Answered step by step

Verified Expert Solution

Question

1 Approved Answer

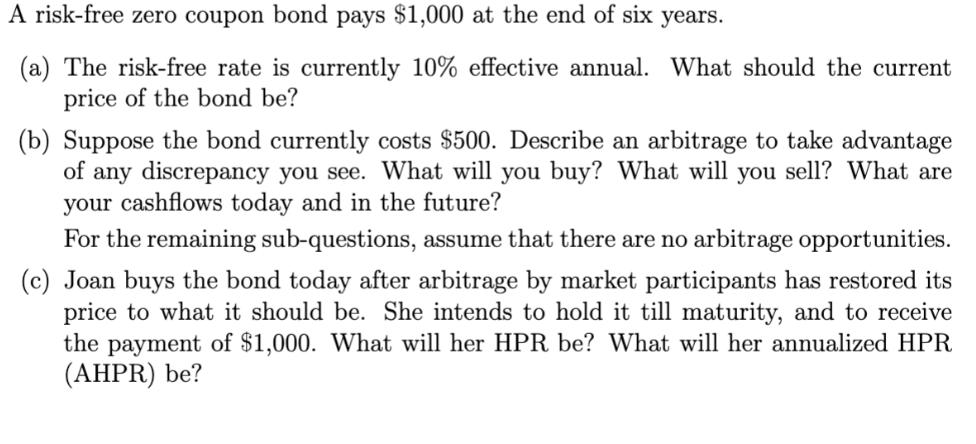

A risk-free zero coupon bond pays $1,000 at the end of six years. (a) The risk-free rate is currently 10% effective annual. What should

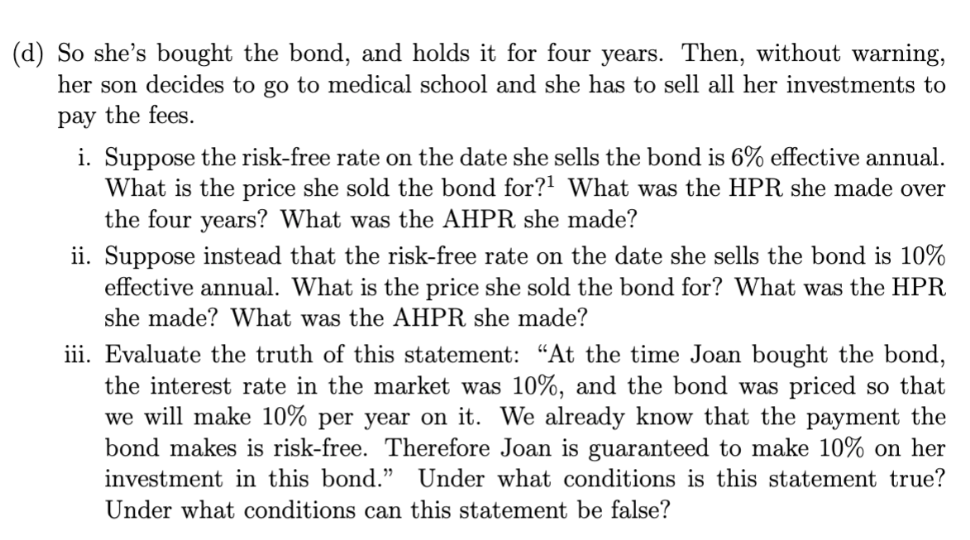

A risk-free zero coupon bond pays $1,000 at the end of six years. (a) The risk-free rate is currently 10% effective annual. What should the current price of the bond be? (b) Suppose the bond currently costs $500. Describe an arbitrage to take advantage of any discrepancy you see. What will you buy? What will you sell? What are your cashflows today and in the future? For the remaining sub-questions, assume that there are no arbitrage opportunities. (c) Joan buys the bond today after arbitrage by market participants has restored its price to what it should be. She intends to hold it till maturity, and to receive the payment of $1,000. What will her HPR be? What will her annualized HPR (AHPR) be? (d) So she's bought the bond, and holds it for four years. Then, without warning, her son decides to go to medical school and she has to sell all her investments to pay the fees. i. Suppose the risk-free rate on the date she sells the bond is 6% effective annual. What is the price she sold the bond for? What was the HPR she made over the four years? What was the AHPR she made? ii. Suppose instead that the risk-free rate on the date she sells the bond is 10% effective annual. What is the price she sold the bond for? What was the HPR she made? What was the AHPR she made? iii. Evaluate the truth of this statement: "At the time Joan bought the bond, the interest rate in the market was 10%, and the bond was priced so that we will make 10% per year on it. We already know that the payment the bond makes is risk-free. Therefore Joan is guaranteed to make 10% on her investment in this bond." Under what conditions is this statement true? Under what conditions can this statement be false?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To determine the current price of the bond we can use the present value formula Current Price Future Value 1 rn Where Future Value 1000 the amount the bond pays at the end of six years r 10 effectiv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started