Question

A restaurant chain purchased a set of kitchen equipment on December 31, 2021 that costs $ 48,000 with cash and fully depreciates over five

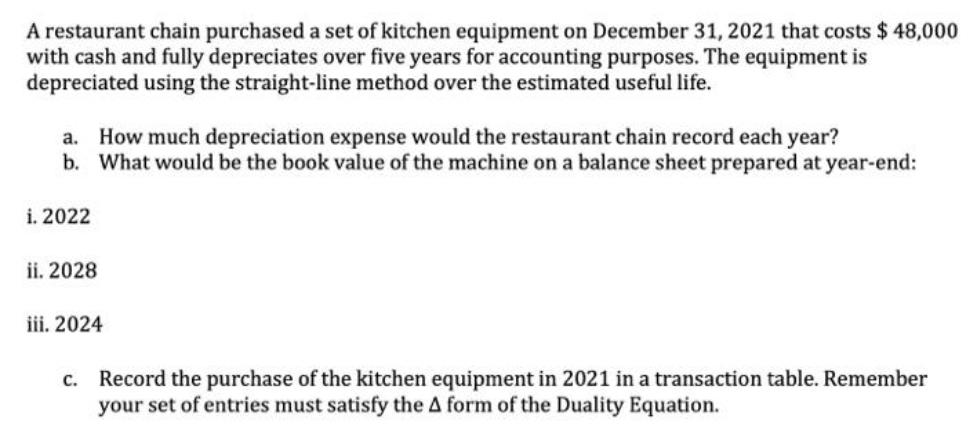

A restaurant chain purchased a set of kitchen equipment on December 31, 2021 that costs $ 48,000 with cash and fully depreciates over five years for accounting purposes. The equipment is depreciated using the straight-line method over the estimated useful life. a. How much depreciation expense would the restaurant chain record each year? b. What would be the book value of the machine on a balance sheet prepared at year-end: i. 2022 ii. 2028 iii. 2024 c. Record the purchase of the kitchen equipment in 2021 in a transaction table. Remember your set of entries must satisfy the A form of the Duality Equation.

Step by Step Solution

3.48 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Kin Lo, George Fisher

Volume 1, 1st Edition

132612119, 978-0132612111

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App