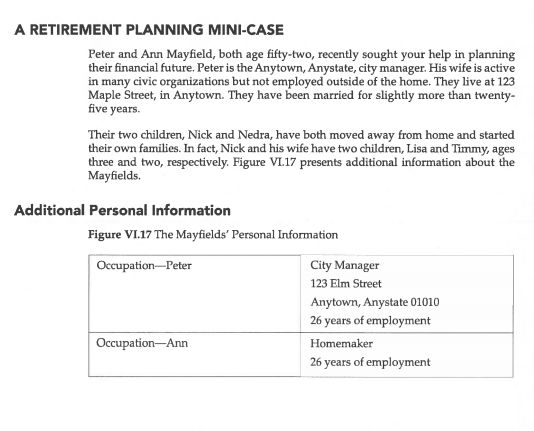

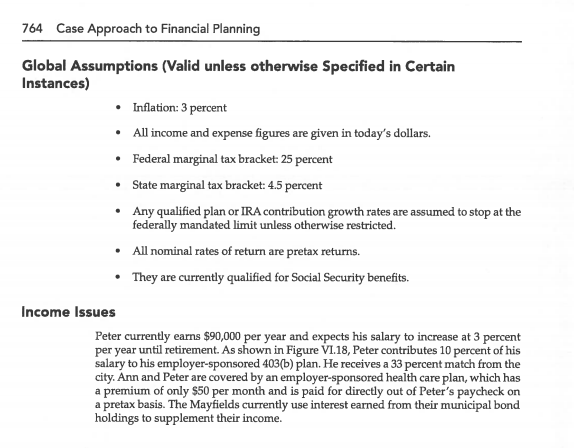

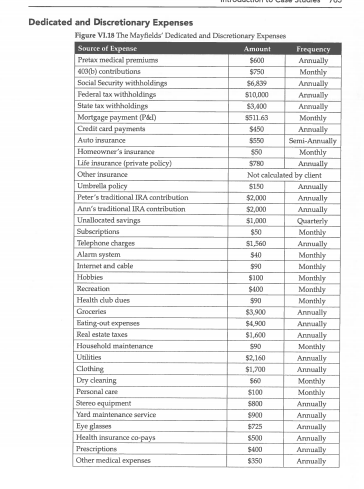

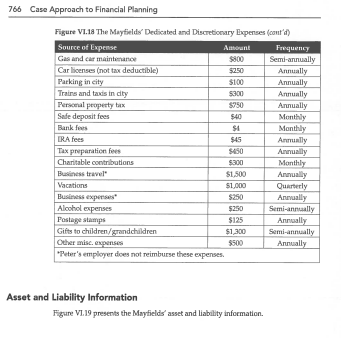

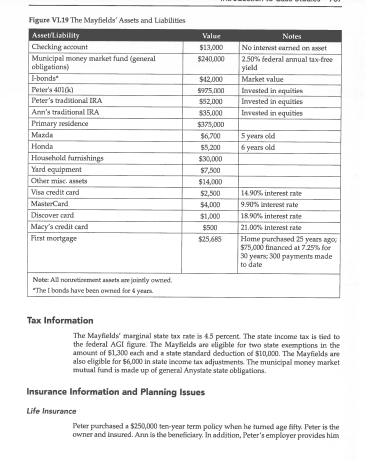

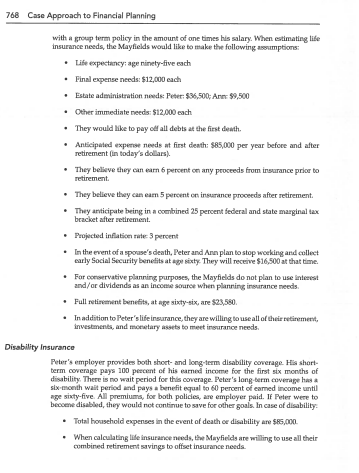

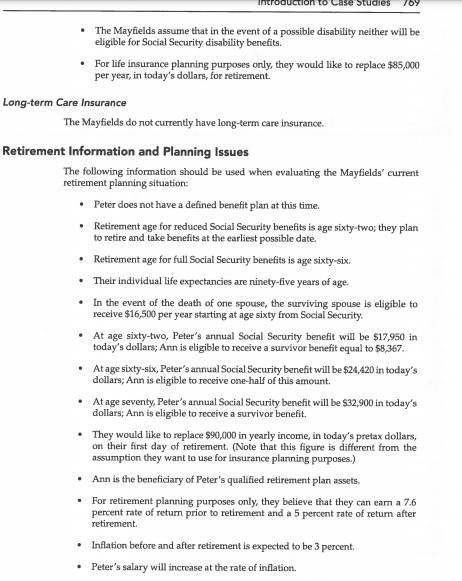

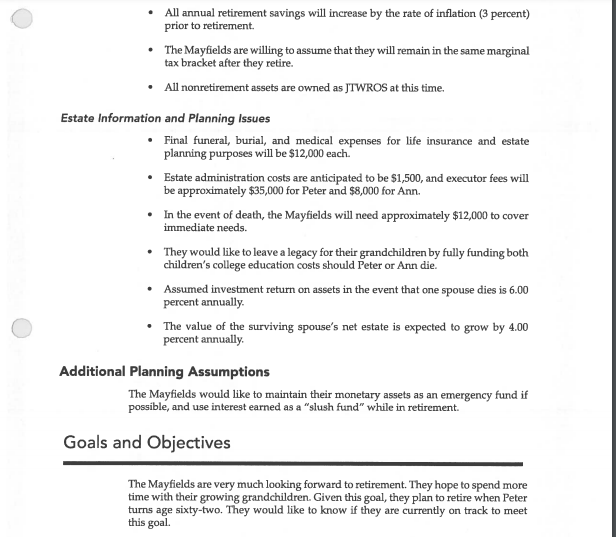

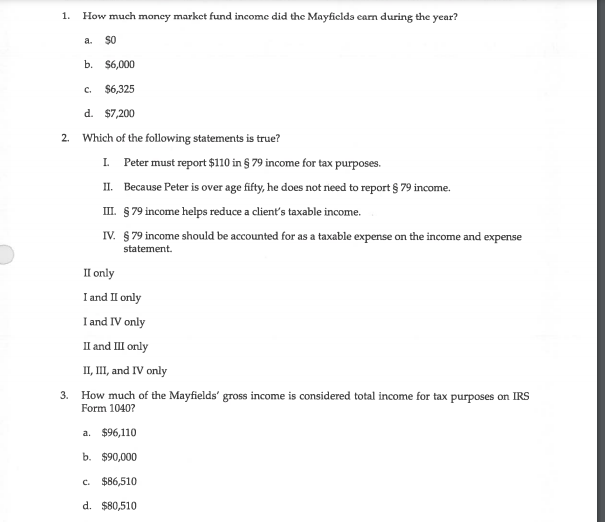

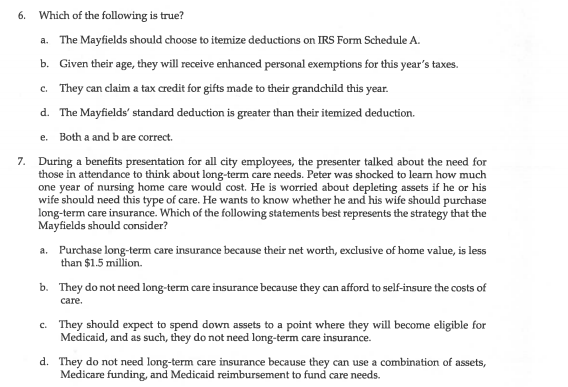

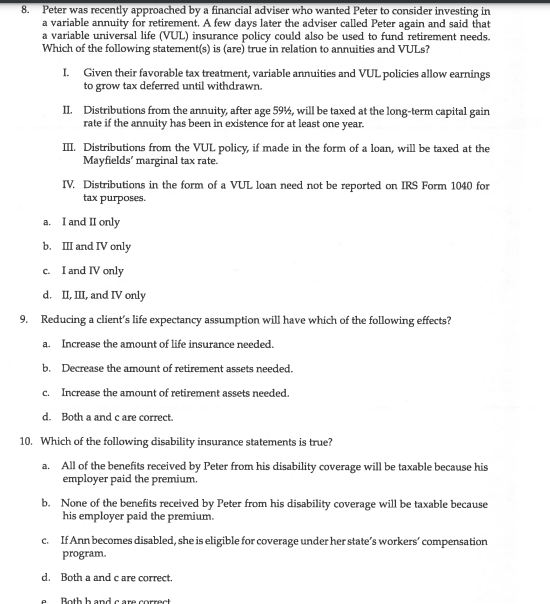

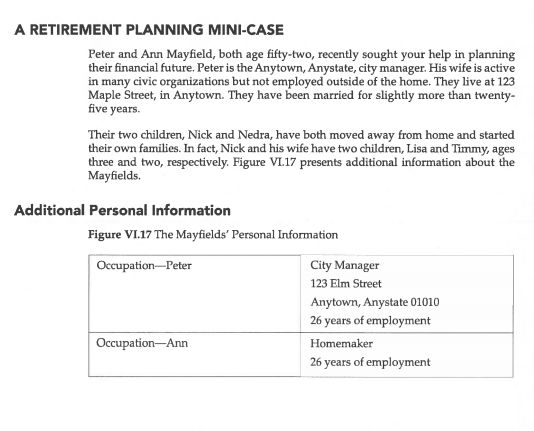

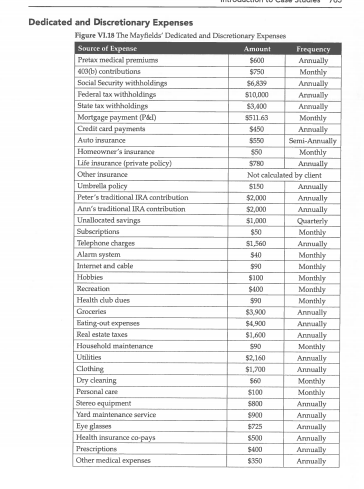

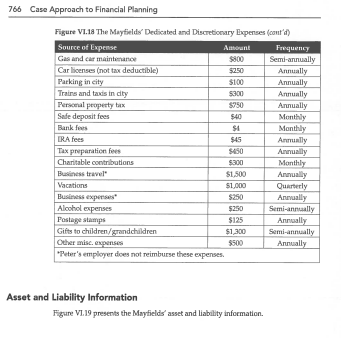

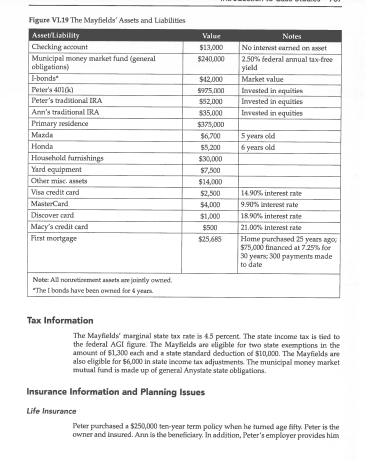

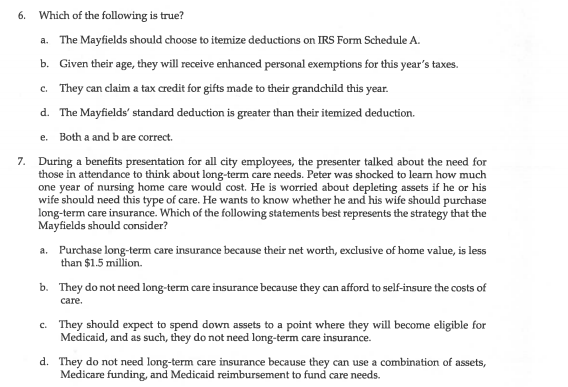

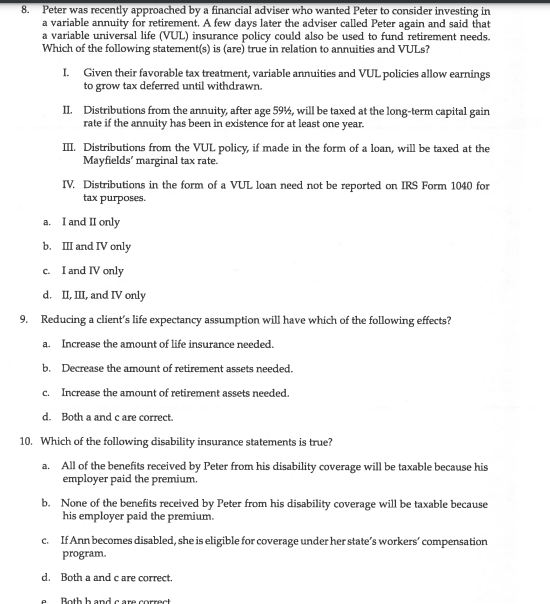

A RETIREMENT PLANNING MINI-CASE Peter and Ann Mayfield, both age fifty-two, recently sought your help in planning their financial future. Peter is the Anytown, Anystate, city manager. His wife is active in many civic organizations but not employed outside of the home. They live at 123 Maple Street, in Anytown. They have been married for slightly more than twenty- five years. Their two children, Nick and Nedra, have both moved away from home and started their own families. In fact, Nick and his wife have two children, Lisa and Timmy, ages three and two, respectively. Figure VI.17 presents additional information about the Mayfields. Additional Personal Information Figure VI.17 The Mayfields' Personal Information Occupation-Peter City Manager 123 Elm Street Anytown, Anystate 01010 26 years of employment Homemaker 26 years of employment Occupation-Ann 764 Case Approach to Financial Planning Global Assumptions (Valid unless otherwise Specified in Certain Instances) Inflation: 3 percent All income and expense figures are given in today's dollars. Federal marginal tax bracket: 25 percent State marginal tax bracket: 4.5 percent Any qualified plan or IRA contribution growth rates are assumed to stop at the federally mandated limit unless otherwise restricted. All nominal rates of return are pretax returns. They are currently qualified for Social Security benefits. Income Issues Peter currently earns $90,000 per year and expects his salary to increase at 3 percent per year until retirement. As shown in Figure V1.18, Peter contributes 10 percent of his salary to his employer-sponsored 403(b) plan. He receives a 33 percent match from the city. Ann and Peter are covered by an employer-sponsored health care plan, which has a premium of only $50 per month and is paid for directly out of Peter's paycheck on a pretax basis. The Mayfields currently use interest earned from their municipal bond holdings to supplement their income. Dedicated and Discretionary Expenses Figure V1.18 The Mayfields Dedicated and Discretionary Expenses Source of Expense Amount Frequency Pretax medical premium $600 Annually 400(b) contributions 5750 Monthly Social Security withholdings $6.839 Annually Federal tax withholdings $10,000 Armually State tax withholding $3,400 Anmually Mortgage payment (PT) $51163 Monthly Credit card payments $150 Annually Auto insurance Semi-Annually Homeowner's insurance 550 Monthly Life insurance private policy) $780 Annually Other insurance Not calculated by client Umbrella policy $150 Annually Peter's traditional IRA contribution $2,000 Annually Ann's traditional IRA contribution $2,000 Annually Unallocated savings $1,000 Quarterly Subscriptions $50 Monthly Telephone charges $1,560 Annually Alarm system $40 Monthly Inter and cable $90 Monthly Hobbies $100 Monthly Recreation $100 Monthly Health dub dues $90 Monthly Groceries $3.900 Annually Eating-out expenses $4.900 Annually Real estate taxes $1,000 Annually Household maintenance 590 Monthly Utilities 52,160 Annually Clothing $1,700 Annually Dry cleaning $60 Monthly Personal care $100 Monthly Stereo equipment $800 Annually Yard maintenance