Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A refiner has 250 tons of CPO in inventory. He will be holding this over the next 3 months. He protect himself from a fall

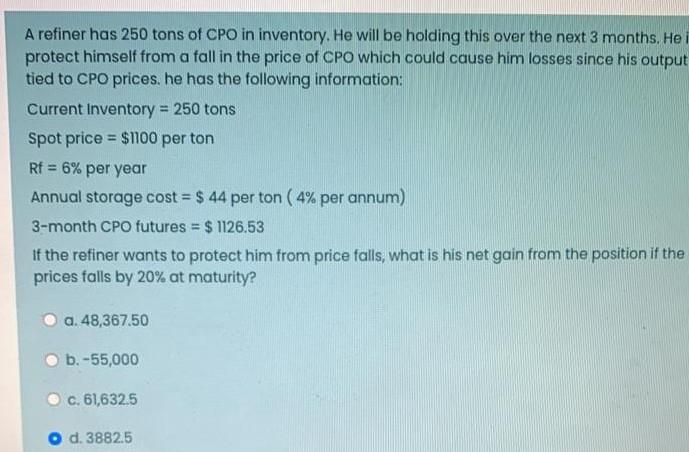

A refiner has 250 tons of CPO in inventory. He will be holding this over the next 3 months. He protect himself from a fall in the price of CPO which could cause him losses since his output tied to CPO prices, he has the following information: Current Inventory = 250 tons Spot price = $1100 per ton Rf = 6% per year Annual storage cost = $ 44 per ton ( 4% per annum) 3-month CPO futures = $ 1126.53 If the refiner wants to protect him from price falls, what is his net gain from the position if the prices falls by 20% at maturity? a. 48,367.50 b.-55,000 c. 61,632.5 d. 3882.5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started