Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A retailer has a perpetual inventory system. The retailer purchases inventory from a supplier on FOB destination terms. What account, if any, would be debited

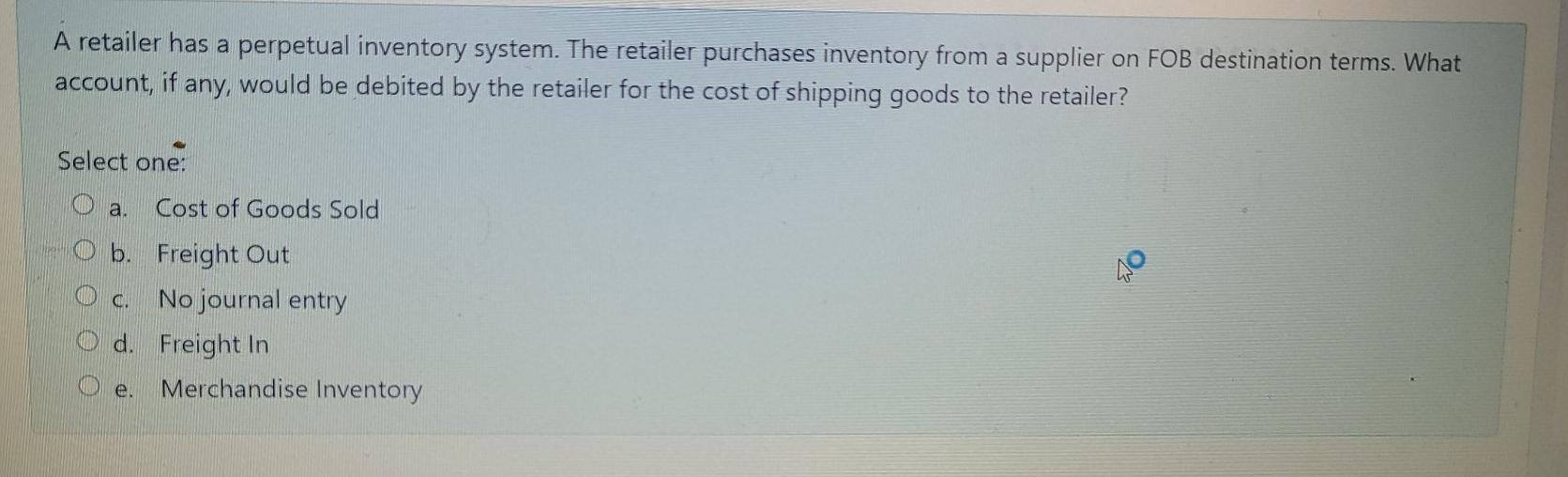

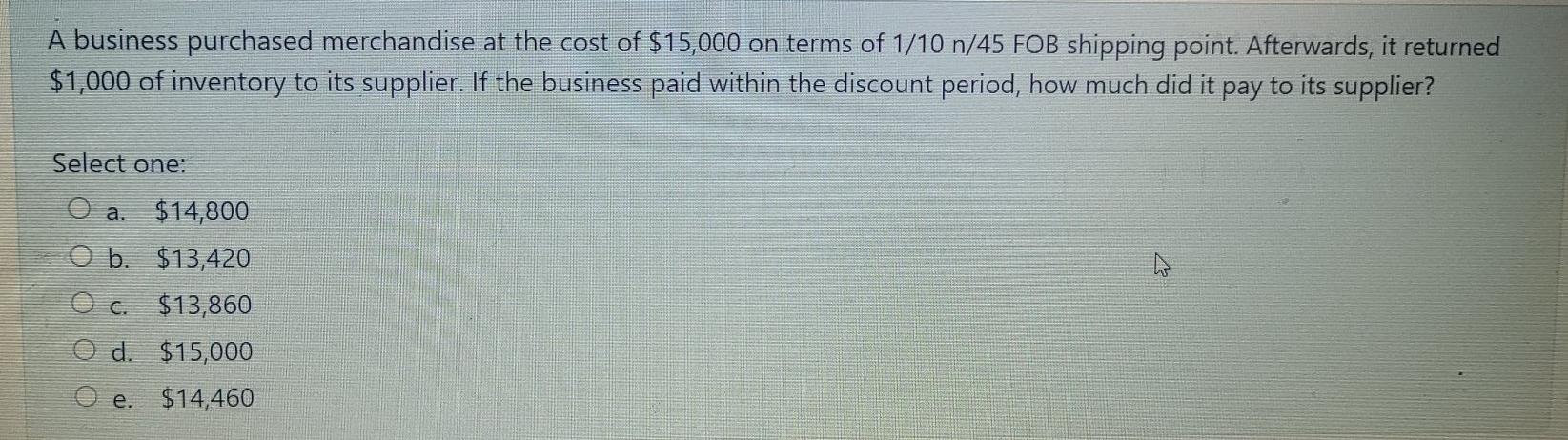

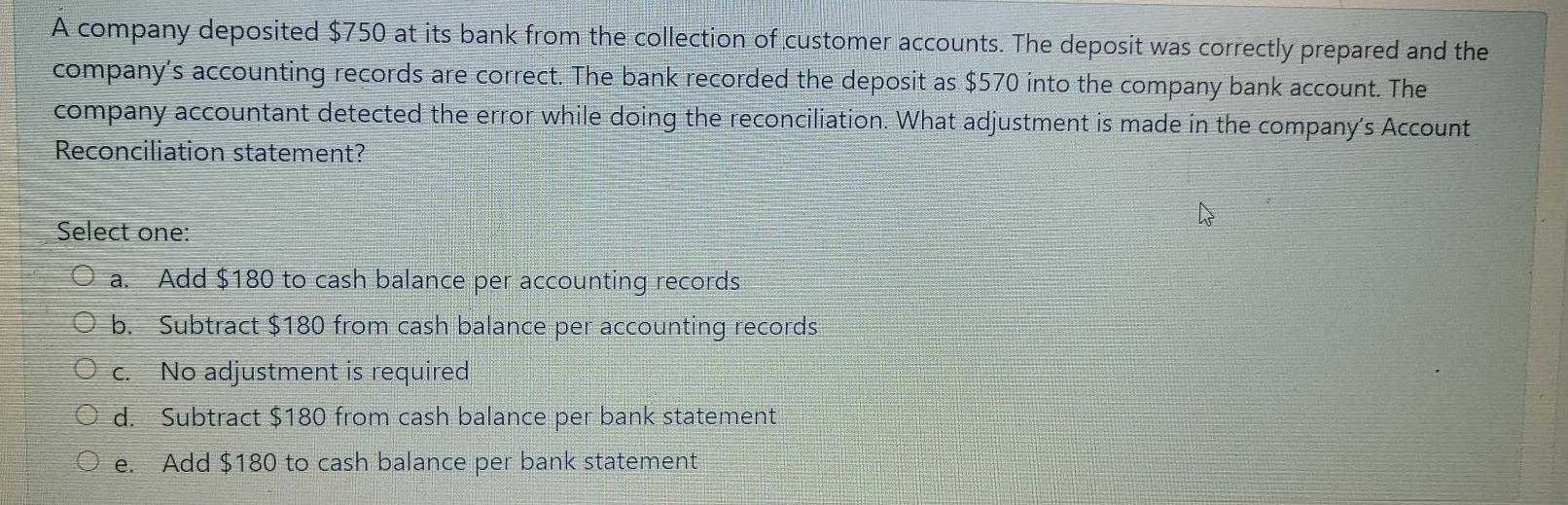

A retailer has a perpetual inventory system. The retailer purchases inventory from a supplier on FOB destination terms. What account, if any, would be debited by the retailer for the cost of shipping goods to the retailer? Select one: O a. Cost of Goods Sold O b. Freight Out O c. No journal entry d. Freight In Merchandise Inventory e. A business purchased merchandise at the cost of $15,000 on terms of 1/10 n/45 FOB shipping point. Afterwards, it returned $1,000 of inventory to its supplier. If the business paid within the discount period, how much did it pay to its supplier? Select one: . $14,800 O b. $13,420 $13,860 d. $15,000 e. $14,460 A company deposited $750 at its bank from the collection of customer accounts. The deposit was correctly prepared and the company's accounting records are correct. The bank recorded the deposit as $570 into the company bank account. The company accountant detected the error while doing the reconciliation. What adjustment is made in the company's Account Reconciliation statement? Select one: . Add $180 to cash balance per accounting records b. Subtract $180 from cash balance per accounting records No adjustment is required O d. Subtract $180 from cash balance per bank statement e. Add $180 to cash balance per bank statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started