service $900 Annually Eyeglass $725 Annually He Insurance ce pays 5500 Annually Prescriptions $400 Annually Other medical expenses $350 Armally 766 Case Approach to Financial Planning Figure VI.18 The Mayfields Dedicated and Discretionary Expenses (contd) Source of Expense Amount Frequency Gas and car maintenance $800 Semi-annually Car licenses (not tax deductible) $250 Annually Parking in city $100 Annually Trains and taxds in city 5300 Annually Personal property tax $750 Annually Safe deposit fees $40 Monthly Bank foes $1 Monthly IRA fees $45 Annually Tax preparation fees $450 Annually Charitable contributions $300 Monthly Business travel $1,500 Annually Vacations $1,000 Quarterly Business expenses $250 Annually Alcohol expenses $250 Semi-annually Postage stamps $125 Annually Gifts to children/grandchildren $1,300 Semi-annually Other misc.expenses $500 Annually "Peter's employer does not reimburse these expenses. Asset and Liability Information Figure V1.19 presents the Mayfields asset and liability information. Value $13,000 $240,000 Notes No interest earned on a 2.50% federal annual tax-free yield Market value Invested in equities Invested in equities Invested in equities Figure VI.19 The Mayfields' Assets and Liabilities Asset Liability Checking account Municipal money market fund (general obligations) I-bonds Peter's 401(k) Peter's traditional IRA Ann's traditional TRA Primary residence Mazda Honda Household furnishings Yand equipment Other misc.assets Visa credit card MasterCard Discover card Macy's credit card Fist mortgage 5 years old 6 years old $12,000 5975,000 $32,000 $35,000 $375,000 $6,700 $5,200 530,000 $7,500 $14,000 $2,500 54,000 $1,000 $500 $25,665 14.90% interest rate 9.90% Interest rate 18.90% interest rate 21.00% Interest rate Home purchased 25 years ago $75,000 financed at 72 for 30 years: 300 payments made to date Note: All notretiems are jointly owned. "The bands have been owned fire 4 years Tax Information The Mayfields' marginal state tax rate is 45 percent. The state income tax is tied to the federal AGI figure. The Mayfields are eligible for two state exemptions in the amount of $1.300 each and a state standard deduction of $10,000. The Mayfields are also eligible for $4,000 in state income tax adjustments. The municipal money market mutual fund is made up of general Anystate state obligations Insurance Information and Planning Issues Life Insurance Peter purchased $250,000 ten-year term policy when he tumedage filty. Peter is the owner and insured. Ann is the beneficiary. In addition, Peter's employer provides him 768 Case Approach to Financial Planning with a group term policy in the amount of one times his salary. When estimating life Insurance needs, the Mayfields would like to make the following sumptions: life expectancy, age ninety-five each Final expense needs: $12,000 each Estate administration needs: Peter: 536,500; Am 99,500 Other immediate needs: $12,000 each They would like to pay of all debts at the first death. Anticipated expense needs at first death: $85,000 per year before and after retirement in today's dollars) They believe they can eam 6 percent on any proceeds from insurance prior to retirement They believe they can cam 5 percent on insurance proceeds after retirement. They anticipate being in a combined 25 percent federal and state marginal tax bracket after retirement Projected Inflation de 3 percent In the event of a spouse's death, Peter and Ann plan to stop working and collect early Social Security benefits at age sixty. They will receive $16.500 at that time. For comervative planning purposes, the Mayfields do not plan to use interest and/or dividends as an income scrurce when planning insurance needs Full retirement benefits, at age sixty-six, are $23,580 In addition to Peter's life insurance, they are willing to