Answered step by step

Verified Expert Solution

Question

1 Approved Answer

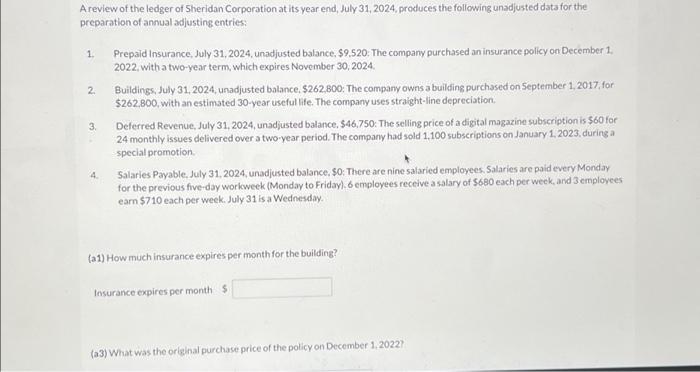

A review of the ledger of Sheridan Corporation at its year end, July 31, 2024, produces the following unadjusted data for the preparation of annual

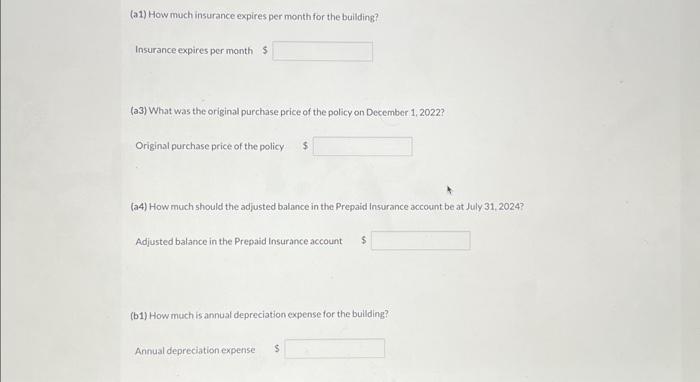

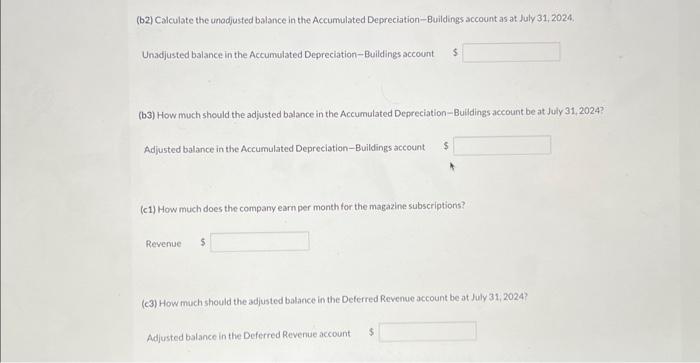

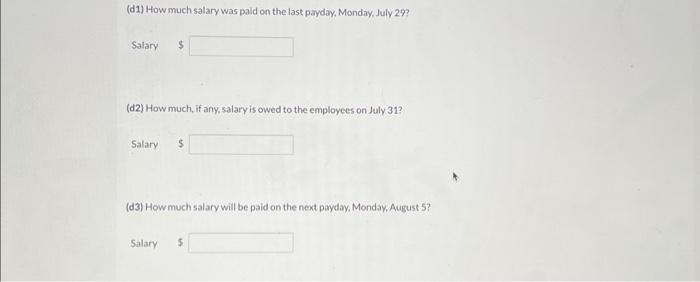

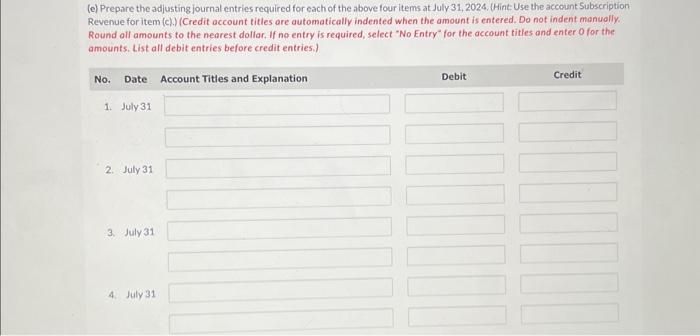

A review of the ledger of Sheridan Corporation at its year end, July 31, 2024, produces the following unadjusted data for the preparation of annual adjusting entries: 1. 2. 3. 4. Prepaid Insurance, July 31, 2024, unadjusted balance, $9,520: The company purchased an insurance policy on December 1, 2022, with a two-year term, which expires November 30, 2024. Buildings, July 31, 2024, unadjusted balance, $262,800: The company owns a building purchased on September 1, 2017, for $262,800, with an estimated 30-year useful life. The company uses straight-line depreciation. Deferred Revenue, July 31, 2024, unadjusted balance, $46,750: The selling price of a digital magazine subscription is $60 for 24 monthly issues delivered over a two-year period. The company had sold 1,100 subscriptions on January 1, 2023, during a special promotion. Salaries Payable, July 31, 2024, adjusted balance, $0: There are nine salaried employees. Salaries are paid every Monday for the previous five-day workweek (Monday to Friday). 6 employees receive a salary of $680 each per week, and 3 employees earn $710 each per week. July 31 is a Wednesday. (a1) How much insurance expires per month for the building? Insurance expires per month $ (a3) What was the original purchase price of the policy on December 1, 2022?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started