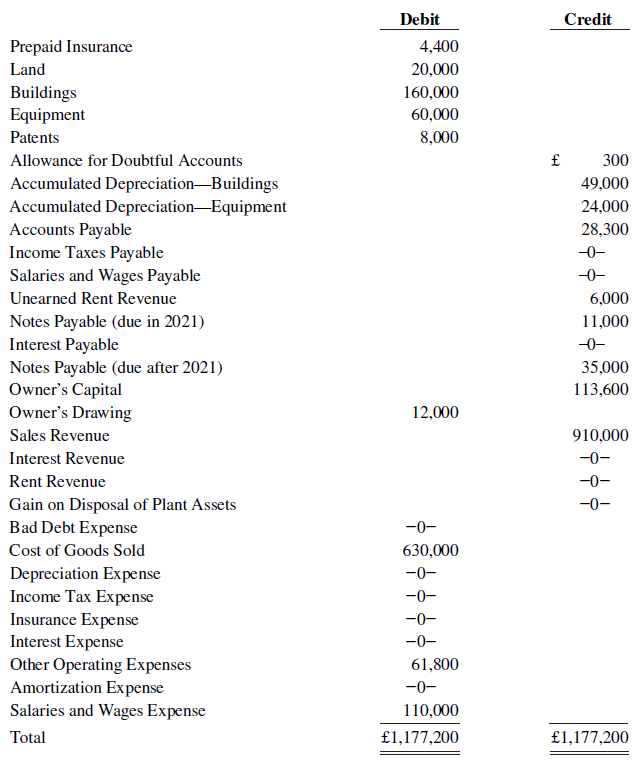

Raymond Constructions trial balance at December 31, 2020, is presented as follows. All 2020 transactions have been

Question:

Raymond Construction’s trial balance at December 31, 2020, is presented as follows. All 2020 transactions have been recorded except for the items described below.

Unrecorded transactions:

Unrecorded transactions:

1. On May 1, 2020, Raymond purchased equipment for £13,000 plus sales taxes of £780 (all paid in cash).

2. On July 1, 2020, Raymond sold for £3,500 equipment which originally cost £5,000. Accumulated depreciation on this equipment at January 1, 2020, was £1,800; 2020 depreciation prior to the sale of the equipment was £450.

3. On December 31, 2020, Raymond sold on account £9,400 of inventory that cost £6,600.

4. Raymond estimates that uncollectible accounts receivable at year-end is £4,000.

5. The note receivable is a one-year, 8% note dated April 1, 2020. No interest has been recorded.

6. The balance in prepaid insurance represents payment of a £4,400 6-month premium on October 1, 2020.

7. The building is being depreciated using the straight-line method over 40 years. The residual value is £20,000.

8. The equipment owned prior to this year is being depreciated using the straight-line method over 5 years. The residual value is 10% of cost.

9. The equipment purchased on May 1, 2020, is being depreciated using the straight-line method over 5 years, with a residual value of £1,000.

10. The patent was acquired on January 1, 2020, and has a useful life of 10 years from that date.

11. Unpaid salaries and wages at December 31, 2020, total £2,200.

12. The unearned rent revenue of £6,000 was received on December 1, 2020, for 4 months rent.

13. Both the short-term and long-term notes payable are dated January 1, 2020, and carry a 9% interest rate. All interest is payable in the next 12 months.

14. Income tax expense was £17,000. It was unpaid at December 31.

Instructions

a. Prepare journal entries for the transactions listed above.

b. Prepare a December 31, 2020, adjusted trial balance.

c. Prepare a 2020 income statement and a 2020 owner’s equity statement.

d. Prepare a December 31, 2020, classified statement of financial position.

Step by Step Answer:

Accounting Principles

ISBN: 978-1119419617

IFRS global edition

Authors: Paul D Kimmel, Donald E Kieso Jerry J Weygandt