Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A regression of sectoral loan losses against total loans losses, both measured as a percentage of loans, of a bank results in the following beta

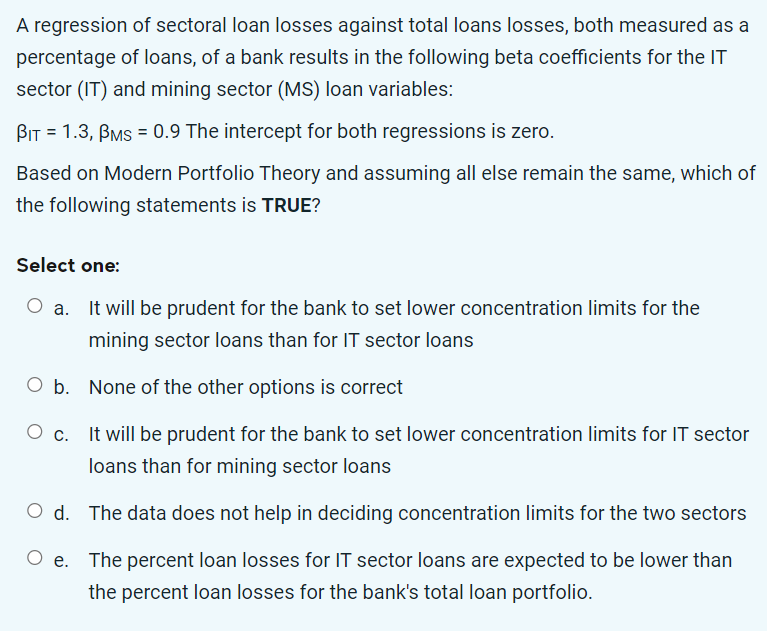

A regression of sectoral loan losses against total loans losses, both measured as a percentage of loans, of a bank results in the following beta coefficients for the IT sector (IT) and mining sector (MS) loan variables: IT=1.3,MS=0.9 The intercept for both regressions is zero. Based on Modern Portfolio Theory and assuming all else remain the same, which of the following statements is TRUE? Select one: a. It will be prudent for the bank to set lower concentration limits for the mining sector loans than for IT sector loans b. None of the other options is correct c. It will be prudent for the bank to set lower concentration limits for IT sector loans than for mining sector loans d. The data does not help in deciding concentration limits for the two sectors e. The percent loan losses for IT sector loans are expected to be lower than the percent loan losses for the bank's total loan portfolio

A regression of sectoral loan losses against total loans losses, both measured as a percentage of loans, of a bank results in the following beta coefficients for the IT sector (IT) and mining sector (MS) loan variables: IT=1.3,MS=0.9 The intercept for both regressions is zero. Based on Modern Portfolio Theory and assuming all else remain the same, which of the following statements is TRUE? Select one: a. It will be prudent for the bank to set lower concentration limits for the mining sector loans than for IT sector loans b. None of the other options is correct c. It will be prudent for the bank to set lower concentration limits for IT sector loans than for mining sector loans d. The data does not help in deciding concentration limits for the two sectors e. The percent loan losses for IT sector loans are expected to be lower than the percent loan losses for the bank's total loan portfolio Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started