Question

A risk-neutral firm believes that the probability of a harmful cyberattack (see the Mini-Case Risk of a Cyberattack) is 25%. It expects to make a

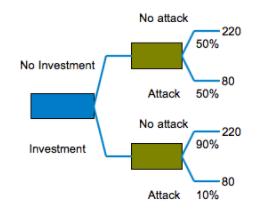

A risk-neutral firm believes that the probability of a harmful cyberattack (see the Mini-Case “Risk of a Cyberattack”) is 25%. It expects to make a profit of $200 million if no attack occurs and $120 million if it is attacked. The firm can spend $5 million to increase its electronic defenses, which reduces the probability of a successful cyberattack to 10%. Use a decision tree similar to Figure to assess whether the firm should make this investment.

No attack 220 50% No Investment -80 Attack 50% No attack 220 90% Investment -80 Attack 10%

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Expected value from investment 200 90 120 10 192 m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International financial management

Authors: Jeff Madura

9th Edition

978-0324593495, 324568207, 324568193, 032459349X, 9780324568202, 9780324568196, 978-0324593471

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App