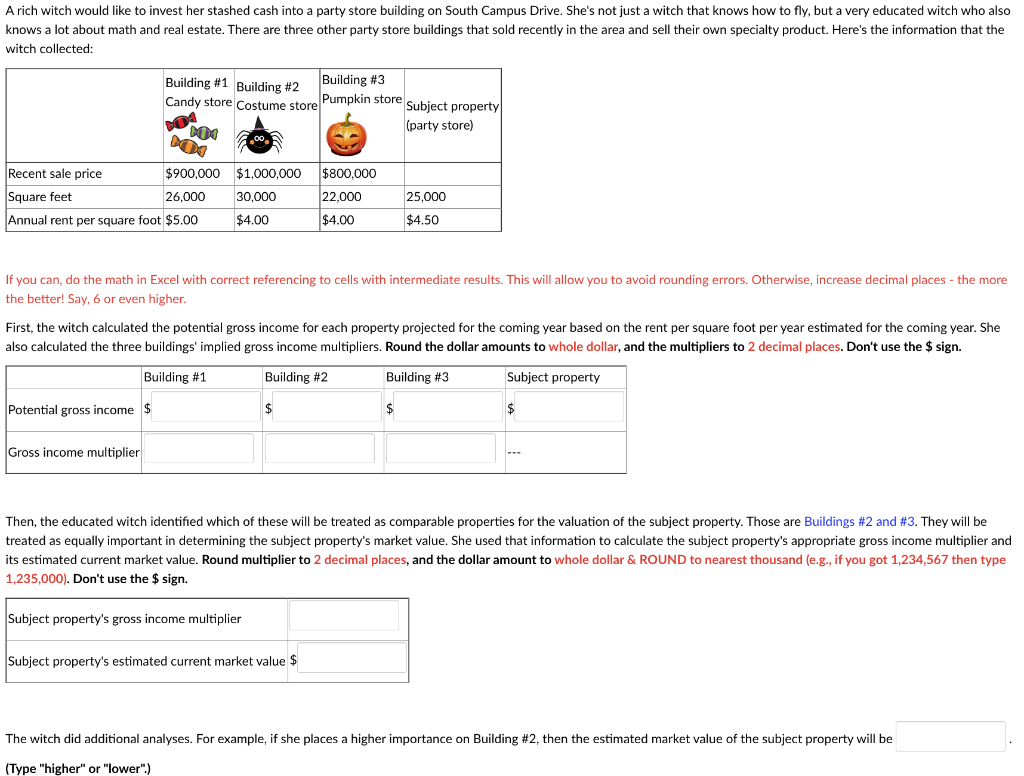

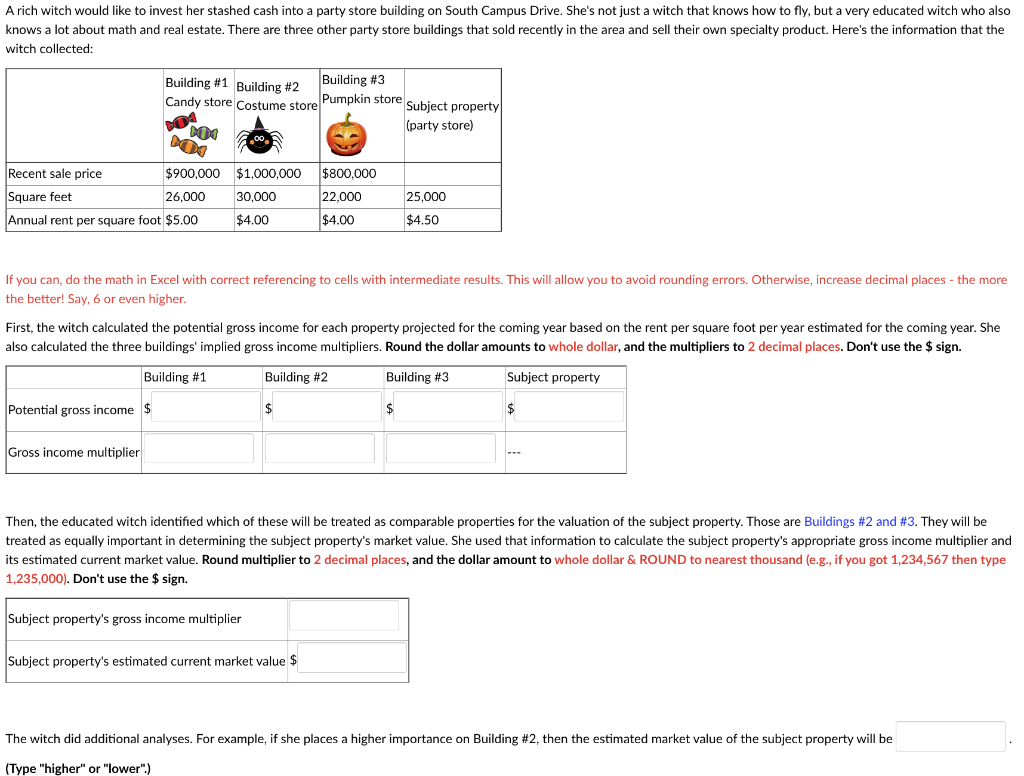

A rich witch would like to invest her stashed cash into a party store building on South Campus Drive. She's not just a witch that knows how to fly, but a very educated witch who also knows a lot about math and real estate. There are three other party store buildings that sold recently in the area and sell their own specialty product. Here's the information that the witch collected: If you can, do the math in Excel with correct referencing to cells with intermediate results. This will allow you to avoid rounding errors. Otherwise, increase decimal places - the more the better! Say, 6 or even higher. First, the witch calculated the potential gross income for each property projected for the coming year based on the rent per square foot per year estimated for the coming year. She also calculated the three buildings' implied gross income multipliers. Round the dollar amounts to whole dollar, and the multipliers to 2 decimal Then, the educated witch identified which of these will be treated as comparable properties for the valuation of the subject property. Those are Buildings \#2 and \#3. They will be treated as equally important in determining the subject property's market value. She used that information to calculate the subject property's appropriate gross income multiplier and its estimated current market value. Round multiplier to 2 decimal places, and the dollar amount to whole dollar \& ROUND to nearest thousand (e.g., if you got 1,234,567 then type 1,235,000). Don't use the $ sign. The witch did additional analyses. For example, if she places a higher importance on Building \#2, then the estimated market value of the subject