Answered step by step

Verified Expert Solution

Question

1 Approved Answer

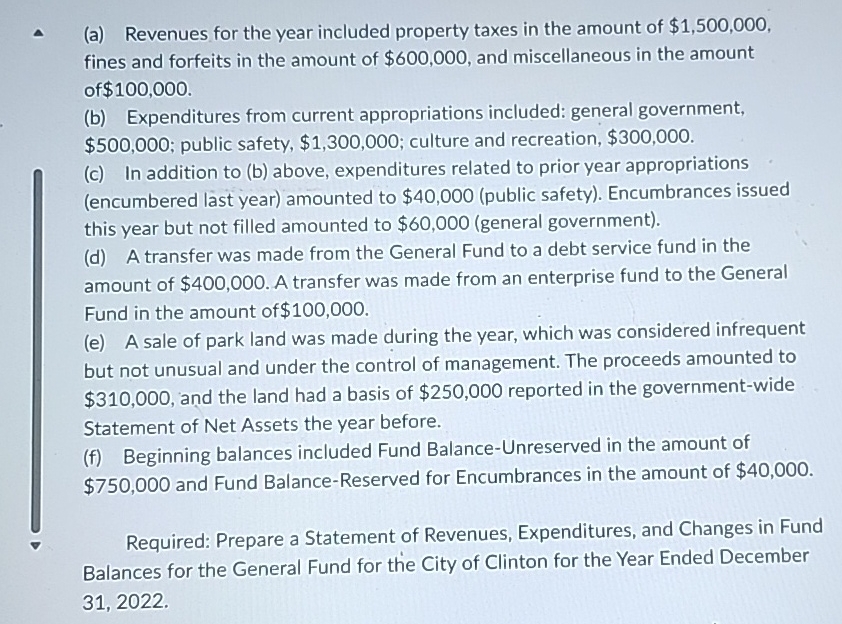

( a ) Revenues for the year included property taxes in the amount of $ 1 , 5 0 0 , 0 0 0 ,

a Revenues for the year included property taxes in the amount of $ fines and forfeits in the amount of $ and miscellaneous in the amount of $

b Expenditures from current appropriations included: general government, $; public safety, $; culture and recreation, $

c In addition to b above, expenditures related to prior year appropriations encumbered last year amounted to $public safety Encumbrances issued this year but not filled amounted to $general government

d A transfer was made from the General Fund to a debt service fund in the amount of $ A transfer was made from an enterprise fund to the General Fund in the amount of $

e A sale of park land was made during the year, which was considered infrequent but not unusual and under the control of management. The proceeds amounted to $ and the land had a basis of $ reported in the governmentwide Statement of Net Assets the year before.

f Beginning balances included Fund BalanceUnreserved in the amount of $ and Fund BalanceReserved for Encumbrances in the amount of $

Required: Prepare a Statement of Revenues, Expenditures, and Changes in Fund Balances for the General Fund for the City of Clinton for the Year Ended December

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started