Question

a. Safri and Hanni have been married for 5 years. They own a condominium in Petaling Jaya, and have no children. Safri is 28 and

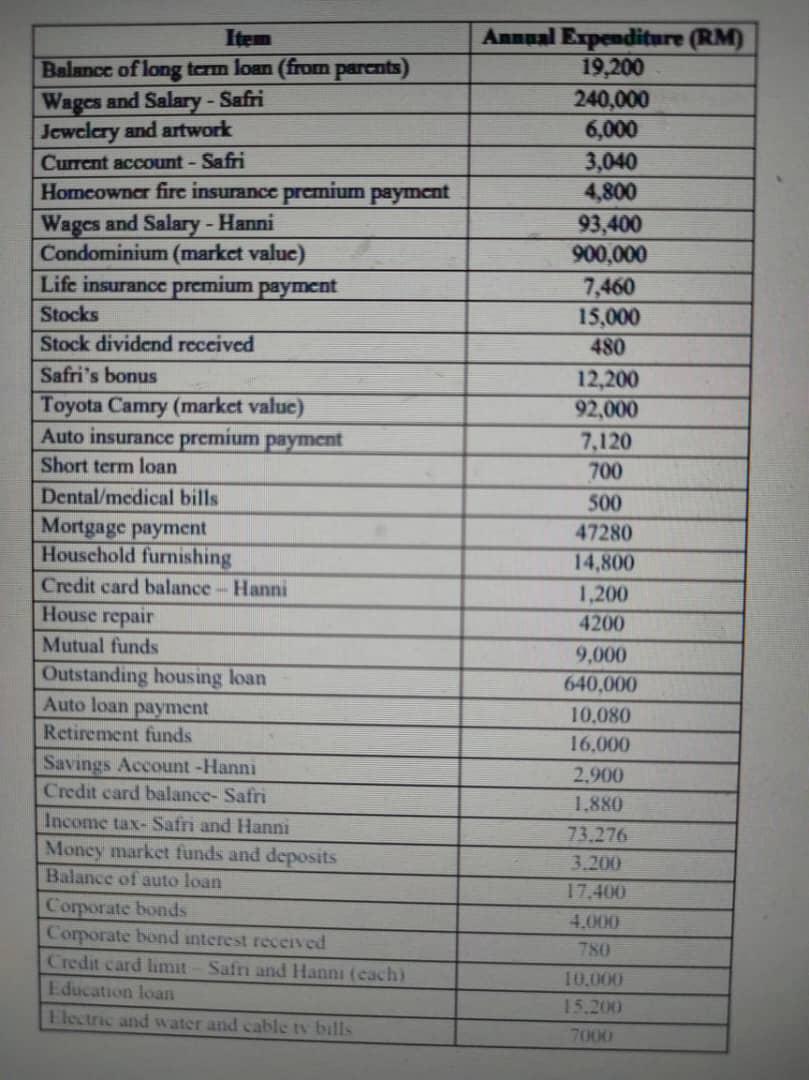

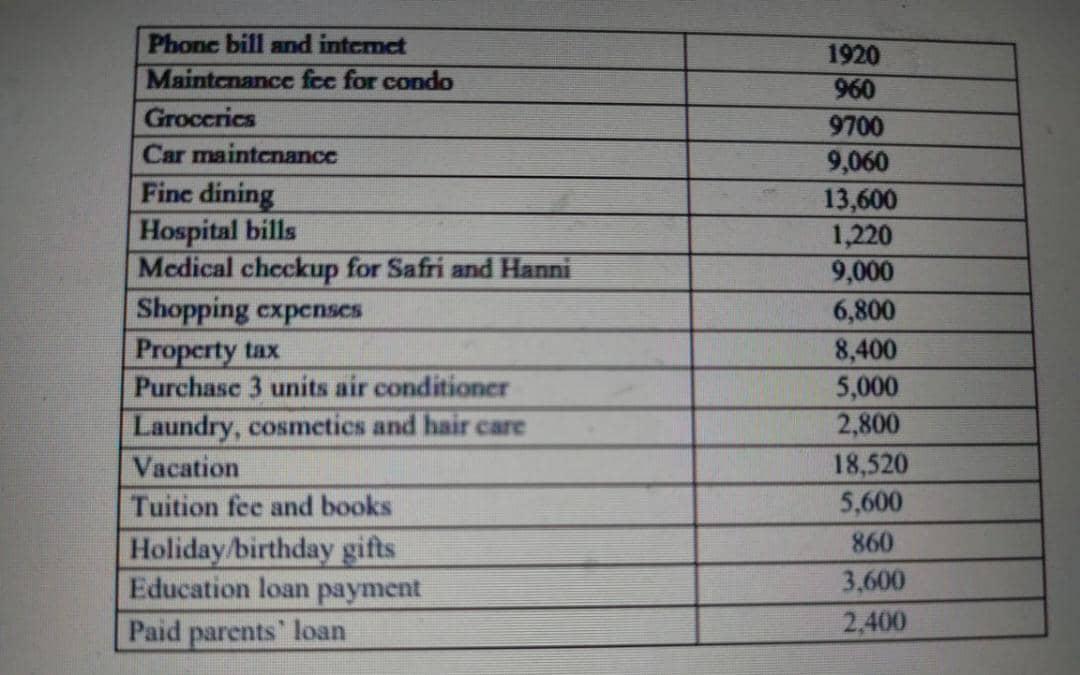

a. Safri and Hanni have been married for 5 years. They own a condominium in Petaling Jaya, and have no children. Safri is 28 and Hanni is 26 years old respectively. Both have set their long term financial goal 34 years from now for their retirement. Safri has just completed his final year as an engineer, now, working in an manufacturing company. Hanni, an MBA graduate is working at a local advertising company. Both love to travel and enjoy water sports. Before they plan to have children, they want to ensure that they are financially stable and have set up their children’s education fund as well and meet all their short and medium goals. They have decided to compile a list of their expenses so that they can see clearly. Below are information of their expenses so they can have a regular savings program:-

i. Prepare the couple’s balance sheet for the year ended 31 December 2020

ii. Prepare the couple’s income statement for the year ended 31 December 2020

iii. Analyze the couple’s financial performance by applying personal finance ratios.

Item Balance of long term loan (from parents) Wages and Salary - Safri Jewelery and artwork Current account - Safri Homeowner fire insurance premium payment Wages and Salary - Hanni Condominium (market value) Life insurance premium payment Stocks Stock dividend received Safri's bonus Toyota Camry (market value) Auto insurance premium payment Short term loan Dental/medical bills Mortgage payment Household furnishing Credit card balance - Hanni House repair Mutual funds Outstanding housing loan Auto loan payment Retirement funds Savings Account -Hanni Credit card balance- Safri Income tax- Safri and Hanni Money market funds and deposits Balance of auto loan Corporate bonds Corporate bond interest received Credit card limit - Safri and Hanni (each) Education loan Electric and water and cable ty bills Annual Expenditure (RM) 19,200 240,000 6,000 3,040 4,800 93,400 900,000 7,460 15,000 480 12,200 92,000 7,120 700 500 47280 14,800 1,200 4200 9,000 640,000 10,080 16,000 2.900 1,880 73.276 3.200 17,400 4.000 780 10,000 15.200 7000

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Assets fixal Assets Balance Sheet Jewellery Art work ma...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started