Question

a) Refer to the Simple BDT interest rate tree above. Consider a 5-year receive fixed swap with a swap rate of 5.455%. Cash flows are

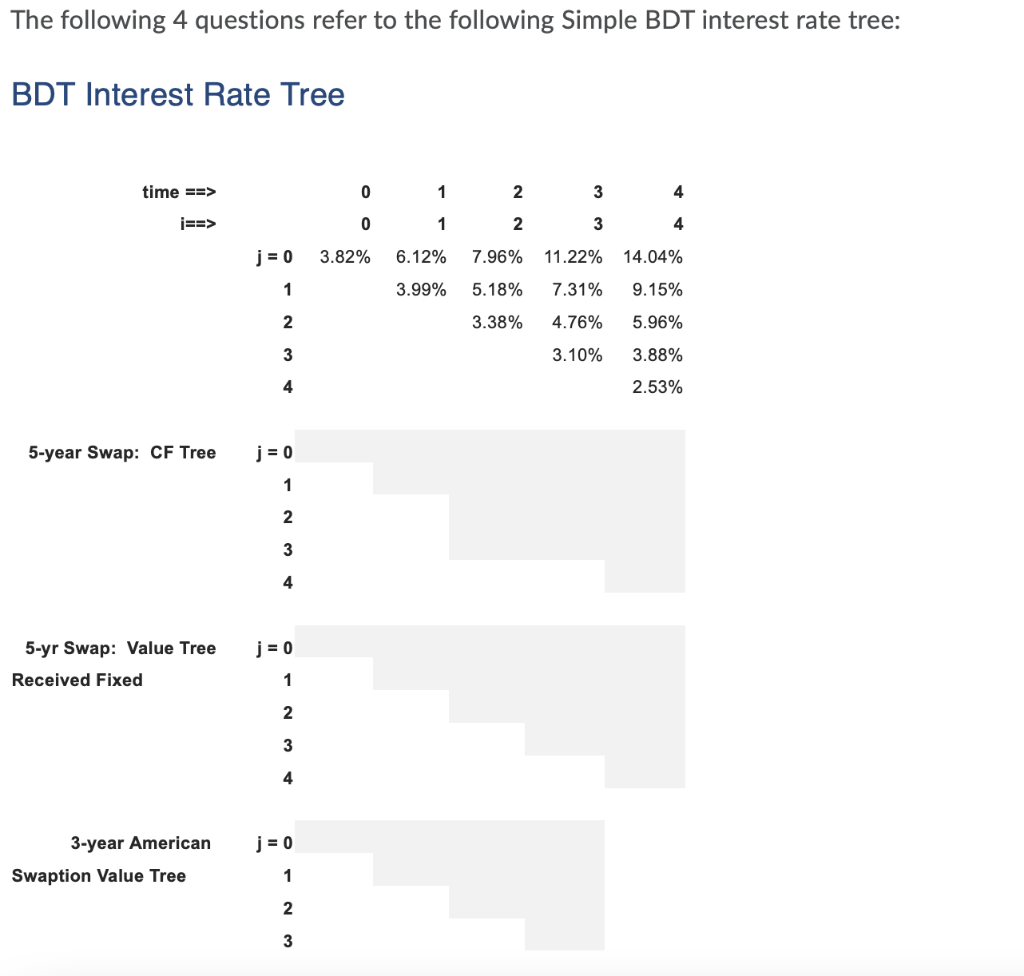

a) Refer to the Simple BDT interest rate tree above. Consider a 5-year receive fixed swap with a swap rate of 5.455%. Cash flows are exchanged annually and the notional principal is 100. Complete the cash flow tree for this swap. Don't forget to convert the interest rates in the BDT model to annual compounding. What is the cash flow in the i = 4, j = 1 node (i.e. CF(4,1))?

Answer Options:

-5.67;

-3.54;

-4.99;

-6.13;

-4.13

b) Refer to the Simple BDT interest rate tree above. Consider a 5-year receive fixed swap with a swap rate of 5.455%. Cash flows are exchanged annually and the notional principal is 100. Complete the value tree for this swap. What is the value of the swap in the i = 3, j = 3 node (i.e. V(3,3))?

Answer Options:

3.70;

2.00;

4.30;

2.30;

2.95

c) Refer to the Simple BDT interest rate tree above. What is the value of a 3-year American Receiver Swaption (i.e. V(0)), with a strike rate of 5.455%, written on the 5-year swap? The swaption can be exercised anytime starting in 1 year. Note: The swaption matures at i=3 and the swap at i = 5.

Answer Options:

1.47;

0.98;

1.93;

2.56;

0

d) Assume a financial institution has just sold the 5-year swap to a client. How could the financial institution hedge this position using a 1-year zero coupon bond and the 3-year American receiver swaption? Specifically, what position would you take in the 1-year zero (i.e. N1) and the swaption (i.e. N2)? Hint: Don't forget the CF associated with the swap.

Answer Options:

N1 = 0.02 and N2=0.3

N1 = -0.05 and N2=0.3

N1=0.3 and N2=0.02

N1=-0.05 and N2=3.34

N1=0.05 and N2=-3.34

The following 4 questions refer to the following Simple BDT interest rate tree: BDT Interest Rate Tree time ==> 0 1 2 4 3 3 0 1 2 4 3.82% 6.12% 7.96% 11.22% j = 0 1 3.99% 5.18% 7.31% 14.04% 9.15% 5.96% 2 3.38% 4.76% 3 3.10% 3.88% 4 2.53% 5-year Swap: CF Tree j = 0 1 2 3 4 5-yr Swap: Value Tree j = 0 Received Fixed 1 2 3 4 j = 0 3-year American Swaption Value Tree 1 2 3 The following 4 questions refer to the following Simple BDT interest rate tree: BDT Interest Rate Tree time ==> 0 1 2 4 3 3 0 1 2 4 3.82% 6.12% 7.96% 11.22% j = 0 1 3.99% 5.18% 7.31% 14.04% 9.15% 5.96% 2 3.38% 4.76% 3 3.10% 3.88% 4 2.53% 5-year Swap: CF Tree j = 0 1 2 3 4 5-yr Swap: Value Tree j = 0 Received Fixed 1 2 3 4 j = 0 3-year American Swaption Value Tree 1 2 3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started