Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A request. Answer the all questions below. Thanks 1. 2. 3. Local Co. has sales of $10.8 million and cost of sales of $6.3 million.

A request. Answer the all questions below. Thanks

1.

2.

3.

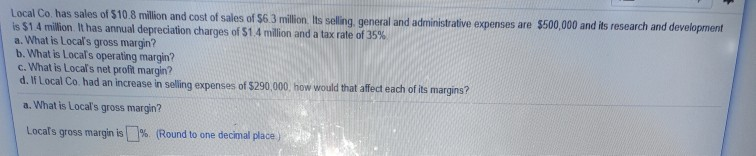

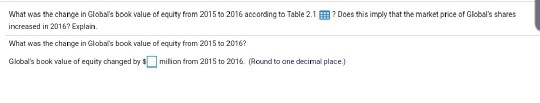

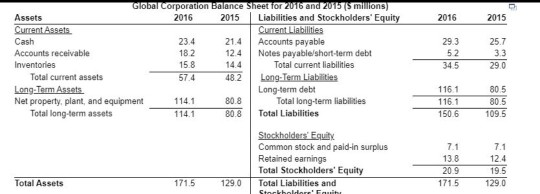

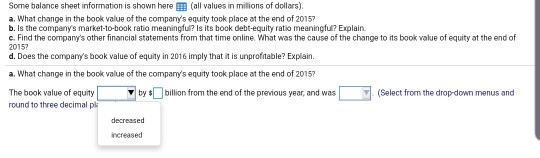

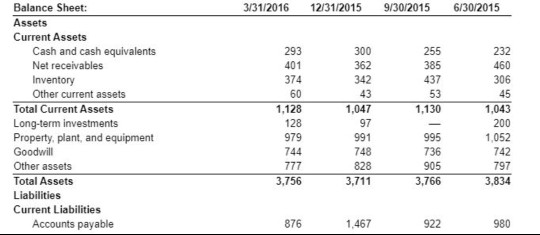

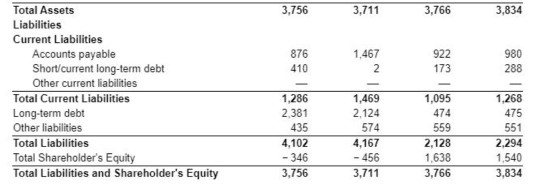

Local Co. has sales of $10.8 million and cost of sales of $6.3 million. Its selling general and administrative expenses are $500,000 and its research and development is $1.4 million. It has annual depreciation charges of $1.4 million and a tax rate of 35 % a. What is Local's gross margin? b. What is Local's operating margin? c. What is Local's net profit margin? d. If Local Co. had an increase in selling expenses of $290,000, how would that affect each of its margins? a. What is Local's gross margin? % (Round to one decimal place Local's gross margin is What was the change in Global's book value of equity from 2015 t0 2016 according to Table 2.1 ? Dces this imply that the market price of Global's shares increased in 2016? Explain. What was the change in Global's book value of equity from 2015 to 2016? Giobal's book value of equity changed by milion from 2015 to 2016 (Round to one decimal place.) Global Corporation Balance Sheet for 2016 and 2015 (S millions) Liabilities and Stockholders' Equity Current Liabilities Accounts payable Notes payable/short-term debt Total current liablities Assets 2016 2015 2016 2015 Current Assets Cash 23.4 21.4 29.3 25.7 Accounts receivable Inventories 18.2 15.8 12.4 5.2 3.3 14.4 34.5 29.0 Long-Term Liabilities Long-term debt Total long-term liabilities Total Liabilities Total current assets 574 48.2 Long-Term Assets Net property, plant, and equipment Total long-term assets 1161 80.5 80.8 80.5 114.1 116. 80.8 150.6 109.5 114.1 Stockholders Equity Common stock and paid-in surplus Retained earnings Total Stockholders' Equity 7.1 7.1 13.8 12.4 20.9 19.5 Total Assets 171.5 129.0 Total Liabilities and Stockboldore: Equity 171.5 129.0 Some balance sheet information is shown here (all values in milions of dollars). a. What change in the book value of the company's equity took place at the end of 2015? b. Is the company's market-to-book ratio meaningful? Is its book debt-equity ratio meaningfu? Explain. c. Find the company's other financial statements from that time online. What was the cause of the change to its book value of equity at the end of 2015? d. Does the company's book value of equity in 2016 imply that it is unprofitable? Explain a. What change in the book value of the company's equity took place at the end of 2015? by billion from the end of the previous year, and was The book value of equity (Select from the drop-down menus and round to three decimal pl decreased increased Some balance sheet information is shown here (all values in milions of dollars). a. What change in the book value of the company's equity took place at the end of 2015? b. Is the company's market-to-book ratio meaningful? Is its book debt-equity ratio meaningful? Explain c. Find the company's other financial statements from that time online. What was the cause of the change to its book value of equity at the end of 2015 d. Does the company's book value of equity in 2016 imply that it is unprofitable? Explain. a. What change in the book value of the company's equity tock place at the end of 2015? The book value of equity round to three decimal places.) by billion from the end of the previous year, and was (Select from the drop-down menus and negative positive Total Assets 3,766 3,834 3,756 3,711 Liabilities Current Liabilities Accounts payable Short/current long-term debt Other current liabilities Total Current Liabilities Long-term debt Other liabilities 876 1,467 922 980 173 288 410 1,286 1,469 1,095 1,268 2,381 475 2,124 474 435 574 559 551 Total Liabilities Total Shareholder's Equity Total Liabilities and Shareholder's Equity 2,294 4,102 4,167 2,128 -346 -456 1,638 1,540 3,711 3,756 3,766 3,834

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started