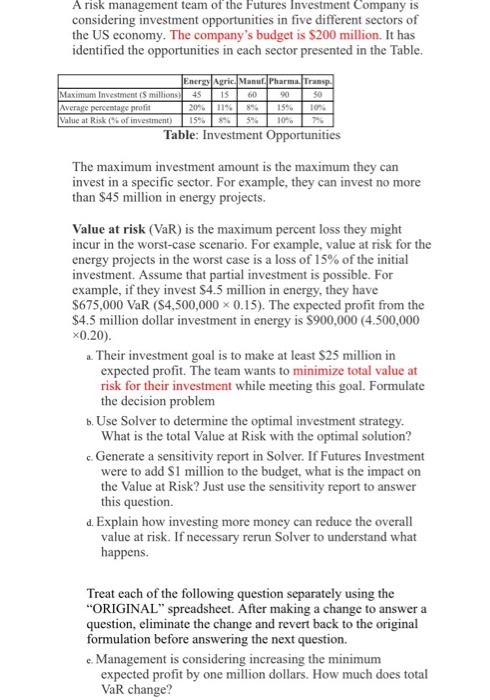

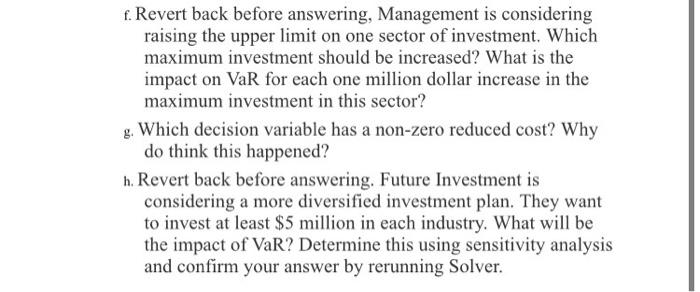

A risk management team of the Futures Investment Company is considering investment opportunities in five different sectors of the US economy. The company's budget is $200 million. It has identified the opportunities in each sector presented in the Table. Energy Agric. Manu Pharma Transp Maximum Investment (5 millions 45 15 60 Average percentage profit 20% 11% 18% 15% 10 Value at Risk of investment) 15% 89 5% Table: Investment Opportunities 10. The maximum investment amount is the maximum they can invest in a specific sector. For example, they can invest no more than $45 million in energy projects. Value at risk (VaR) is the maximum percent loss they might incur in the worst-case scenario. For example, value at risk for the energy projects in the worst case is a loss of 15% of the initial investment. Assume that partial investment is possible. For example, if they invest $4.5 million in energy, they have $675,000 VaR ($4,500,000 * 0.15). The expected profit from the $4.5 million dollar investment in energy is $900,000 (4.500,000 x0.20). 2. Their investment goal is to make at least S25 million in expected profit. The team wants to minimize total value at risk for their investment while meeting this goal. Formulate the decision problem 6. Use Solver to determine the optimal investment strategy What is the total value at Risk with the optimal solution? c. Generate a sensitivity report in Solver. If Futures Investment were to add S1 million to the budget, what is the impact on the Value at Risk? Just use the sensitivity report to answer this question. . Explain how investing more money can reduce the overall value at risk. If necessary rerun Solver to understand what happens. Treat each of the following question separately using the "ORIGINAL" spreadsheet. After making a change to answer a question, eliminate the change and revert back to the original formulation before answering the next question. e Management is considering increasing the minimum expected profit by one million dollars. How much does total VaR change? e f. Revert back before answering, Management is considering raising the upper limit on one sector of investment. Which maximum investment should be increased? What is the impact on VaR for each one million dollar increase in the maximum investment in this sector? g. Which decision variable has a non-zero reduced cost? Why do think this happened? h. Revert back before answering. Future Investment is considering a more diversified investment plan. They want to invest at least $5 million in each industry. What will be the impact of VaR? Determine this using sensitivity analysis and confirm your answer by rerunning Solver. A risk management team of the Futures Investment Company is considering investment opportunities in five different sectors of the US economy. The company's budget is $200 million. It has identified the opportunities in each sector presented in the Table. Energy Agric. Manu Pharma Transp Maximum Investment (5 millions 45 15 60 Average percentage profit 20% 11% 18% 15% 10 Value at Risk of investment) 15% 89 5% Table: Investment Opportunities 10. The maximum investment amount is the maximum they can invest in a specific sector. For example, they can invest no more than $45 million in energy projects. Value at risk (VaR) is the maximum percent loss they might incur in the worst-case scenario. For example, value at risk for the energy projects in the worst case is a loss of 15% of the initial investment. Assume that partial investment is possible. For example, if they invest $4.5 million in energy, they have $675,000 VaR ($4,500,000 * 0.15). The expected profit from the $4.5 million dollar investment in energy is $900,000 (4.500,000 x0.20). 2. Their investment goal is to make at least S25 million in expected profit. The team wants to minimize total value at risk for their investment while meeting this goal. Formulate the decision problem 6. Use Solver to determine the optimal investment strategy What is the total value at Risk with the optimal solution? c. Generate a sensitivity report in Solver. If Futures Investment were to add S1 million to the budget, what is the impact on the Value at Risk? Just use the sensitivity report to answer this question. . Explain how investing more money can reduce the overall value at risk. If necessary rerun Solver to understand what happens. Treat each of the following question separately using the "ORIGINAL" spreadsheet. After making a change to answer a question, eliminate the change and revert back to the original formulation before answering the next question. e Management is considering increasing the minimum expected profit by one million dollars. How much does total VaR change? e f. Revert back before answering, Management is considering raising the upper limit on one sector of investment. Which maximum investment should be increased? What is the impact on VaR for each one million dollar increase in the maximum investment in this sector? g. Which decision variable has a non-zero reduced cost? Why do think this happened? h. Revert back before answering. Future Investment is considering a more diversified investment plan. They want to invest at least $5 million in each industry. What will be the impact of VaR? Determine this using sensitivity analysis and confirm your answer by rerunning Solver