use all of their retirement, investments, and monetary to meet insurance needs. Disability Insurance Peter's employer provides both short and long-term disability coverage. His short- term coverage pays 100 percent of his earned income for the first six months of disability. There is no wait period for this coverage. Peter's long-term coverage six-month wait period and pays a benefit equal to 60 percent of eamed income until ge sixty-five. All premium, for both policies, are employer paid. If Peter were to become disabled, they would not continue to save for other goals. In case of disability Total household expenses in the event of death or disability are $65,000 When calculating life insurance needs, the Mayfields are willing to use all their combined retirement savings to offset Insurance needs Studies The Mayfields assume that in the event of a possible disability neither will be eligible for Social Security disability benefits For life insurance planning purposes only, they would like to replace $85,000 per year, in today's dollars, for retirement. Long-term Care Insurance The Mayfields do not currently have long-term care insurance. Retirement Information and Planning Issues The following information should be used when evaluating the Mayfields' current retirement planning situation: Peter does not have a defined benefit plan at this time. Retirement age for reduced Social Security benefits is age sixty-two, they plan to retire and take benefits at the earliest possible date. Retirement age for full Social Security benefits is age sixty-six. Their individual life expectancies are ninety-five years of age. In the event of the death of one spouse, the surviving spouse is eligible to receive $16,500 per year starting at age sixty from Social Security, At age sixty-two, Peter's annual Social Security benefit will be $17,950 in today's dollars; Ann is eligible to receive a survivor benefit equal to $5,367 At age sixty-six, Peter's annual Social Security benefit will be $24,420 in today's dollars; Ann is eligible to receive one-half of this amount At age seventy, Peter's annual Social Security benefit will be $32,900 in today's dollars; Ann is eligible to receive a survivor benefit. They would like to replace $90,000 in yearly income, in today's pretax dollars, on their first day of retirement. (Note that this figure is different from the assumption they want to use for insurance planning purposes.) Ann is the beneficiary of Peter's qualified retirement plan assets. For retirement planning purposes only, they believe that they can earn a 7.6 percent rate of return prior to retirement and a 5 percent rate of return after retirement Inflation before and after retirement is expected to be 3 percent Peter's salary will increase at the rate of inflation. All annual retirement savings will increase by the rate of inflation (3 percent) prior to retirement The Mayfields are willing to assume that they will remain in the same marginal tax bracket after they retire. All nonretirement assets are owned as JTWROS at this time. Estate Information and Planning Issues Final funeral, burial, and medical expenses for life insurance and estate planning purposes will be $12,000 each. Estate administration costs are anticipated to be $1,500, and executor fees will be approximately $35,000 for Peter and $8,000 for Ann. In the event of death, the Mayfields will need approximately $12,000 to cover immediate needs. They would like to leave a legacy for their grandchildren by fully funding both children's college education costs should Peter or Ann die. Assumed investment return on assets in the event that one spouse dies is 6.00 percent annually. The value of the surviving spouse's net estate is expected to grow by 4.00 percent annually. Additional Planning Assumptions The Mayfields would like to