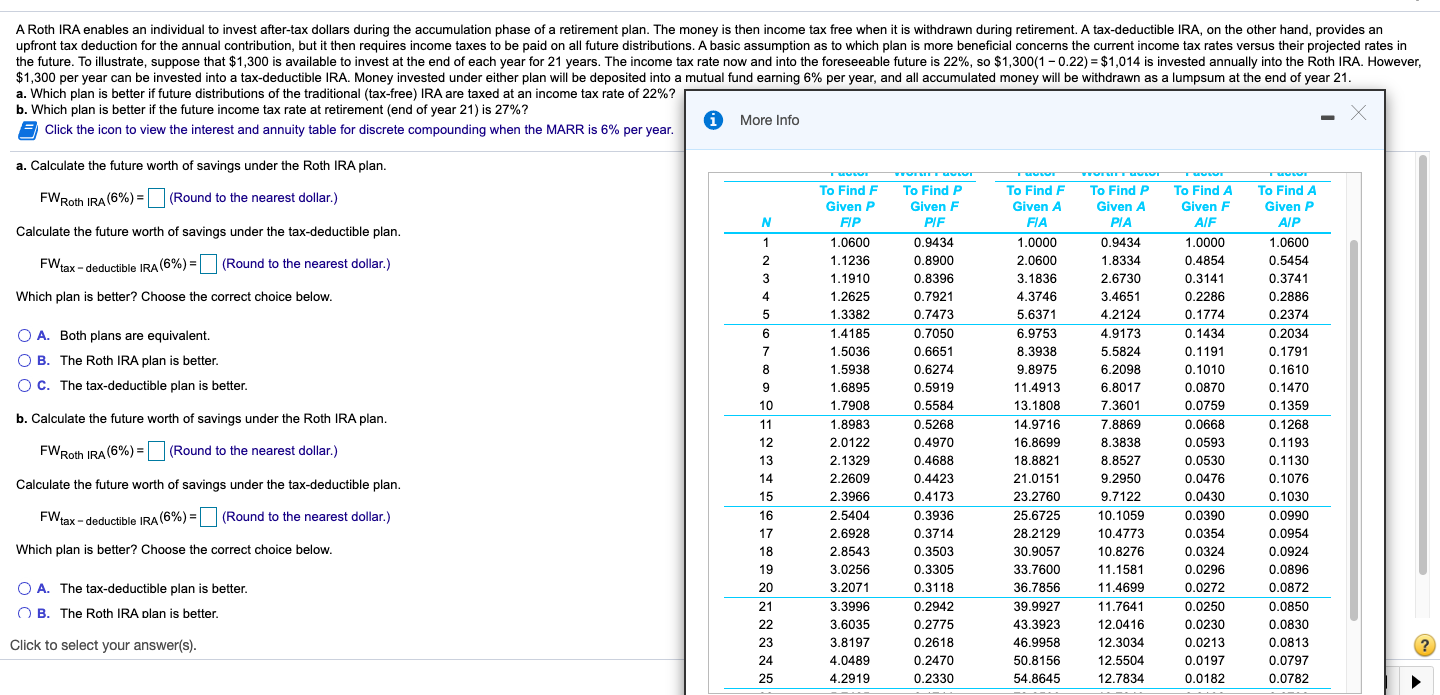

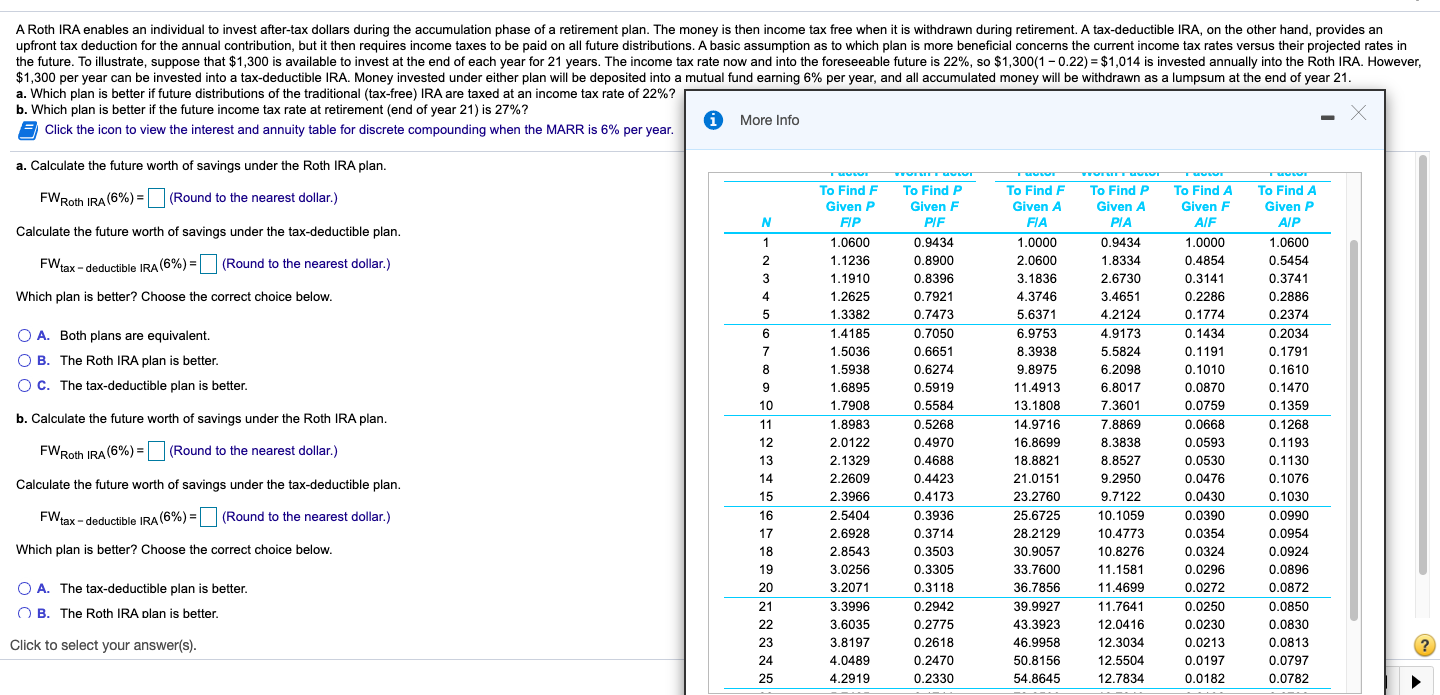

A Roth IRA enables an individual to invest after-tax dollars during the accumulation phase of a retirement plan. The money is then income tax free when it is withdrawn during retirement. A tax-deductible IRA, on the other hand, provides an upfront tax deduction for the annual contribution, but it then requires income taxes to be paid on all future distributions. A basic assumption as to which plan is more beneficial concerns the current income tax rates versus their projected rates in the future. To illustrate, suppose that $1,300 is available to invest at the end of each year for 21 years. The income tax rate now and into the foreseeable future is 22%, so $1,300(1 - 0.22) = $1,014 is invested annually into the Roth IRA. However, $1,300 per year can be invested into a tax-deductible IRA. Money invested under either plan will be deposited into a mutual fund earning 6% per year, and all accumulated money will be withdrawn as a lumpsum at the end of year 21. a. Which plan is better if future distributions of the traditional (tax-free) IRA are taxed at an income tax rate of 22%? b. Which plan is better if the future income tax rate at retirement (end of year 21) is 27%? More Info 5 Click the icon to view the interest and annuity table for discrete compounding when the MARR is 6% per year. a. Calculate the future worth of savings under the Roth IRA plan. Tormoran TI To Find P Given F PUF AIF FW Roth IRA (6%) = (Round to the nearest dollar.) Calculate the future worth of savings under the tax-deductible plan. FWtax - deductible IRA (6%) = (Round to the nearest dollar.) Which plan is better? Choose the correct