A) Regarding the below A/R, Allowance for doubtfull accounts, retained earnings, and bad depts, If possible could you please provide reasoning and or calcuations to

A) Regarding the below A/R, Allowance for doubtfull accounts, retained earnings, and bad depts, If possible could you please provide reasoning and or calcuations to the answer. I really want to learn this but I'm very confused. Also, i f possible I need help with questions 1-6 (part of those questions have to do with the above question).

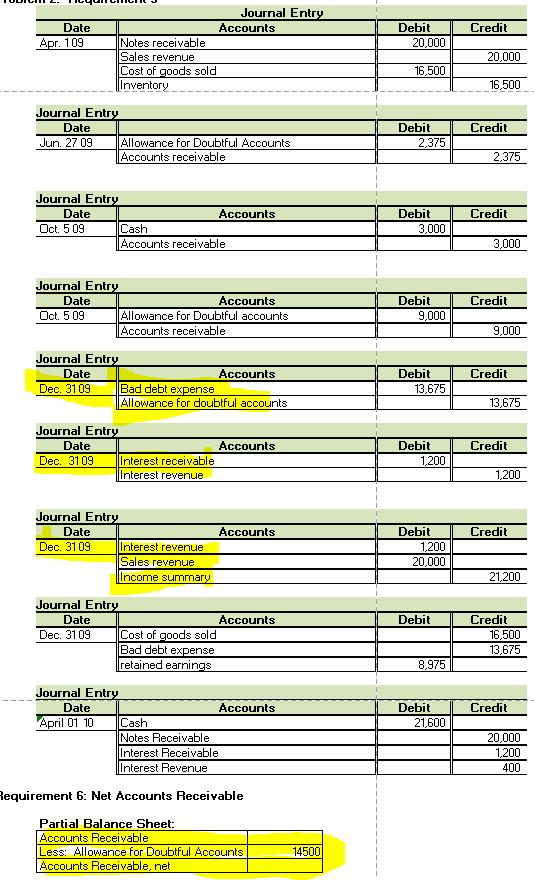

B) Regarding the journal entries at the very end of this page. I've submitted the question 3 times, all with different answers with the Dec 31st entries, ( 2 from the same person). If possible could someone please check all three of the Dec 31st entries to see if these are correct or not? Provide rationale or calclations to help guide me if they are not correct.

Thank you in advance!

------------------------------------------------------------------------------------------------------------------------------------

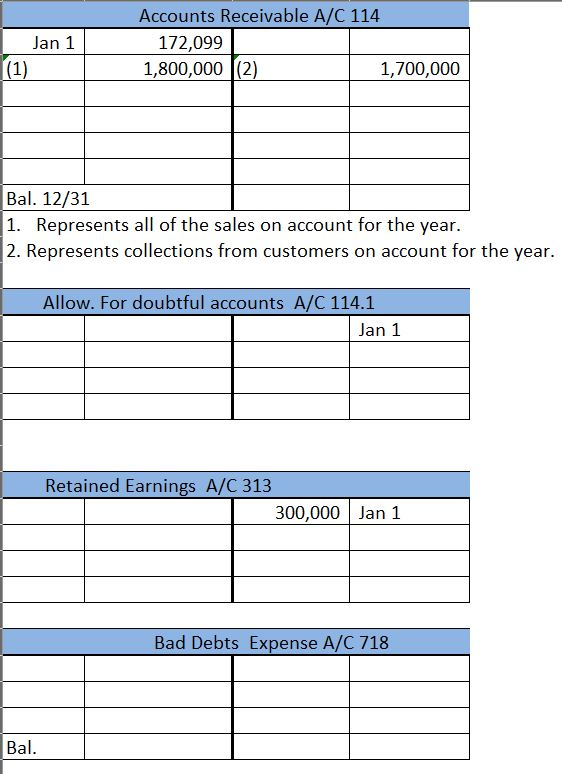

1. Open the following selected accounts recording the opening balances as of January 1 of the current year. In the

| 114.1 | Allowance for doubtful accounts | 12,200 Credit |

| 313 | Income summary |

|

|

|

|

|

| 718 | Bad debts expense |

|

2. Post these transactions to the three selected accounts above and to Accounts receivable.

3. Enter the ending balances in the three accounts above and enter the ending balance in the Accounts Receivable account.

| Apr 1, 09 | Accepted a $20,000, one - year, 8% note dated April 1 from Bruce Hanson for the sale of inventory; Cost of Goods Sold=+ was $16,500. |

| June 27 | Wrote off the $2,375 balance owed by Miller Corp., which has no assets. |

| Oct. 5 | Received 25% of the $12,000 balance owed by F.M. Knox Co., a bankrupt, and wrote off the remainder as uncollectible. |

| Dec. 31 | Based on an analysis of the $257,724 of accounts receivable, it was estimated that $14,500 will be uncollectible. Record the adjusting entry using the Aging method. |

| Dec. 31 | Record the adjusting entry for interest accrued on the Bruce Hanson note |

| Dec. 31 | Record the entries to close the appropriate accounts into Retained Earnings. |

| April 1, 10 | Collected the maturity value on the Hanson note. |

4. Determine the net accounts receivable (the amount Summer expects to collect as of December.

5. Compute the accounts receivable turnover and the days sales in receivables for the year. Assume that there were $1,800,000 sales account.

6. How is Summer Company doing with collection of their accounts receivable compared to the industry? Assume the industry average for the accounts receivable turnover is 11 and the industry average for the days sales in receivables is 37 days?

JOURNAL ENTRIES TO CHECK.

Accounts Receivable A/C 114 Jan 1 172,099 1,800,000 |(2) 1,700,000 Bal. 12/31 1. Represents all of the sales on account for the year. 2. Represents collections from customers on account for the year. Allow. For doubtful accounts A/C 114.1 Jan 1 Retained Earnings A/C 313 300,000 Jan 1 Bad Debts Expense A/C 718 Bal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started