Answered step by step

Verified Expert Solution

Question

1 Approved Answer

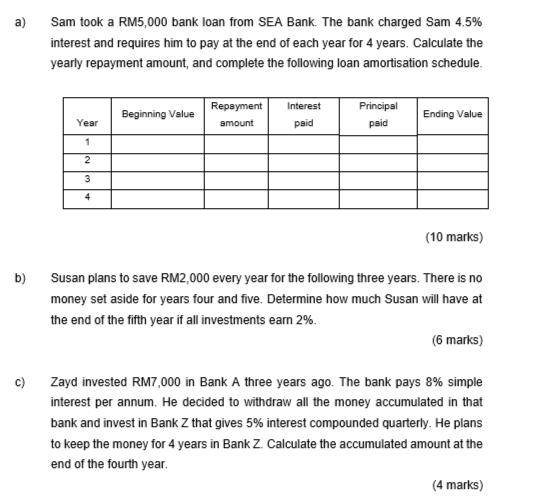

a) Sam took a RM5,000 bank loan from SEA Bank. The bank charged Sam 4.5% interest and requires him to pay at the end

a) Sam took a RM5,000 bank loan from SEA Bank. The bank charged Sam 4.5% interest and requires him to pay at the end of each year for 4 years. Calculate the yearly repayment amount, and complete the following loan amortisation schedule. b) c) Beginning Value Year Repayment Interest amount paid Principal paid Ending Value 1 2 3 4 (10 marks) Susan plans to save RM2,000 every year for the following three years. There is no money set aside for years four and five. Determine how much Susan will have at the end of the fifth year if all investments earn 2%. (6 marks) Zayd invested RM7,000 in Bank A three years ago. The bank pays 8% simple interest per annum. He decided to withdraw all the money accumulated in that bank and invest in Bank Z that gives 5% interest compounded quarterly. He plans to keep the money for 4 years in Bank Z. Calculate the accumulated amount at the end of the fourth year. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started