Answered step by step

Verified Expert Solution

Question

1 Approved Answer

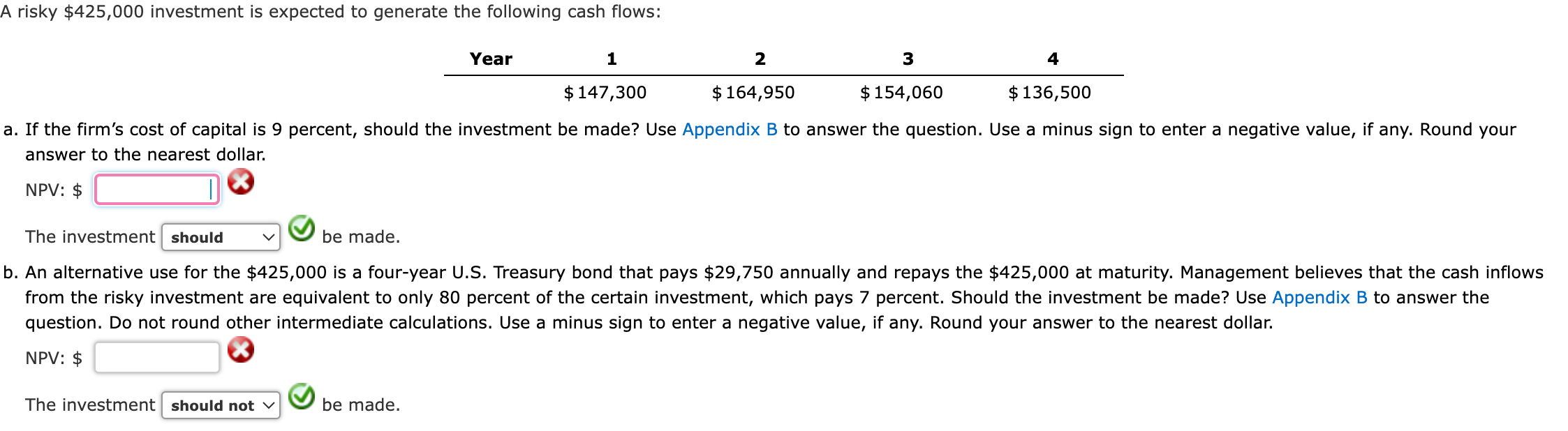

A risky $ 4 2 5 , 0 0 0 investment is expected to generate the following cash flows: a . If the firm's cost

A risky $ investment is expected to generate the following cash flows:

a If the firm's cost of capital is percent, should the investment be made? Use Appendix B to answer the question. Use a minus sign to enter a negative value, if any. Round your

answer to the nearest dollar.

NPV: $

The investment

be made.

b An alternative use for the $ is a fouryear US Treasury bond that pays $ annually and repays the $ at maturity. Management believes that the cash

from the risky investment are equivalent to only percent of the certain investment, which pays percent. Should the investment be made? Use Appendix to answer the

question. Do not round other intermediate calculations. Use a minus sign to enter a negative value, if any. Round your answer to the nearest dollar.

NPV: $

The investment

be made.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started