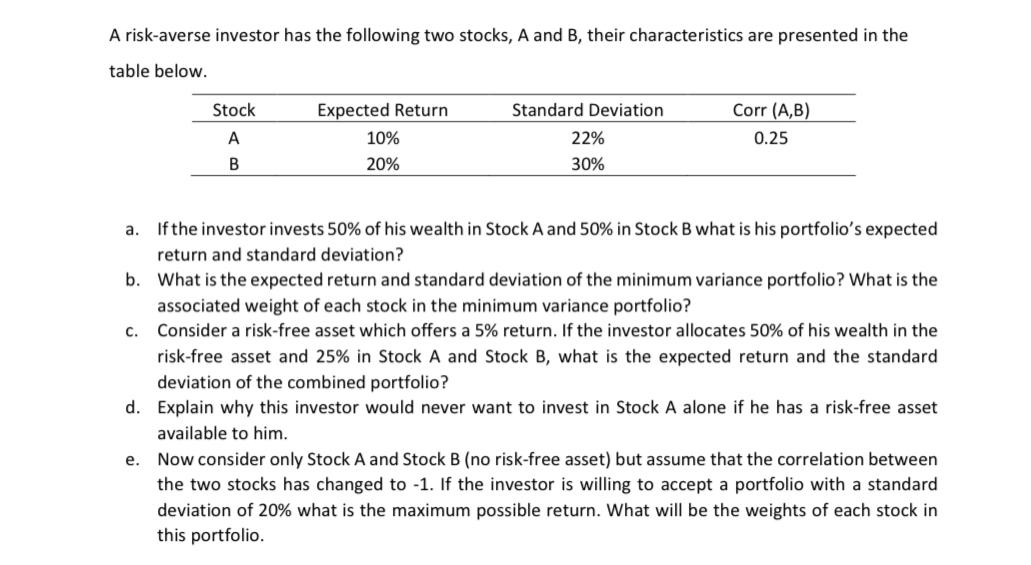

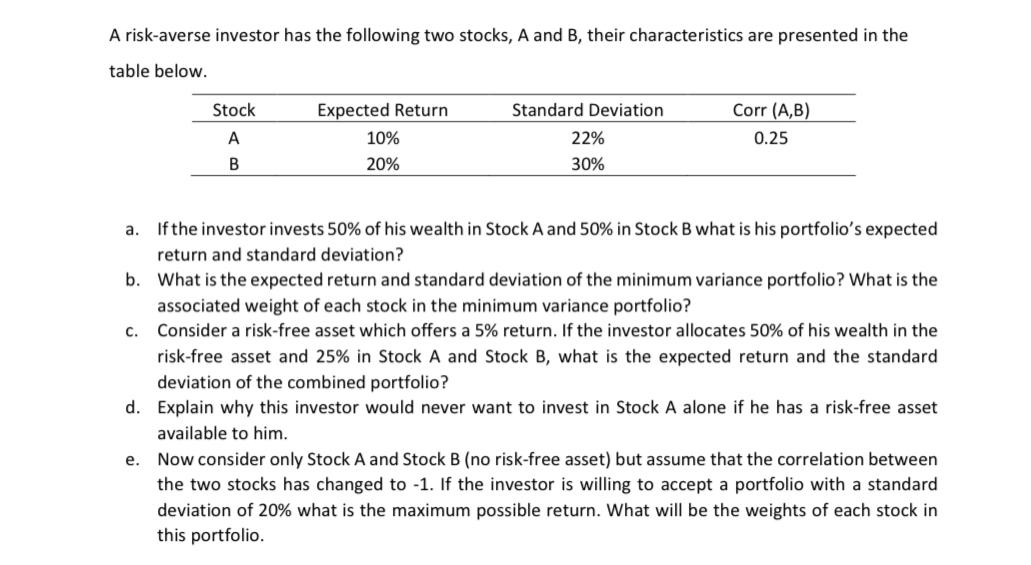

A risk-averse investor has the following two stocks, A and B, their characteristics are presented in the table below. Stock Expected Return 10% 20% A Standard Deviation 22% 30% Corr (A,B) 0.25 B a. If the investor invests 50% of his wealth in Stock A and 50% in Stock B what is his portfolio's expected return and standard deviation? b. What is the expected return and standard deviation of the minimum variance portfolio? What is the associated weight of each stock in the minimum variance portfolio? C. Consider a risk-free asset which offers a 5% return. If the investor allocates 50% of his wealth in the risk-free asset and 25% in Stock A and Stock B, what is the expected return and the standard deviation of the combined portfolio? d. Explain why this investor would never want to invest in Stock A alone if he has a risk-free asset available to him. Now consider only Stock A and Stock B (no risk-free asset) but assume that the correlation between the two stocks has changed to -1. If the investor is willing to accept a portfolio with a standard deviation of 20% what is the maximum possible return. What will be the weights of each stock in this portfolio. e. A risk-averse investor has the following two stocks, A and B, their characteristics are presented in the table below. Stock Expected Return 10% 20% A Standard Deviation 22% 30% Corr (A,B) 0.25 B a. If the investor invests 50% of his wealth in Stock A and 50% in Stock B what is his portfolio's expected return and standard deviation? b. What is the expected return and standard deviation of the minimum variance portfolio? What is the associated weight of each stock in the minimum variance portfolio? C. Consider a risk-free asset which offers a 5% return. If the investor allocates 50% of his wealth in the risk-free asset and 25% in Stock A and Stock B, what is the expected return and the standard deviation of the combined portfolio? d. Explain why this investor would never want to invest in Stock A alone if he has a risk-free asset available to him. Now consider only Stock A and Stock B (no risk-free asset) but assume that the correlation between the two stocks has changed to -1. If the investor is willing to accept a portfolio with a standard deviation of 20% what is the maximum possible return. What will be the weights of each stock in this portfolio. e