Question

A researcher is interested in assessing the risk exposure of a particular managed portfolio of UK stocks. She has collected a sample of monthly excess

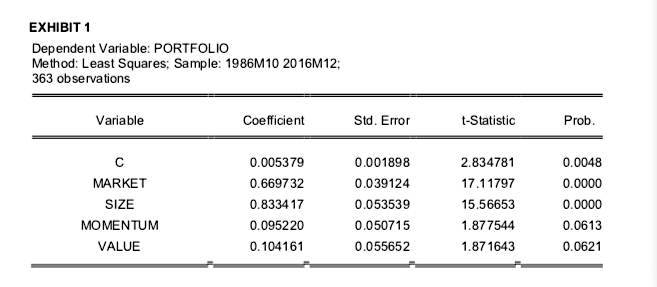

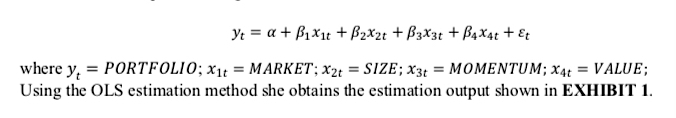

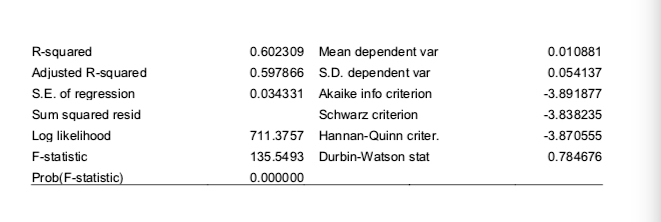

A researcher is interested in assessing the risk exposure of a particular managed portfolio of UK stocks. She has collected a sample of monthly excess returns on the portfolio (PORTFOLIO) as well as monthly returns on four UK risk factors covering the same time period: the market factor (MARKET) is the excess return on the FTSE 100 index, the size factor (SIZE) is the return on a portfolio of small UK stocks less the return on a portfolio of large UK stocks (where size is measured using market capitalization), the value factor (VALUE) is the return on a portfolio of high value UK stocks less the return on a portfolio of low value UK stocks (where value is measured using the book-to-market ratio), and the momentum (MOMENTUM) factor is the return on UK stocks that have performed strongly over the last year less the return on a portfolio of UK stocks that have performed poorly. All the returns are expressed in decimals. The researcher estimates the multiple linear regression model

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started