Answered step by step

Verified Expert Solution

Question

1 Approved Answer

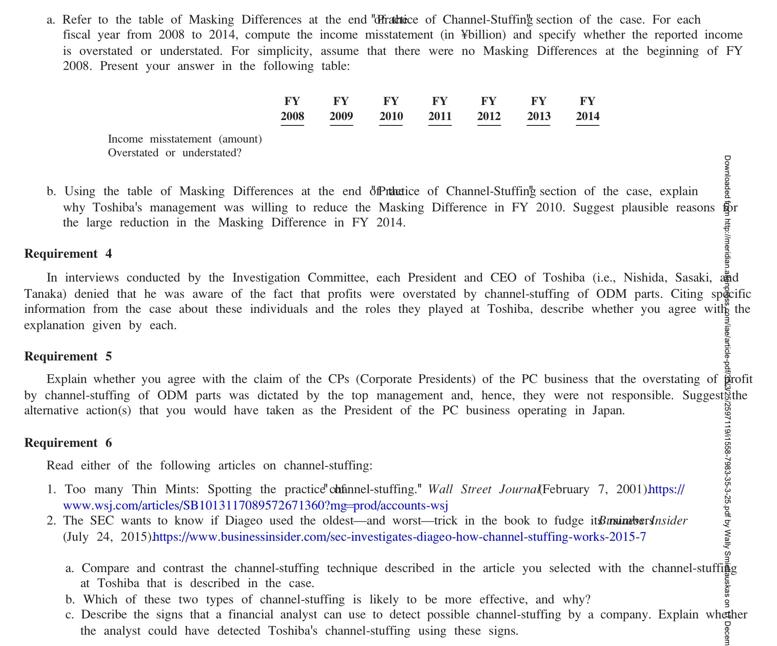

a. Refer to the table of Masking Differences at the end frahice of Channel-Stuffing section of the case. For each fiscal year from 2008

a. Refer to the table of Masking Differences at the end "frahice of Channel-Stuffing section of the case. For each fiscal year from 2008 to 2014, compute the income misstatement (in billion) and specify whether the reported income is overstated or understated. For simplicity, assume that there were no Masking Differences at the beginning of FY 2008. Present your answer in the following table: Income misstatement (amount) Overstated or understated? FY FY 2008 2009 FY FY FY FY FY 2010 2011 2012 2013 2014 b. Using the table of Masking Differences at the end ofPithutice of Channel-Stuffing section of the case, explain why Toshiba's management was willing to reduce the Masking Difference in FY 2010. Suggest plausible reasons the large reduction in the Masking Difference in FY 2014. Downloaded from http://meridian Requirement 4 In interviews conducted by the Investigation Committee, each President and CEO of Toshiba (i.e., Nishida, Sasaki, and Tanaka) denied that he was aware of the fact that profits were overstated by channel-stuffing of ODM parts. Citing specific information from the case about these individuals and the roles they played at Toshiba, describe whether you agree with the explanation given by each. Requirement 5 Explain whether you agree with the claim of the CPs (Corporate Presidents) of the PC business that the overstating of profit by channel-stuffing of ODM parts was dictated by the top management and, hence, they were not responsible. Suggest the alternative action(s) that you would have taken as the President of the PC business operating in Japan. Requirement 6 Read either of the following articles on channel-stuffing: 1. Too many Thin Mints: Spotting the practice" chfinnel-stuffing." Wall Street JournalFebruary 7, 2001)https:// www.wsj.com/articles/SB1013117089572671360?mg-prod/accounts-wsj 2. The SEC wants to know if Diageo used the oldest and worst-trick in the book to fudge it Binsinaberinsider (July 24, 2015) https://www.businessinsider.com/sec-investigates-diageo-how-channel-stuffing-works-2015-7 25/2597119/1558-7983-35-3-25.pdf by Wally Smietauskas or a. Compare and contrast the channel-stuffing technique described in the article you selected with the channel-stuffing at Toshiba that is described in the case. b. Which of these two types of channel-stuffing is likely to be more effective, and why? c. Describe the signs that a financial analyst can use to detect possible channel-stuffing by a company. Explain whether the analyst could have detected Toshiba's channel-stuffing using these signs. Decem

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer Lets address each of your requirements one by one Requirement 1 a Heres the table calculating the income misstatement for each fiscal year from 2008 to 2014 based on the Masking Differences pro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started