maintain their monetary assets as an emergency fund if possible, and use interest earned as a "slush fund while in retirement Goals and Objectives The Mayfields are very much looking forward to retirement. They hope to spend more time with their growing grandchildren. Given this goal, they plan to retire when Peter turns age sixty-two. They would like to know if they are currently on track to meet this goal. 1. How much money market fund income did the Mayficlds cam during the year? a. $0 b. $6,000 $6,325 d. $7,200 2. Which of the following statements is true? I. Peter must report $110 in $ 79 income for tax purposes. II. Because Peter is over age fifty, he does not need to report $ 79 income. III. $ 79 income helps reduce a client's taxable income. IV. $ 79 income should be accounted for as a taxable expense on the income and expense statement. II only I and II only I and IV only II and III only II, III, and IV only 3. How much of the Mayfields' gross income is considered total income for tax purposes on IRS Form 10402 a. $96,110 b. $90,000 c. $86,510 d. $80,510 6. Which of the following is true? a. The Mayfields should choose to itemize deductions on IRS Form Schedule A. b. Given their age, they will receive enhanced personal exemptions for this year's taxes. c. They can claim a tax credit for gifts made to their grandchild this year. d. The Mayfields' standard deduction is greater than their itemized deduction. e. Both a and b are correct. 7. During a benefits presentation for all city employees, the presenter talked about the need for those in attendance to think about long-term care needs. Peter was shocked to learn how much one year of nursing home care would cost. He is worried about depleting assets if he or his wife should need this type of care. He wants to know whether he and his wife should purchase long-term care insurance. Which of the following statements best represents the strategy that the Mayfields should consider? a. Purchase long-term care insurance because their net worth, exclusive of home value, is less than $1.5 million b. They do not need long-term care insurance because they can afford to self-insure the costs of care, C. They should expect to spend down assets to a point where they will become eligible for Medicaid, and as such, they do not need long-term care insurance. d. They do not need long-term care insurance because they can use a combination of assets, Medicare funding, and Medicaid reimbursement to fund care needs. 8. Peter was recently approached by a financial adviser who wanted Peter to consider investing in a variable annuity for retirement. A few days later the adviser called Peter again and said that a variable universal life (VUL) insurance policy could also be used to fund retirement needs. Which of the following statement(s) is (are) true in relation to annuities and VULS? I. Given their favorable tax treatment, variable annuities and VUL policies allow earnings to grow tax deferred until withdrawn. II. Distributions from the annuity, after age 59%, will be taxed at the long-term capital gain rate if the annuity has been in existence for at least one year. III. Distributions from the VUL policy, if made in the form of a loan, will be taxed at the Mayfields' marginal tax rate. IV. Distributions in the form of a VUL loan need not be reported on IRS Form 1040 for tax purposes. a. I and II only b. III and IV only c. I and IV only d. II, III, and IV only 9. Reducing a client's life expectancy assumption will have which of the following effects? a. Increase the amount of life insurance needed. b. Decrease the amount of retirement assets needed. c. Increase the amount of retirement assets needed. d. Both a and care correct. 