choice below. O A. Both plans are equivalent. OB. The Roth IRA plan is better. O C. The tax-deductible plan is better. b. Calculate the future worth of savings under the Roth IRA plan. To Find F Given P FIP 1.0600 1.1236 1.1910 1.2625 1.3382 1.4185 1.5036 1.5938 1.6895 1.7908 1.8983 2.0122 2.1329 2.2609 2.3966 2.5404 2.6928 2.8543 3.0256 3.2071 3.3996 3.6035 3.8197 4.0489 4.2919 Tvoorwurworvoor To Find F To Find P To Find A Given A Given A Given F FIA PIA 1.0000 0.9434 1.0000 2.0600 1.8334 0.4854 3.1836 2.6730 0.3141 4.3746 3.4651 0.2286 5.6371 4.2124 0.1774 6.9753 4.9173 0.1434 8.3938 5.5824 0.1191 9.8975 6.2098 0.1010 11.4913 6.8017 0.0870 13.1808 7.3601 0.0759 14.9716 7.8869 0.0668 16.8699 8.3838 0.0593 18.8821 8.8527 0.0530 21.0151 9.2950 0.0476 23.2760 9.7122 0.0430 25.6725 10.1059 0.0390 28.2129 10.4773 0.0354 30.9057 10.8276 0.0324 33.7600 11.1581 0.0296 36.7856 11.4699 0.0272 39.9927 11.7641 0.0250 43.3923 12.0416 0.0230 46.9958 12.3034 0.0213 50.8156 12.5504 0.0197 54.8645 12.7834 0.0182 To Find A Given P AIP 1.0600 0.5454 0.3741 0.2886 0.2374 0.2034 0.1791 0.1610 0.1470 0.1359 0.1268 0.1193 0.1130 0.1076 0.1030 0.0990 0.0954 0.0924 0.0896 0.0872 0.0850 0.0830 0.0813 0.0797 0.0782 0.9434 0.8900 0.8396 0.7921 0.7473 0.7050 0.6651 0.6274 0.5919 0.5584 0.5268 0.4970 0.4688 0.4423 0.4173 0.3936 0.3714 0.3503 0.3305 0.3118 0.2942 0.2775 0.2618 0.2470 0.2330 FW Roth IRA (6%)= (Round to the nearest dollar.) Calculate the future worth of savings under the tax-deductible plan FWtax - deductible IRA (6%) = (Round to the nearest dollar.) Which plan is better? Choose the correct choice below. O A. The tax-deductible plan is better. OB. The Roth IRA plan is better. Click to select your answer(s)