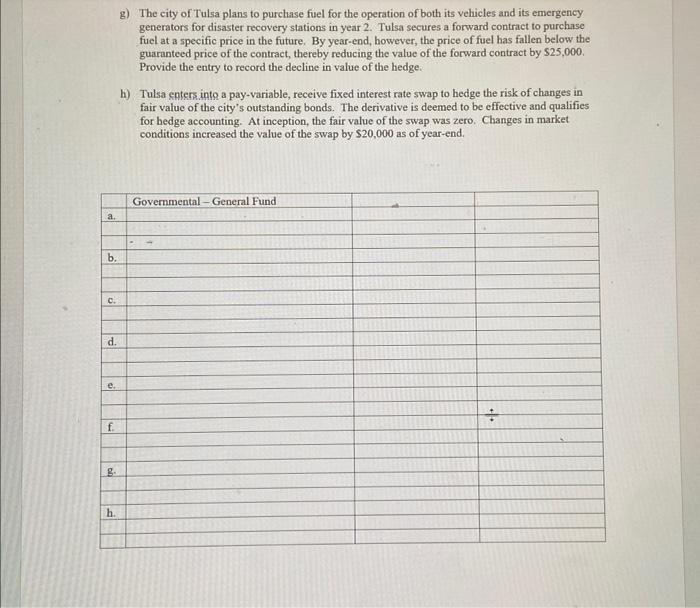

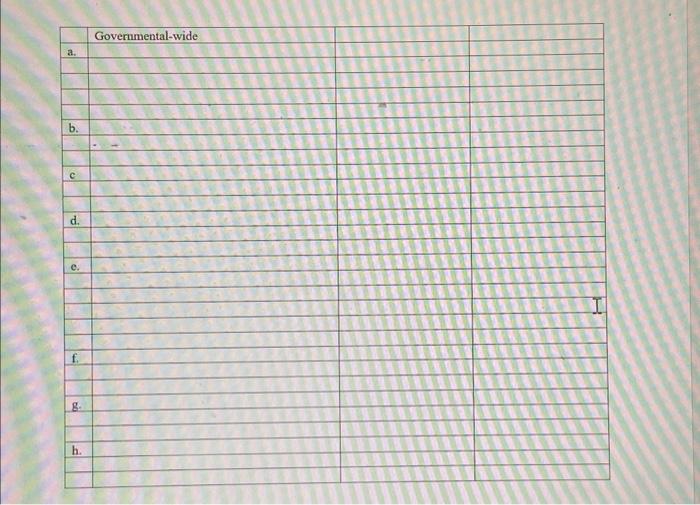

A. Recorded in the General Fund B. Recorded in the government-wide statements If appropriate, write "No entry required." a) The city sold for $7,000 a police car that had been purchased four years ago at a cost of $35,000. At the time of acquisition, the city estimated that the police car had a useful life of five years and a salvage value of $5,000. b) The city purchased for cash three dump trucks for $45,000 each. c) The city received a gift of land from a citizen. The land is to be used to build a city park. The land had been in the donor's family since it was homesteaded. It had a fair value when contributed of $3 million. d) During the year, the city spent $16 million to build a third lane on both sides of the major northsouth highway through town. e) The city traded in a pickup truck used in general goverument operations for a new pickup truck, paying a difference of $32,000. The old pickup truck was purchased three years ago at a cost of $21,000. At the time it bad an estimated useful life of five years and an estimated salvage value of $6,000. At the time of the trade the old truck had a fair value of $7,000. The new truck has a sticker price of $39,000. f) During the year the city began construction of a new city hall. By year-end, the city had made progress payments to the contractor of S1.5 million. g) The city of Tulsa plans to purchase fuel for the operation of both its vehicles and its emergency generators for disaster recovery stations in year 2 . Tulsa secures a forward contract to purchase fuel at a specific price in the future. By year-end, however, the price of fuel has fallen below the guaranteed price of the contract, thereby reducing the value of the forward contract by $25,000. Provide the entry to record the decline in value of the hedge. h) Tulsa chters into a pay-variable, receive fixed interest rate swap to hedge the risk of changes in fair value of the city's outstanding bonds. The derivative is deemed to be effective and qualifies for hedge accounting. At inception, the fair value of the swap was zero. Changes in market conditions increased the value of the swap by $20,000 as of year-end. \begin{tabular}{|l|l|l|l|} \hline & Governmental-wide & & \\ \hline a. & & & \end{tabular} A. Recorded in the General Fund B. Recorded in the government-wide statements If appropriate, write "No entry required." a) The city sold for $7,000 a police car that had been purchased four years ago at a cost of $35,000. At the time of acquisition, the city estimated that the police car had a useful life of five years and a salvage value of $5,000. b) The city purchased for cash three dump trucks for $45,000 each. c) The city received a gift of land from a citizen. The land is to be used to build a city park. The land had been in the donor's family since it was homesteaded. It had a fair value when contributed of $3 million. d) During the year, the city spent $16 million to build a third lane on both sides of the major northsouth highway through town. e) The city traded in a pickup truck used in general goverument operations for a new pickup truck, paying a difference of $32,000. The old pickup truck was purchased three years ago at a cost of $21,000. At the time it bad an estimated useful life of five years and an estimated salvage value of $6,000. At the time of the trade the old truck had a fair value of $7,000. The new truck has a sticker price of $39,000. f) During the year the city began construction of a new city hall. By year-end, the city had made progress payments to the contractor of S1.5 million. g) The city of Tulsa plans to purchase fuel for the operation of both its vehicles and its emergency generators for disaster recovery stations in year 2 . Tulsa secures a forward contract to purchase fuel at a specific price in the future. By year-end, however, the price of fuel has fallen below the guaranteed price of the contract, thereby reducing the value of the forward contract by $25,000. Provide the entry to record the decline in value of the hedge. h) Tulsa chters into a pay-variable, receive fixed interest rate swap to hedge the risk of changes in fair value of the city's outstanding bonds. The derivative is deemed to be effective and qualifies for hedge accounting. At inception, the fair value of the swap was zero. Changes in market conditions increased the value of the swap by $20,000 as of year-end. \begin{tabular}{|l|l|l|l|} \hline & Governmental-wide & & \\ \hline a. & & & \end{tabular}