10. Which of the following disability insurance statements is true? a. All of the benefits received by Peter from his disability coverage will be taxable because his employer paid the premium. b. None of the benefits received by Peter from his disability coverage will be taxable because his employer paid the premium. c. If Ann becomes disabled, she is eligible for coverage under her state's workers' compensation program d. Both a and care correct. e Both hand care correct A RETIREMENT PLANNING MINI-CASE Peter and Ann Mayfield, both age fifty-two, recently sought your help in planning their financial future. Peter is the Anytown, Anystate, city manager. His wife is active in many civic organizations but not employed outside of the home. They live at 123 Maple Street, in Anytown. They have been married for slightly more than twenty- five years. Their two children, Nick and Nedra, have both moved away from home and started their own families. In fact, Nick and his wife have two children, Lisa and Timmy, ages three and two, respectively. Figure VI.17 presents additional information about the Mayfields. Additional Personal Information Figure VI.17 The Mayfields' Personal Information Occupation-Peter City Manager 123 Elm Street Anytown, Anystate 01010 26 years of employment Homemaker 26 years of employment Occupation-Ann 764 Case Approach to Financial Planning Global Assumptions (Valid unless otherwise Specified in Certain Instances) Inflation: 3 percent All income and expense figures are given in today's dollars. Federal marginal tax bracket: 25 percent State marginal tax bracket: 4.5 percent Any qualified plan or IRA contribution growth rates are assumed to stop at the federally mandated limit unless otherwise restricted. All nominal rates of return are pretax returns. They are currently qualified for Social Security benefits. Income Issues Peter currently earns $90,000 per year and expects his salary to increase at 3 percent per year until retirement. As shown in Figure V1.18, Peter contributes 10 percent of his salary to his employer-sponsored 403(b) plan. He receives a 33 percent match from the city. Ann and Peter are covered by an employer-sponsored health care plan, which has a premium of only $50 per month and is paid for directly out of Peter's paycheck on a pretax basis. The Mayfields currently use interest earned from their municipal bond holdings to supplement their income. Dedicated and Discretionary Expenses Figure V1.18 The Mayfields Dedicated and Discretionary Expenses Source of Expense Amount Frequency Pretax medical premium $600 Annually 400(b) contributions 5750 Monthly Social Security withholdings $6.839 Annually Federal tax withholdings $10,000 Armually State tax withholding $3,400 Anmually Mortgage payment (PT) $51163 Monthly Credit card payments $150 Annually Auto insurance Semi-Annually Homeowner's insurance 550 Monthly Life insurance private policy) $780 Annually Other insurance Not calculated by client Umbrella policy $150 Annually Peter's traditional IRA contribution $2,000 Annually Ann's traditional IRA contribution $2,000 Annually Unallocated savings $1,000 Quarterly Subscriptions $50 Monthly Telephone charges $1,560 Annually Alarm system $40 Monthly Inter and cable $90 Monthly Hobbies $100 Monthly Recreation $100 Monthly Health dub dues $90 Monthly Groceries $3.900 Annually Eating-out expenses $4.900 Annually Real estate taxes $1,000 Annually Household maintenance 590 Monthly Utilities 52,160 Annually Clothing $1,700 Annually Dry cleaning $60 Monthly Personal care $100 Monthly Stereo equipment $800 Annually Yard maintenance service $900 Annually Eyeglass $725 Annually He Insurance ce pays 5500 Annually Prescriptions $400 Annually Other medical expenses $350 Armally 766 Case Approach to Financial Planning Figure VI.18 The Mayfields Dedicated and Discretionary Expenses (contd) Source of Expense Amount Frequency Gas and car maintenance $800 Semi-annually Car licenses (not