Answered step by step

Verified Expert Solution

Question

1 Approved Answer

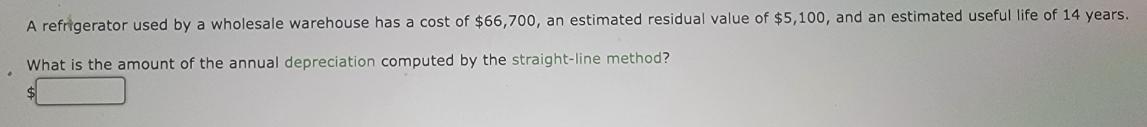

A refrigerator used by a wholesale warehouse has a cost of $66,700, an estimated residual value of $5,100, and an estimated useful life of

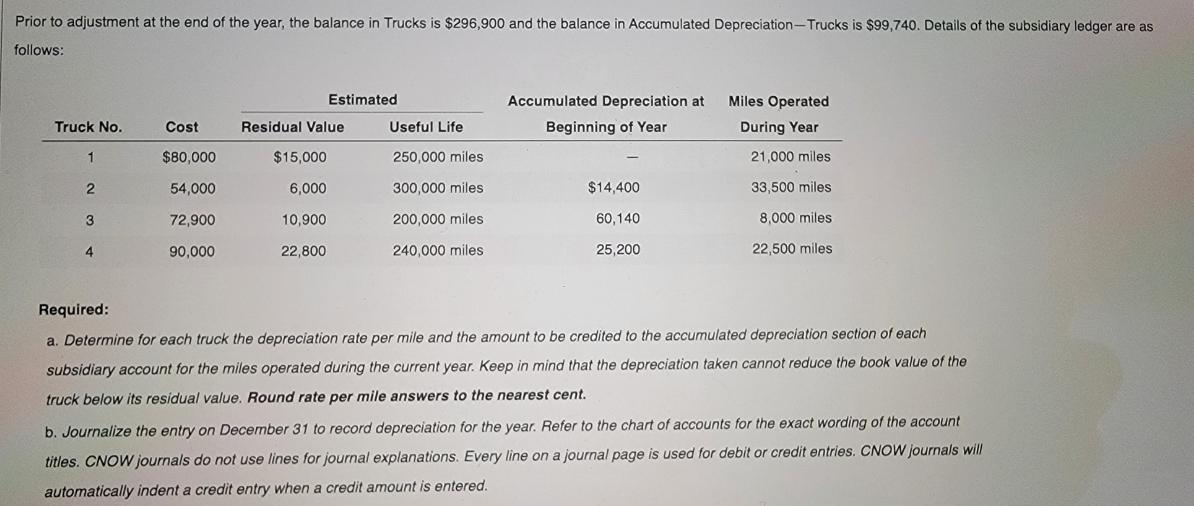

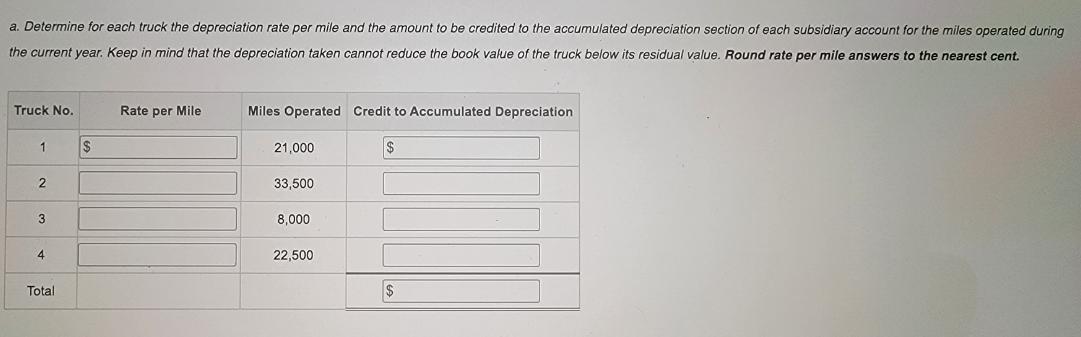

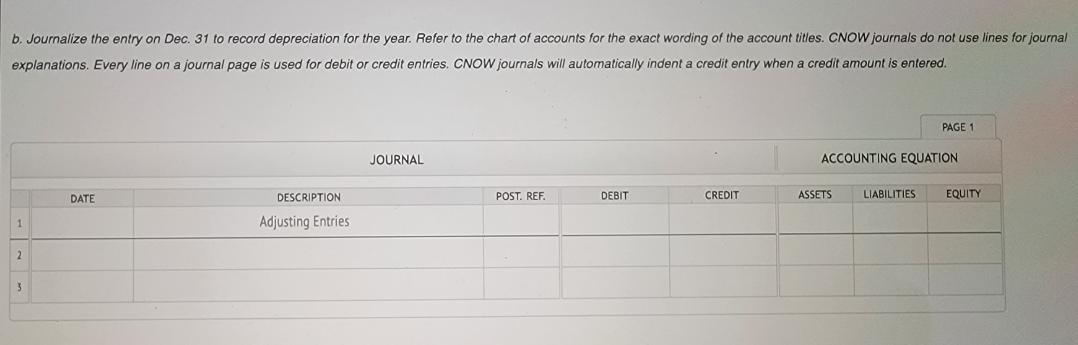

A refrigerator used by a wholesale warehouse has a cost of $66,700, an estimated residual value of $5,100, and an estimated useful life of 14 years. What is the amount of the annual depreciation computed by the straight-line method? Prior to adjustment at the end of the year, the balance in Trucks is $296,900 and the balance in Accumulated Depreciation-Trucks is $99,740. Details of the subsidiary ledger are as follows: Truck No. 1 2 3 4 Cost $80,000 54,000 72,900 90,000 Residual Value $15,000 6,000 Estimated 10,900 22,800 Useful Life 250,000 miles 300,000 miles 200,000 miles 240,000 miles Accumulated Depreciation at Beginning of Year $14,400 60,140 25,200 Miles Operated During Year 21,000 miles 33,500 miles 8,000 miles 22,500 miles Required: a. Determine for each truck the depreciation rate per mile and the amount to be credited to the accumulated depreciation section of each subsidiary account for the miles operated during the current year. Keep in mind that the depreciation taken cannot reduce the book value of the truck below its residual value. Round rate per mile answers to the nearest cent. b. Journalize the entry on December 31 to record depreciation for the year. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. a. Determine for each truck the depreciation rate per mile and the amount to be credited to the accumulated depreciation section of each subsidiary account for the miles operated during the current year. Keep in mind that the depreciation taken cannot reduce the book value of the truck below its residual value. Round rate per mile answers to the nearest cent. Truck No. 1 2 3 4 Total $ Rate per Mile Miles Operated Credit to Accumulated Depreciation $ 21,000 33,500 8,000 22,500 $ b. Journalize the entry on Dec. 31 to record depreciation for the year. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. 1 2 3 DATE DESCRIPTION Adjusting Entries JOURNAL POST. REF. DEBIT CREDIT PAGE 1 ACCOUNTING EQUATION ASSETS LIABILITIES. EQUITY

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To determine the depreciation rate per mile and the amount to be credited to the accumulated depre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started