Question

a reduction in operating costs is needed for your company to improve profitability. you have been asked to evaluate replacement of the existing lights with

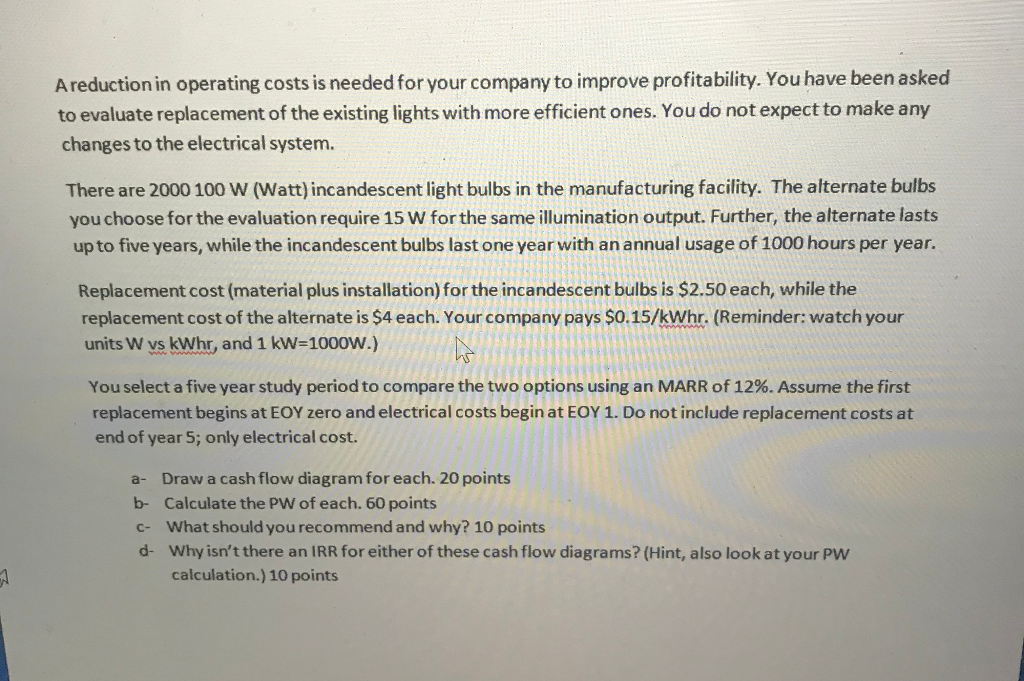

a reduction in operating costs is needed for your company to improve profitability. you have been asked to evaluate replacement of the existing lights with more efficient ones. you do not expect to make any changes to the electrical system. there are 2000 100 w (watt) incandescent light bulbs in the manufacturing facility. the alternate bulbs you choose for the evaluation require 15 w for the same illumination output. further, the alternate lasts up to five years, while the incandescent bulbs last one year with an annual usage of 1000 hours per year. replacement cost (material plus installation) for the incandescent bulbs is $2.50 each, while the replacement cost of the alternate is $4 each. your company pays $0.15/kwh. (reminder: watch your units w vs kwh, and 1 kw=1000w.) you select a five year study period to compare the two options using an marr of 12%. assume the first replacement begins at eoy zero and electrical costs begin at eoy 1. do not include replacement costs at end of year 5; only electrical cost.

a reduction in operating costs is needed for your company to improve profitability. you have been asked to evaluate replacement of the existing lights with more efficient ones. you do not expect to make any changes to the electrical system. there are 2000 100 w (watt) incandescent light bulbs in the manufacturing facility. the alternate bulbs you choose for the evaluation require 15 w for the same illumination output. further, the alternate lasts up to five years, while the incandescent bulbs last one year with an annual usage of 1000 hours per year. replacement cost (material plus installation) for the incandescent bulbs is $2.50 each, while the replacement cost of the alternate is $4 each. your company pays $0.15/kwh. (reminder: watch your units w vs kwh, and 1 kw=1000w.) you select a five year study period to compare the two options using an marr of 12%. assume the first replacement begins at eoy zero and electrical costs begin at eoy 1. do not include replacement costs at end of year 5; only electrical cost.

a- Draw a cash flow diagram for each.

b- Calculate the Pw of each.

c- What should you recommend an why?

d- Why isn't there an IRR for either of these cash flow diagrams?

Areduction in operating costs is needed for your company to improve profitability. You have been asked to evaluate replacement of the existing lights with more efficient ones. You do not expect to make any changes to the electrical system. There are 2000 100 W (Watt) incandescent light bulbs in the manufacturing facility. The alternate bulbs you choose for the evaluation require 15 W for the same illumination output. Further, the alternate lasts up to five years, while the incandescent bulbs last one year with an annual usage of 1000 hours per year. Replacement cost (material plus installation) for the incandescent bulbs is $2.50 each, while the replacement cost of the alternate is $4 each. Your company pays $0.15/kWhr. (Reminder: watch your units W vs kWhr, and 1 kW=1000W.) You select a five year study period to compare the two options using an MARR of 12%. Assume the first replacement begins at EOY zero and electrical costs begin at EOY 1. Do not include replacement costs at end of year 5; only electrical cost. a- Draw a cash flow diagram for each. 20 points b- Calculate the PW of each. 60 points C- What should you recommend and why? 10 points d- Why isn't there an IRR for either of these cash flow diagrams? (Hint, also look at your PW calculation.) 10 pointsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started