tax deductible) $250 Annually Parking in city $100 Annually Trains and taxds in city 5300 Annually Personal property tax $750 Annually Safe deposit fees $40 Monthly Bank foes $1 Monthly IRA fees $45 Annually Tax preparation fees $450 Annually Charitable contributions $300 Monthly Business travel $1,500 Annually Vacations $1,000 Quarterly Business expenses $250 Annually Alcohol expenses $250 Semi-annually Postage stamps $125 Annually Gifts to children/grandchildren $1,300 Semi-annually Other misc.expenses $500 Annually "Peter's employer does not reimburse these expenses. Asset and Liability Information Figure V1.19 presents the Mayfields asset and liability information. Value $13,000 $240,000 Notes No interest earned on a 2.50% federal annual tax-free yield Market value Invested in equities Invested in equities Invested in equities Figure VI.19 The Mayfields' Assets and Liabilities Asset Liability Checking account Municipal money market fund (general obligations) I-bonds Peter's 401(k) Peter's traditional IRA Ann's traditional TRA Primary residence Mazda Honda Household furnishings Yand equipment Other misc.assets Visa credit card MasterCard Discover card Macy's credit card Fist mortgage 5 years old 6 years old $12,000 5975,000 $32,000 $35,000 $375,000 $6,700 $5,200 530,000 $7,500 $14,000 $2,500 54,000 $1,000 $500 $25,665 14.90% interest rate 9.90% Interest rate 18.90% interest rate 21.00% Interest rate Home purchased 25 years ago $75,000 financed at 72 for 30 years: 300 payments made to date Note: All notretiems are jointly owned. "The bands have been owned fire 4 years Tax Information The Mayfields' marginal state tax rate is 45 percent. The state income tax is tied to the federal AGI figure. The Mayfields are eligible for two state exemptions in the amount of $1.300 each and a state standard deduction of $10,000. The Mayfields are also eligible for $4,000 in state income tax adjustments. The municipal money market mutual fund is made up of general Anystate state obligations Insurance Information and Planning Issues Life Insurance Peter purchased $250,000 ten-year term policy when he tumedage filty. Peter is the owner and insured. Ann is the beneficiary. In addition, Peter's employer provides him 768 Case Approach to Financial Planning with a group term policy in the amount of one times his salary. When estimating life Insurance needs, the Mayfields would like to make the following sumptions: life expectancy, age ninety-five each Final expense needs: $12,000 each Estate administration needs: Peter: 536,500; Am 99,500 Other immediate needs: $12,000 each They would like to pay of all debts at the first death. Anticipated expense needs at first death: $85,000 per year before and after retirement in today's dollars) They believe they can eam 6 percent on any proceeds from insurance prior to retirement They believe they can cam 5 percent on insurance proceeds after retirement. They anticipate being in a combined 25 percent federal and state marginal tax bracket after retirement Projected Inflation de 3 percent In the event of a spouse's death, Peter and Ann plan to stop working and collect early Social Security benefits at age sixty. They will receive $16.500 at that time. For comervative planning purposes, the Mayfields do not plan to use interest and/or dividends as an income scrurce when planning insurance needs Full retirement benefits, at age sixty-six, are $23,580 In addition to Peter's life insurance, they are willing to use all of their retirement, investments, and monetary to meet insurance needs. Disability Insurance Peter's employer provides both short and long-term disability coverage. His short- term coverage pays 100 percent of his earned income for the first six months of disability. There is no wait period for this coverage. Peter's long-term coverage six-month