property will be (Type "higher" or "lower".) A rich witch would like to invest her stashed cash into a party store building on South Campus Drive. She's not just a witch that knows how to fly, but a very educated witch who also knows a lot about math and real estate. There are three other party store buildings that sold recently in the area and sell their own specialty product. Here's the information that the witch collected: If you can, do the math in Excel with correct referencing to cells with intermediate results. This will allow you to avoid rounding errors. Otherwise, increase decimal places - the more the better! Say, 6 or even higher. First, the witch calculated the potential gross income for each property projected for the coming year based on the rent per square foot per year estimated for the coming year. She also calculated the three buildings' implied gross income multipliers. Round the dollar amounts to whole dollar, and the multipliers to 2 decimal Then, the educated witch identified which of these will be treated as comparable properties for the valuation of the subject property. Those are Buildings \#2 and \#3. They will be treated as equally important in determining the subject property's market value. She used that information to calculate the subject property's appropriate gross income multiplier and its estimated current market value. Round multiplier to 2 decimal places, and the dollar amount to whole dollar \& ROUND to nearest thousand (e.g., if you got 1,234,567 then type 1,235,000). Don't use the $ sign. The witch did additional analyses. For example, if she places a higher importance on Building \#2, then the estimated market value of the subject property will be (Type "higher" or "lower".)