wait period and pays a benefit equal to 60 percent of eamed income until ge sixty-five. All premium, for both policies, are employer paid. If Peter were to become disabled, they would not continue to save for other goals. In case of disability Total household expenses in the event of death or disability are $65,000 When calculating life insurance needs, the Mayfields are willing to use all their combined retirement savings to offset Insurance needs Studies The Mayfields assume that in the event of a possible disability neither will be eligible for Social Security disability benefits For life insurance planning purposes only, they would like to replace $85,000 per year, in today's dollars, for retirement. Long-term Care Insurance The Mayfields do not currently have long-term care insurance. Retirement Information and Planning Issues The following information should be used when evaluating the Mayfields' current retirement planning situation: Peter does not have a defined benefit plan at this time. Retirement age for reduced Social Security benefits is age sixty-two, they plan to retire and take benefits at the earliest possible date. Retirement age for full Social Security benefits is age sixty-six. Their individual life expectancies are ninety-five years of age. In the event of the death of one spouse, the surviving spouse is eligible to receive $16,500 per year starting at age sixty from Social Security, At age sixty-two, Peter's annual Social Security benefit will be $17,950 in today's dollars; Ann is eligible to receive a survivor benefit equal to $5,367 At age sixty-six, Peter's annual Social Security benefit will be $24,420 in today's dollars; Ann is eligible to receive one-half of this amount At age seventy, Peter's annual Social Security benefit will be $32,900 in today's dollars; Ann is eligible to receive a survivor benefit. They would like to replace $90,000 in yearly income, in today's pretax dollars, on their first day of retirement. (Note that this figure is different from the assumption they want to use for insurance planning purposes.) Ann is the beneficiary of Peter's qualified retirement plan assets. For retirement planning purposes only, they believe that they can earn a 7.6 percent rate of return prior to retirement and a 5 percent rate of return after retirement Inflation before and after retirement is expected to be 3 percent Peter's salary will increase at the rate of inflation. All annual retirement savings will increase by the rate of inflation (3 percent) prior to retirement The Mayfields are willing to assume that they will remain in the same marginal tax bracket after they retire. All nonretirement assets are owned as JTWROS at this time. Estate Information and Planning Issues Final funeral, burial, and medical expenses for life insurance and estate planning purposes will be $12,000 each. Estate administration costs are anticipated to be $1,500, and executor fees will be approximately $35,000 for Peter and $8,000 for Ann. In the event of death, the Mayfields will need approximately $12,000 to cover immediate needs. They would like to leave a legacy for their grandchildren by fully funding both children's college education costs should Peter or Ann die. Assumed investment return on assets in the event that one spouse dies is 6.00 percent annually. The value of the surviving spouse's net estate is expected to grow by 4.00 percent annually. Additional Planning Assumptions The Mayfields would like to maintain their monetary assets as an emergency fund if possible, and use interest earned as a "slush fund while in retirement Goals and Objectives The Mayfields are very much looking forward to retirement. They hope to spend more time with their growing grandchildren. Given this goal, they plan to retire when Peter turns age sixty-two. They would like to know if they are currently on track to meet this goal. 1. How much money market fund income did the Mayficlds cam during the year? a. $0 b. $6,000 $6,325 d. $7,200 2. Which of the following statements is true? I. Peter must report $110 in $ 79 income for tax purposes. II. Because Peter is over age fifty, he does not need to report $ 79 income. III. $ 79 income helps reduce a client's taxable income. IV. $ 79 income should be accounted for as a taxable expense on the income and expense statement. II only I and II only I and IV only II and III only II, III, and IV only 3. How much of the Mayfields' gross income is considered total income for tax purposes on IRS Form 10402 a. $96,110 b. $90,000 c. $86,510 d. $80,510 6. Which of the following is true? a. The Mayfields should choose to itemize deductions on IRS Form Schedule A. b. Given their age, they will receive enhanced personal exemptions for this year's taxes. c. They can claim a tax credit for gifts made to their grandchild this year. d. The Mayfields' standard deduction is greater than their itemized deduction. e. Both a and b are correct. 7. During a benefits presentation for all city employees, the presenter talked about the need for those in attendance to think about long-term care needs. Peter was shocked to learn how much one year of nursing home care would cost. He is worried about depleting assets if he or his wife should need this type of care. He wants to know whether he and his wife should purchase long-term care insurance. Which of the following statements best represents the strategy that the Mayfields should consider? a. Purchase long-term care insurance because their net worth, exclusive of home value, is less than $1.5 million b. They do not need long-term care insurance because they can afford to self-insure the costs of care, C. They should expect to spend down assets to a point where they will become eligible for Medicaid, and as such, they do not need long-term care insurance. d. They do not need long-term care insurance because they can use a combination of assets, Medicare funding, and Medicaid reimbursement to fund care needs. 8. Peter was recently approached by a financial adviser who wanted Peter to consider investing in a variable annuity for retirement. A few days later the adviser called Peter again and said that a variable universal life (VUL) insurance policy could also be used to fund retirement needs. Which of the following statement(s) is (are) true in relation to annuities and VULS? I. Given their favorable tax treatment, variable annuities and VUL policies allow earnings to grow tax deferred until withdrawn. II. Distributions from the annuity, after age 59%, will be taxed at the long-term capital gain rate if the annuity has been in existence for at least one year. III. Distributions from the VUL policy, if made in the form of a loan, will be taxed at the Mayfields' marginal tax rate. IV. Distributions in the form of a VUL loan need not be reported on IRS Form 1040 for tax purposes. a. I and II only b. III and IV only c. I and IV only d. II, III, and IV only 9. Reducing a client's life expectancy assumption will have which of the following effects? a. Increase the amount of life insurance needed. b. Decrease the amount of retirement assets needed. c. Increase the amount of retirement assets needed. d. Both a and care correct. 10. Which of the following disability insurance statements is true? a. All of the benefits received by Peter from his disability coverage will be taxable because his employer paid the premium. b. None of the benefits received by Peter from his disability coverage will be taxable because his employer paid the premium. c. If Ann becomes disabled, she is eligible for coverage under her state's workers' compensation program d. Both a and care correct. e Both hand care correct